Get the free outside of cbra zone

Show details

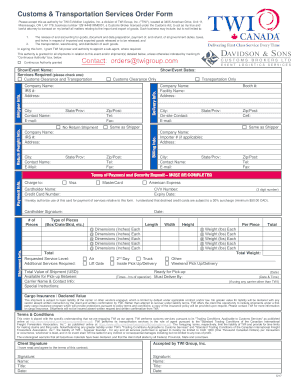

NPC / CBA FLOOD INSURANCE APPLICATION. SOUTHWEST BUSINESS ... Agent. Agency Name: Contact: Address: City: State: Zip: Phone:(. ) Fax:(. ) E-mail ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign outside of cbra zone

Edit your outside of cbra zone form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your outside of cbra zone form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing outside of cbra zone online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit outside of cbra zone. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out outside of cbra zone

How to fill out CBRA flood insurance:

01

Obtain the necessary forms: Start by obtaining the CBRA flood insurance application forms from the appropriate insurance provider or agency. These forms are usually available online or can be requested via mail.

02

Provide personal information: Fill out the required personal information section of the application. This includes your name, address, contact details, and any other information the form asks for.

03

Determine the coverage needed: Assess the coverage that you require based on the specific details of your property and its location within the CBRA flood zone. It is important to accurately determine the value of your property and any additional structures when deciding on the coverage amount.

04

Complete the property details: Provide detailed information about the property you are seeking insurance for. This includes the address, the type of property (residential or commercial), and any relevant details such as the number of floors, square footage, and year of construction.

05

Understand the flood risk: Familiarize yourself with the flood risk associated with your property in the CBRA area. This information can often be obtained from maps or flood zone designations provided by local authorities or insurance agencies. Understanding the flood risk is crucial for determining the appropriate coverage and mitigating potential damages.

06

Provide supporting documents: Submit any required supporting documents with your application. This may include property surveys, elevation certificates, and any other documents that help assess the flood risk and determine the insurance premium.

07

Review and submit the application: Carefully review all the information you have filled out on the application form to ensure accuracy and completeness. Double-check that you have included all relevant supporting documents. Once satisfied, submit the application to the insurance provider or agency through the preferred method outlined in the instructions.

Who needs CBRA flood insurance:

01

Properties located within CBRA flood zones: CBRA flood insurance is mostly needed by property owners or occupants who have properties located within Coastal Barrier Resources Act (CBRA) designated flood zones. These areas are identified as ecologically sensitive and generally lack federal financial assistance, making it crucial for property owners to secure adequate flood insurance to protect their investments.

02

Property owners with mortgage requirements: In some cases, lenders may require property owners in CBRA zones to maintain flood insurance as a condition for obtaining a mortgage or loan. This ensures that the property has sufficient protection against potential flood-related damages.

03

Individuals seeking additional protection: Even if flood insurance is not mandatory, some property owners or occupants may opt for CBRA flood insurance voluntarily to ensure their property and belongings are protected in the event of a flood. This provides peace of mind and financial security in the face of potential flood-related losses.

It is important to consult with insurance professionals or agencies specializing in CBRA flood insurance to understand the specific requirements and coverage options available for your property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify outside of cbra zone without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your outside of cbra zone into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send outside of cbra zone to be eSigned by others?

Once your outside of cbra zone is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit outside of cbra zone on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign outside of cbra zone. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is cbra flood insurance?

CBRA flood insurance stands for Coastal Barrier Resources Act flood insurance, which provides coverage for properties located in designated coastal barrier resource areas.

Who is required to file cbra flood insurance?

Property owners located in coastal barrier resource areas are required to file CBRA flood insurance.

How to fill out cbra flood insurance?

To fill out CBRA flood insurance, property owners need to provide information about the property's location, value, and any previous flood insurance coverage.

What is the purpose of cbra flood insurance?

The purpose of CBRA flood insurance is to provide financial protection to property owners in coastal barrier resource areas from flood damage.

What information must be reported on cbra flood insurance?

Information such as property location, value, and previous flood insurance coverage must be reported on CBRA flood insurance.

Fill out your outside of cbra zone online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Outside Of Cbra Zone is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.