VA Application High Mileage Discount 2021 free printable template

Show details

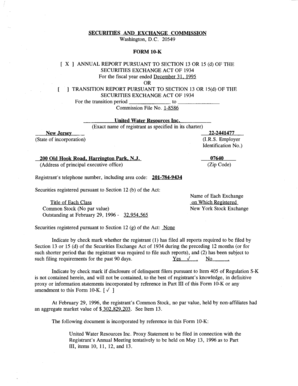

COUNTY OF HANOVER, VIRGINIA

APPLICATION FOR HIGH MILEAGE DISCOUNT

TAX YEAR 2021T. Scott Harris, MCR

CommissionerOffice of the Commissioner of the Revenue

PO Box 129, Hanover, VA 23069

Phone: (804)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA Application High Mileage Discount

Edit your VA Application High Mileage Discount form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA Application High Mileage Discount form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA Application High Mileage Discount online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit VA Application High Mileage Discount. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA Application High Mileage Discount Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA Application High Mileage Discount

How to fill out VA Application High Mileage Discount

01

Gather all necessary documents including vehicle information and mileage records.

02

Obtain the VA Application form for the High Mileage Discount from the official VA website or office.

03

Fill out personal information at the top of the application form.

04

Provide details about your vehicle including make, model, and year.

05

Enter the current mileage of your vehicle and any relevant usage information.

06

Attach any required supporting documents such as odometer readings or maintenance records.

07

Review the application for accuracy and completeness.

08

Submit the completed application either online, by mail, or in person at the appropriate VA office.

Who needs VA Application High Mileage Discount?

01

Veterans who regularly use their personal vehicles for travel related to VA services.

02

Individuals who exceed a specified annual mileage threshold as defined by the VA.

03

Veterans seeking financial assistance or reductions related to vehicle usage.

Instructions and Help about VA Application High Mileage Discount

Fill

form

: Try Risk Free

People Also Ask about

Why is Virginia car tax so high?

Supply chain issues in the auto industry have caused car values to increase, leading to higher amounts on personal property tax bills. For a car that's now a year older, taxpayers in the Commonwealth could be paying a higher fee because of that increased value. “Production of new vehicles is way down.

How much is personal property tax in Prince William County?

The current rate, which was adopted earlier this year as part of the county's fiscal year 2023 budget, is $3.45 per $100 in assessed value.

How do I avoid car tax in Virginia?

That said, you can't legally avoid paying car tax in Virginia. People have tried to avoid the car tax by registering their cars in different states or lying about their circumstances. However, doing so means you face fines of up to 25% of the initial tax rate with 5% interest each year it goes unpaid.

Do all counties in VA have personal property tax?

All cities and counties in Virginia have personal property tax. The County of Southampton taxes cars, trucks, buses, motorcycles, motor homes, trailers, semitrailer, boats, recreational vehicles, aircraft, wreckers/tow trucks, mobile homes, etc. This tax is assessed by the Commissioner of the Revenue.

What is the real estate tax rate in Hanover County VA?

Hanover County collects, on average, 0.68% of a property's assessed fair market value as property tax. Hanover County has one of the highest median property taxes in the United States, and is ranked 496th of the 3143 counties in order of median property taxes.

Who is exempt from Virginia car tax?

Veterans of the United States Armed Forces or the Virginia National Guard who the U.S. Department of Veteran Affairs (VA) has determined have a 100% service-connected, permanent and total disability are eligible for a SUT exemption on the purchase of a vehicle owned and used primarily by or for the qualifying veteran.

Can I avoid paying car tax?

You must tax your vehicle, even if you do not have to pay anything. Motorists who do not tax their vehicle can face financial penalties, court action and the risk of having their vehicles clamped or impounded.

At what age do seniors stop paying property taxes in Virginia?

Owner/Applicant must be at least 65 or permanently disabled as of December 31 of the previous year. Sworn affidavits from two medical doctors licensed in Virginia or two military officers who practice medicine in the United States Armed Forces - use the Tax Relief Affidavit of Disability for their completion.

