TX Form 37A - Harris County 2005 free printable template

Show details

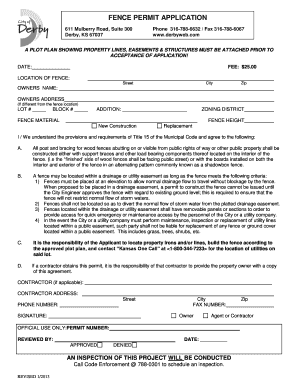

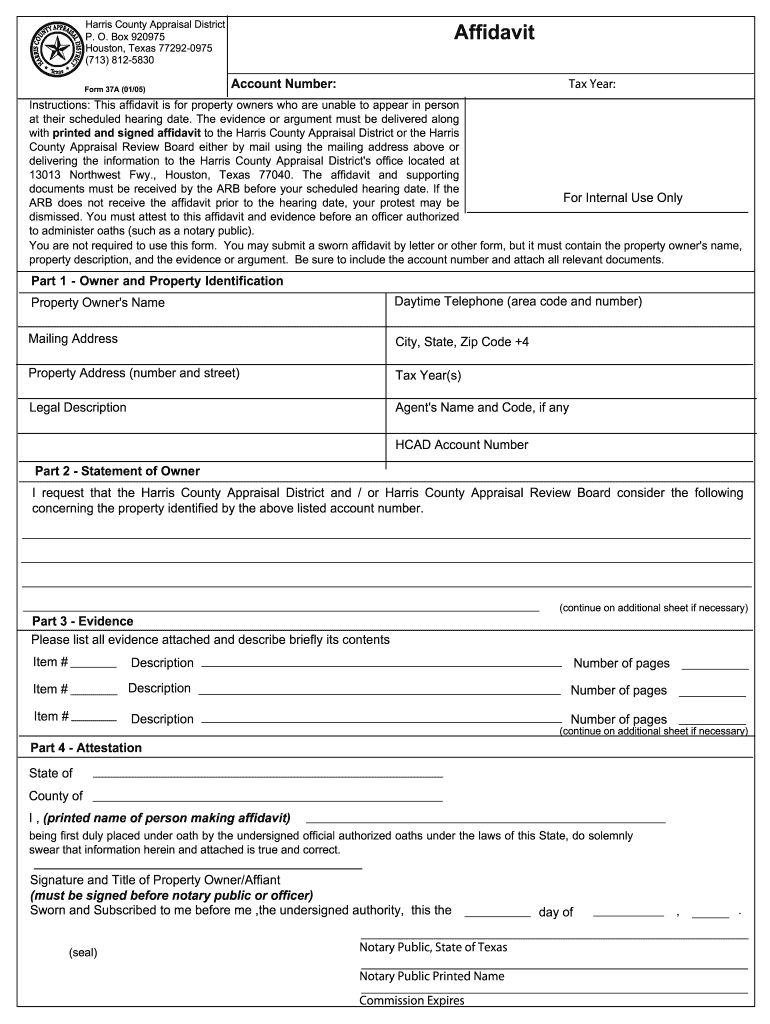

Harris County Appraisal District P. O. Box 920975 Houston, Texas 77292-0975 (713) 812-5830 Form 37A (01/05) Affidavit Account Number: Tax Year: Instructions: This affidavit is for property owners

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Form 37A - Harris County

Edit your TX Form 37A - Harris County form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Form 37A - Harris County form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Form 37A - Harris County online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX Form 37A - Harris County. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Form 37A - Harris County Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Form 37A - Harris County

How to fill out TX Form 37A - Harris County

01

Obtain a copy of TX Form 37A - Harris County from the official website or local county office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide the relevant case details, including case number and type of request.

04

Clearly state the purpose for submitting the form in the designated section.

05

Attach any required supporting documents or evidence as indicated on the form.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form in the designated area before submission.

08

Submit the form either in person or by mail to the appropriate Harris County office.

Who needs TX Form 37A - Harris County?

01

Individuals involved in legal proceedings in Harris County who need to submit a specific request or application.

02

Attorneys representing clients in legal matters needing to formalize a request to the court.

03

Parties who are requesting access to court records or filings in Harris County.

Instructions and Help about TX Form 37A - Harris County

Fill

form

: Try Risk Free

People Also Ask about

How much is the Harris County over 65 exemption?

At-Large Council Member Sallie Alcorn agreed, noting that Houston now has the highest exemption for seniors in the region. Harris County's over-65 exemption is set at $229,000.

How do I apply for over 65 property tax exemption in Harris County?

You may apply to the appraisal district the year you become age 65 or qualify for disability. If your application is approved, you will receive the exemption for the entire year in which you become age 65 or disabled and for subsequent years as long as you own a qualified residence homestead.

At what age do you stop paying property taxes in Harris County?

What this means is that, at the age of 65, you can file your affidavit requesting that the local tax authority stop collecting taxes on your homestead - not indefinitely, but for a specific period. The deferral will end 181 days after one of two events: 1) the homeowner's death or 2) the sale of the property.

How much is the Harris County homestead exemption?

Harris County: Harris County provides a 20% exemption on your appraised value.

How much is the senior property tax exemption in Texas?

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

Do seniors over 65 pay property taxes in Texas?

You may be aware that seniors can apply for an exemption from Texas property taxes. This is true: when you reach the age of 65, you can file an affidavit with the chief appraiser in your district to exempt yourself from the collection of taxes on your property.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TX Form 37A - Harris County?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the TX Form 37A - Harris County. Open it immediately and start altering it with sophisticated capabilities.

How do I complete TX Form 37A - Harris County online?

pdfFiller has made filling out and eSigning TX Form 37A - Harris County easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the TX Form 37A - Harris County electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your TX Form 37A - Harris County.

What is TX Form 37A - Harris County?

TX Form 37A is a property tax form used in Harris County, Texas, primarily for property owners to report specific information related to their property for tax assessment purposes.

Who is required to file TX Form 37A - Harris County?

Property owners in Harris County who are seeking exemptions or need to report certain property information are required to file TX Form 37A.

How to fill out TX Form 37A - Harris County?

To fill out TX Form 37A, property owners must provide required personal information, details about the property, and any supporting documentation as needed for the specific exemptions being claimed.

What is the purpose of TX Form 37A - Harris County?

The purpose of TX Form 37A is to verify the eligibility of property owners for certain tax exemptions or to provide necessary property information to the Harris County Appraisal District.

What information must be reported on TX Form 37A - Harris County?

Information that must be reported on TX Form 37A includes property owner's name, address, property details, exemption types requested, and any additional information pertinent to the tax assessment.

Fill out your TX Form 37A - Harris County online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Form 37a - Harris County is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.