Get the free fha refinance authorization

Show details

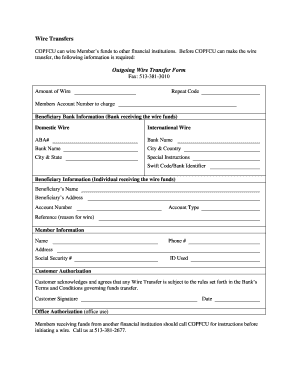

FHA REFINANCE AUTHORIZATION REQUEST FORM FHA Refinance Authorization Request Form Follow the steps below and then complete this form as indicated in Step 2. 1. Upload and Submit to LOS the file on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha refinance authorization form

Edit your fha refi authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha connection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha real estate certification form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fha transfer request form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha streamline refinance maximum mortgage worksheet form

How to fill out FHA refinance authorization form:

01

Begin by carefully reading through the form to understand the information that is required.

02

Provide your personal details accurately, such as your name, address, and contact information.

03

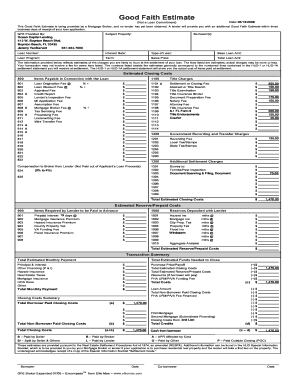

Enter your loan information, including the current loan amount, interest rate, and the reason for refinancing.

04

Include any co-borrower information if applicable, including their name, contact information, and their relationship to you.

05

Fill in the details of the property being refinanced, such as the address, type of property, and the current appraised value.

06

If you have any additional liens or judgments on the property, disclose them as requested on the form.

07

Provide the details of the new loan you are applying for, such as the desired loan amount, interest rate, and loan term.

08

Sign and date the form to indicate your agreement and understanding of the information provided.

09

Submit the completed form along with any additional documents requested by the lender.

Who needs FHA refinance authorization form:

01

Individuals who are looking to refinance their current FHA-insured mortgage.

02

Homeowners who want to take advantage of lower interest rates or better loan terms.

03

Borrowers who wish to consolidate debt or access cash from their home's equity by refinancing.

04

Individuals seeking to change the loan program from an adjustable-rate mortgage to a fixed-rate mortgage.

05

Homeowners who want to remove a co-borrower from the mortgage or add one to the refinance application.

Fill

fha loan application form

: Try Risk Free

People Also Ask about fha streamline refinance

What is a FHA streamline refinance?

Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting. Streamline refinances are available under credit qualifying and non-credit qualifying options.

What is the Ufmip factor?

FHA Upfront MIP of 1.75% The FHA upfront mortgage insurance premium (UFMIP) is mandatory for FHA home loans. By default, the FHA UFMIP of 1.75% is automatically added to mortgage balance. Adding this to the loan amount does not impact the LTV for underwriting purposes.

How to refinance a FHA loan?

To qualify for an FHA Simple Refinance, you must: Already have an FHA insured loan. Be current on your payments and meet payment history requirements. Meet the loan requirements for credit score, income and other assets. Have an appraisal of the property.

What credit score do you need for FHA streamline refinance?

The FHA does not require a credit report as part of the streamline refinance loan application. Most lenders will require one, though. A standard minimum credit score for the FHA streamline refinance program is 640. However, some lenders may allow a score between 600-620.

Do you need good credit for streamline refinance?

To do this, you'll need at least 20 percent equity in your home and a credit score of at least 620 or higher. You'll also need to pay closing costs and complete the new loan's underwriting process. Does a Streamline Refinance affect your credit score?

Can you be denied an FHA streamline refinance?

It has just 4 approval criteria : Your must have made at least 6 payments on your current FHA mortgage. You must not have made a late payment on your mortgage going back 3 months. You must not have made more than one 30-day late payment going back 12 months.

What makes an FHA streamline credit qualifying?

The FHA permits streamline refinancing loans with no credit check with the borrower has owned the property for at least six months. ing to HUD 4155.1 Chapter 6 Section C: "the borrower must have made at least six payments on the FHA-insured mortgage being refinanced.

What is the FHA sponsor identifier?

Nine-digit Employer Identification Number (EIN) of the mortgage banker or broker that originated the mortgage and was established as a sponsored originator by an FHA-approved lender. FHA's unique 10-digit identifier for the FHA-approved lender acting as a sponsor or agent for the mortgage originator.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fha refinance authorization form for eSignature?

Once your fha refinance authorization form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete fha refinance authorization form on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your fha refinance authorization form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit fha refinance authorization form on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share fha refinance authorization form on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is fha refinance authorization form?

The FHA refinance authorization form is a document that allows a borrower to request permission for refinancing an existing FHA-insured mortgage loan.

Who is required to file fha refinance authorization form?

The borrower who is seeking to refinance their FHA-insured mortgage must file the FHA refinance authorization form.

How to fill out fha refinance authorization form?

To fill out the FHA refinance authorization form, borrowers should provide their personal information, loan details, and any required signatures as instructed on the form.

What is the purpose of fha refinance authorization form?

The purpose of the FHA refinance authorization form is to facilitate the refinancing process by notifying the necessary parties and obtaining consent from the borrower.

What information must be reported on fha refinance authorization form?

The information that must be reported on the FHA refinance authorization form includes the borrower's name, address, contact information, details of the current mortgage, and the new loan terms being requested.

Fill out your fha refinance authorization form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Refinance Authorization Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.