Does Prince William County have personal property tax?

In Prince William County, a personal property tax is assessed annually (as of January 1) on automobiles, trucks, motorcycles, trailers, and mobile homes. Business are also assessed a business tangible property tax on items such as furniture and fixtures, computers, and construction equipment.

Does Virginia have personal property tax on vehicles?

Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1.

Do you have to pay car taxes every year in Virginia?

Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1.

Are property taxes public record in Virginia?

Under Virginia State Law, these real estate assessment records are public information. Display of this property information on the Internet is specifically authorized by the Code of Virginia 58.1-3122.2 (as amended).

Can I pay my Virginia personal property tax online?

You can pay your personal property tax through your online bank account. When you use this method to pay taxes, please make a separate payment per tax account number. Also, if it is a combination bill, please include both the personal property tax amount and VLF amount as a grand total for each tax account number.

How do I find my local property tax?

Your area's property tax levy can be found on your local tax assessor or municipality website, and it's typically represented as a percentage—like 4%. To estimate your real estate taxes, you merely multiply your home's assessed value by the levy.

How do I find my personal property tax in Virginia?

How can I obtain information about personal property taxes? You can call the Personal Property Tax Division at (804) 501-4263 or visit the Department of Finance website .

Who is exempt from personal property tax in Virginia?

General Information. Personal property tax relief is provided for any passenger car, motorcycle, or pickup or panel truck having a registered gross weight with DMV of 10,000 pounds or less on January 1. Qualifying vehicles must be owned or leased by an individual and be used 50% or less for business purposes.

Which county in Virginia has the highest property tax?

Residents of Fairfax County pay highest average property taxes in Virginia StateRegion Where Residents Pay the Most in Property TaxesAverage Property Tax PaymentsVirginiaFairfax County$5,641WashingtonKing County$4,611West VirginiaPutnam County$988WisconsinDane County$4,99446 more rows • 17-Nov-2020

What is Virginia's real estate tax rate?

With an average effective property tax rate of 0.80%, Virginia property taxes come in well below the national average of 1.07%.Overview of Virginia Taxes. New York County$4,8131.925% of Assessed Home ValueNational $2,7751.110% of Assessed Home Value1 more row

What is the property tax rate in Hanover County VA?

Hanover County collects, on average, 0.68% of a property's assessed fair market value as property tax. Hanover County has one of the highest median property taxes in the United States, and is ranked 496th of the 3143 counties in order of median property taxes.

Does Virginia have a personal property tax?

Personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in Virginia. Tax rates differ depending on where you live. If you have questions about personal property tax or real estate tax, contact your local tax office.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit VA Application High Mileage Discount online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your VA Application High Mileage Discount and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the VA Application High Mileage Discount form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign VA Application High Mileage Discount and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out VA Application High Mileage Discount on an Android device?

On an Android device, use the pdfFiller mobile app to finish your VA Application High Mileage Discount. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is VA Application High Mileage Discount?

The VA Application High Mileage Discount is a benefit offered to veterans allowing them to receive a discount on vehicle-related expenses based on high mileage driven in connection with VA-approved activities.

Who is required to file VA Application High Mileage Discount?

Veterans who frequently travel for VA-related appointments, employment, or other approved activities and wish to claim a reimbursement for high mileage are required to file the application.

How to fill out VA Application High Mileage Discount?

To fill out the VA Application High Mileage Discount, applicants need to complete the form provided by the VA, detailing their mileage, dates of travel, purpose, and any relevant supporting documentation.

What is the purpose of VA Application High Mileage Discount?

The purpose of the VA Application High Mileage Discount is to provide financial relief to veterans who incur expenses due to extensive travel for VA services, ensuring they are not financially burdened by these necessary trips.

What information must be reported on VA Application High Mileage Discount?

Applicants must report their total mileage driven, dates of travel, purpose of each trip, and any other details required by the VA, such as travel to medical appointments or employment related to their veteran status.

Fill out your VA Application High Mileage Discount online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA Application High Mileage Discount is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.