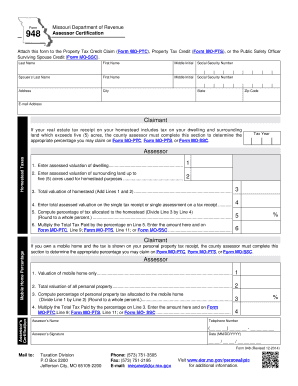

MO Form 948 2020-2025 free printable template

Show details

This form is used to certify the assessed valuation of a taxpayer's dwelling and surrounding land for property tax credit claims in Missouri.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign irs form 948

Edit your missouri form 948 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mo form 948 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing missouri personal property tax receipt online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mo personal property tax receipt form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form 948 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out personal property tax missouri form

How to fill out MO Form 948

01

Obtain MO Form 948 from the official website or local office.

02

Start by filling in your personal information such as name, address, and contact details on the top of the form.

03

Provide information about your income and any deductions you may have.

04

Complete the sections related to your tax situation, including filing status and number of dependents.

05

Review the form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate tax authority either by mail or online, as per the instructions.

Who needs MO Form 948?

01

Individuals or businesses in Missouri who are filing for state tax adjustments or claims.

02

Persons who have specific tax situations requiring detailed reporting.

03

Taxpayers seeking to claim certain credits or deductions offered by the state.

Fill

missouri property tax credit forms

: Try Risk Free

People Also Ask about missouri tax forms

What is the Missouri caregiver tax credit?

The credit is the amount of your Missouri tax liability or $500, whichever is less. If your Missouri tax liability is $200, you will receive a credit of $200.

Can I file Mo PTC online?

If you are eligible for a Property Tax Credit and required to file federal and Missouri (Form MO-1040) income tax forms, you are eligible to e-file.

What is Missouri for 948?

Form MO-948, is the Missouri Department of Revenue Assessor Certification. It is used to help determine personal and business property tax allocation.

What is a mo ptc form?

To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2021 real estate tax in calendar year 2022, you must file a 2021 Property Tax Credit Claim (Form MO-PTC).

Who is exempt from paying property taxes?

From 2022, the exemption applies if someone lives in the property and they are not a joint owner of the property. For example, they may be a tenant, relative or friend. Property purchased, built or adapted for a person who is permanently and totally incapacitated to live there as their sole or main residence.

Who is eligible for MO PTC?

The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home.

What is the income limit for PTC in Missouri?

To be eligible, a person who owns their home must occupy it for the entire year, and have an income of $30,000 or less for a single person, or $34,000 or less for a household.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mo property tax receipt?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific property tax receipt missouri and other forms. Find the template you need and change it using powerful tools.

How do I edit personal property tax receipt missouri online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your personal property tax missouri lookup to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the missouri property tax in Gmail?

Create your eSignature using pdfFiller and then eSign your missouri personal property tax vehicle immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is MO Form 948?

MO Form 948 is a Missouri state tax form used for reporting certain tax information.

Who is required to file MO Form 948?

Individuals or businesses that meet specific eligibility criteria and have certain tax obligations in Missouri are required to file MO Form 948.

How to fill out MO Form 948?

To fill out MO Form 948, the taxpayer must gather the necessary financial information, complete the required sections of the form, and ensure all details are accurate before submitting it to the appropriate tax authority.

What is the purpose of MO Form 948?

The purpose of MO Form 948 is to facilitate the reporting of specific tax information to the Missouri Department of Revenue.

What information must be reported on MO Form 948?

Information that must be reported on MO Form 948 includes identification details of the taxpayer, income details, deductions, credits, and any other relevant financial information as specified on the form.

Fill out your MO Form 948 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Missouri Tax Forms 2025 is not the form you're looking for?Search for another form here.

Keywords relevant to how to get personal property tax receipt

Related to personal property tax waiver missouri online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.