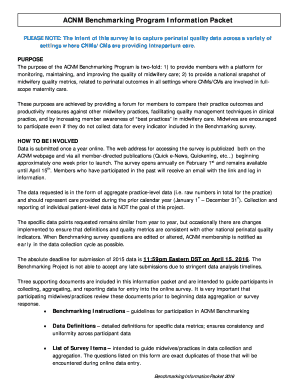

UK Companies House DS01 2018-2025 free printable template

Get, Create, Make and Sign dso1 form

How to edit form ds01 companies house online

Uncompromising security for your PDF editing and eSignature needs

UK Companies House DS01 Form Versions

How to fill out ds01 form companies house

How to fill out UK Companies House DS01

Who needs UK Companies House DS01?

Video instructions and help with filling out and completing ds01 form

Instructions and Help about ds01 form online

Strike another company can be an alternative to placing the company into form and solvency when there is simply no Isis in a company to fund a liquidation or the directors are unwilling or unable to personally meet the costs of a liquidation a strike or application it's not always a pitiful, and therefore it is always best to seek professional advice from a licensed insolvency practitioner to discuss all the options available to the company to see it the struggle application is the best course available to the directors a struggle application is not a formal insolvency process than to the insolvency Act and isn't that the company's up process, and therefore it will never be as quick and as efficient as a formal accommodation there are certain restrictions regarding when a company can have this drug off which are basically it hasn't traded or changes name with the last three months provided that the company meets ordered the corn wine criteria the first step to apply for us type of application is to complete a DSO one form which can be downloaded from the company's hatch website once that form is completed it will need to be submitted to Companies House on receipts that form could miss hatch workplace and notice other than the cassette advertising the stripe application within seven days of submitting that form a crappy must be sent to order the shareholders directors employees and creditors and any other interested parties while it is not required by law I always think it's a good idea to provide all interested parties with a summary of the Cabbies assets and liabilities together with a history of the company detailing the events that led to its insolvency this is important because any interested party can within three months of the London Gazette noticed object to the striking off according therefore while demonstrating that there are no assets and explain the reasons why the company should be struck from the register any interested party are more likely not to object if a creditor does object than the whole process is suspended for a six-month period after six months companies hands will advertise the application again develop the Gazette and the process starts again if the creditor the subject I would normally write my creditor to ask them to either withdraw their objection another head of the company to be struck off or alternatively invite them to issue a warrant and a petition against the company issue a wine to that petition will cost the creditor anywhere between two thousand two three and a half thousand pounds and usually the creditor will be unwilling to incur this cost because often it can be seen as throwing good money after bad if there are no objections or any objections have that happy receipt are withdrawn companies house will then strike the company from the register any assets that belong to the company will then become what is known as boner for County her which means are they will be best in the crown tube disadvantages of a...

People Also Ask about form ds01 for closing a ltd company

What are the consequences of a strike off?

What happens when a company is struck off?

What happens if my business is struck off?

How long does DS01 take?

What is DS01?

Who to send DS01 to?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find strike off company online?

Can I create an electronic signature for signing my ds01 online in Gmail?

How can I edit ds01 company form on a smartphone?

What is UK Companies House DS01?

Who is required to file UK Companies House DS01?

How to fill out UK Companies House DS01?

What is the purpose of UK Companies House DS01?

What information must be reported on UK Companies House DS01?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.