Get the free Occupational Tax Certificate Application - Clayton County ... - claytoncountyga

Show details

JEFFREY E. TURNER CHAIRMAN GAIL B. CAMBRIC VICE CHAIRMAN DONNA SINGLETON-GREGORY COMMISSIONER Community Development Department 121 South McDonough Street, Jonesboro, Georgia 30236 Office: (770) 477-3569

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occupational tax certificate application

Edit your occupational tax certificate application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occupational tax certificate application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing occupational tax certificate application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit occupational tax certificate application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occupational tax certificate application

How to fill out an occupational tax certificate application:

01

Begin by gathering all the necessary information and documents required for the application. This may include your business name, address, contact information, federal tax ID number, and any relevant licenses or permits.

02

Research the specific requirements and guidelines for the occupational tax certificate application in your jurisdiction. Each location may have different rules and regulations, so it is essential to familiarize yourself with the specific requirements before proceeding.

03

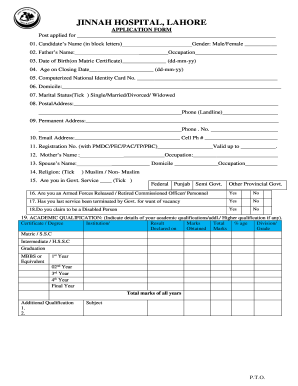

Obtain the application form from the appropriate government office or website. Typically, these forms can be found online or by visiting the local government office responsible for issuing occupational tax certificates.

04

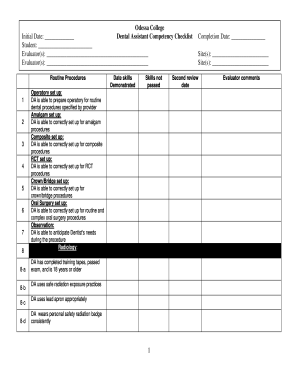

Carefully read and understand all the instructions provided on the application form. Some forms may require specific information or supporting documents to be attached, so make sure to follow the guidelines closely.

05

Fill out the application form accurately and legibly. Double-check all the information provided to ensure its accuracy. Inaccurate or incomplete applications may result in delays or rejection of your certificate.

06

Attach any necessary supporting documents or additional information required by the application. This might include copies of licenses, permits, or identification documents.

07

Review the completed application and supporting documents to ensure everything is in order. Check for any errors, missing information, or inconsistencies. It may be helpful to have someone else review the application as well to catch any mistakes or oversights.

08

Submit the completed application and any required fees to the appropriate government office or online portal. Make sure to keep copies of all the documents submitted for your records.

Who needs an occupational tax certificate application?

01

Business owners: Any individual or entity operating a business within a specific jurisdiction may be required to obtain an occupational tax certificate. This includes sole proprietors, partnerships, LLCs, corporations, and other legal entities.

02

Professionals: Certain professionals, such as doctors, lawyers, accountants, and contractors, may also be required to obtain occupational tax certificates. These certificates ensure that professionals are compliant with local regulations and have met any necessary licensing requirements.

03

Non-profit organizations: Even non-profit organizations may need to apply for occupational tax certificates if they engage in certain activities that generate revenue or require specific permits or licenses.

04

Home-based businesses: Individuals running businesses from their homes may also need to obtain occupational tax certificates. Local regulations vary, so it is essential to check with the appropriate government office to determine if a certificate is required.

05

Temporary or seasonal businesses: Businesses operating for a limited period or during specific seasons may still need to apply for an occupational tax certificate. This ensures that they are legally authorized to conduct business within the jurisdiction during their designated operating period.

Remember, the specific requirements for obtaining an occupational tax certificate can vary depending on your location. It is crucial to research and understand the regulations and guidelines applicable to your jurisdiction to ensure compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is occupational tax certificate application?

Occupational tax certificate application is a form that must be completed by individuals or businesses in order to obtain a license to conduct business in a certain jurisdiction.

Who is required to file occupational tax certificate application?

Any individual or business that plans to conduct business in a specific jurisdiction may be required to file an occupational tax certificate application.

How to fill out occupational tax certificate application?

The occupational tax certificate application typically requires basic information about the individual or business, such as name, address, type of business, and projected income.

What is the purpose of occupational tax certificate application?

The purpose of the occupational tax certificate application is to ensure that businesses operating in a jurisdiction comply with local tax laws and regulations.

What information must be reported on occupational tax certificate application?

The occupational tax certificate application may require information such as business name, address, type of business, projected income, and number of employees.

How can I send occupational tax certificate application for eSignature?

When you're ready to share your occupational tax certificate application, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete occupational tax certificate application online?

pdfFiller makes it easy to finish and sign occupational tax certificate application online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete occupational tax certificate application on an Android device?

Complete occupational tax certificate application and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your occupational tax certificate application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occupational Tax Certificate Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.