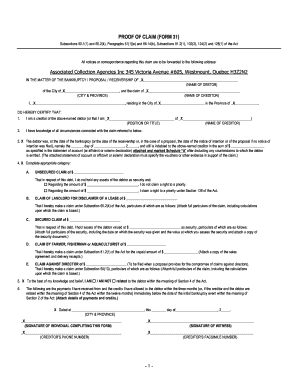

Get the free form 31

Show details

This form is used to apply for an advance from the Employee's Provident Fund for specific purposes, such as marriage or housing needs. It details the information required for processing the advance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign epfo 31 form

Edit your form 31 format form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 31 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 31 download online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit from 31 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out esic form 31 application for changing imp

How to fill out EPF withdrawal form 31:

01

Obtain the EPF withdrawal form 31 from the official EPF website or your nearest EPF office.

02

Fill out the personal information section, including your name, EPF account number, and contact details.

03

Provide the reason for your withdrawal, specifying whether it is for housing, medical expenses, or education purposes.

04

Attach supporting documents as required, such as medical reports, education fee receipts, or housing loan agreements.

05

Indicate the amount you wish to withdraw and provide bank account details for the funds to be transferred to.

06

Sign and date the form, ensuring all information is accurate and complete.

07

Submit the filled-out form along with the supporting documents to your nearest EPF office.

Who needs EPF withdrawal form 31:

01

Individuals who are employees and contributing to the Employees' Provident Fund (EPF) in India.

02

People who require financial assistance for specific purposes such as housing, medical expenses, or education.

03

Members who have completed a certain number of years of service and are eligible for partial withdrawal from their EPF account.

Fill

form no 31 pf

: Try Risk Free

People Also Ask about form31

How much EPF can be withdrawn from Form 31?

Withdrawal is allowed only after you have completed 54 years of age and within 1 year of retirement, whichever is later. You can withdraw a maximum of up to 90% of the amount from your EPF account.

How long it will take to process Form 31?

How long does it take for the verification of an application and transfer of funds to a bank account? Verification of an application takes at least two weeks. Funds will be transferred to the bank account in the same period. You can track the process by checking EPF Form 31 claim status online.

Can I withdraw 100% from EPFO?

As per the new rule, EPFO allows withdrawal of 75% of the EPF corpus after 1 month of unemployment. The remaining 25% can be transferred to a new EPF account after gaining new employment. As per the old rule, 100% EPF withdrawal is allowed after 2 months of unemployment.

How long does it take to process PF illness claim?

This will be a non-refundable deposit. EPFO online claims are stipulated to be settled within 72 hours, while offline claims may take up to 20 days for settlement. However, there are various EPF withdrawal rules that one needs to adhere to in order to make withdrawals from the PF account.

How can I withdraw my PF Form 31?

Step 1: Log in to the UAN portal through the official government website. Step 2: Check if the required KYC details are updated and verified. Step 3: Once the KYC details are verified, visit the “online service” tab and choose claim Form 31. Step 4: Next, Fill in details like KYC, service details, etc.

How can I withdraw my full PF amount online?

Step 1: Visit the Member e-Sewa portal on the EPFO portal. Step 2: Sign in to your account with a password, UAN and Captcha code. Step 3: Select 'Claim (Form-19, 31, 10C & 10D)' from the 'Online Services' tab. Step 4: A new webpage will open where you need to provide the correct bank account number linked with UAN.

How much can I withdraw from PF advance Form 31?

ing to the new rules, PF account holders can withdraw money equivalent to three months of their basic salary plus dearness allowance or 75% of the net balance in their PF or EPF account, whichever is lower. This will be taken as a non-refundable deposit. These withdrawal claims can be raised online.

How much can I withdraw from EPF Form 31?

Maximum 90% of the amount in the EPF account of the member can be withdrawn.

How can I get under process Form 31 PF?

Step 1: Log in to the UAN portal through the official government website. Step 2: Check if the required KYC details are updated and verified. Step 3: Once the KYC details are verified, visit the “online service” tab and choose claim Form 31. Step 4: Next, Fill in details like KYC, service details, etc.

Can I withdraw 90% of my PF?

Note: Only 90% of total PF balance can be withdrawn before one year of retirement. Also, income tax (TDS) is deducted if the PF account is less than five years old, but not in case the total balance is below INR 50,000.

What is the difference between Form 19 and Form 31?

Form 19 is filled for PF final settlement, Form 10C is filled for pension withdrawal and Form 31 is filled for partial EPF withdrawal. However, only the Composite Claim Form has to be filled for withdrawing funds offline.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 31 in epfo in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form 31 in minutes.

Can I create an eSignature for the form 31 in Gmail?

Create your eSignature using pdfFiller and then eSign your form 31 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit form 31 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share form 31 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is form 31?

Form 31 is a notification form used in various contexts, often related to taxation or regulatory compliance, to report specific information to government authorities.

Who is required to file form 31?

Individuals or entities required to file Form 31 typically include taxpayers or businesses that need to report particular transactions, changes in circumstances, or fulfill regulatory obligations as mandated by law.

How to fill out form 31?

To fill out Form 31, you need to gather necessary information as specified in the form, complete the required sections accurately, and submit it by the specified due date either electronically or by mail.

What is the purpose of form 31?

The purpose of Form 31 is to provide authorities with information that may be necessary for compliance, assessment, or monitoring purposes related to taxes or regulations.

What information must be reported on form 31?

Information that must be reported on Form 31 may include details such as taxpayer identification information, specific transaction data, dates, amounts involved, and any other relevant information as required by the form.

Fill out your form 31 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 31 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.