MI Housing Education Program Household Profile 2006 free printable template

Fill out, sign, and share forms from a single PDF platform

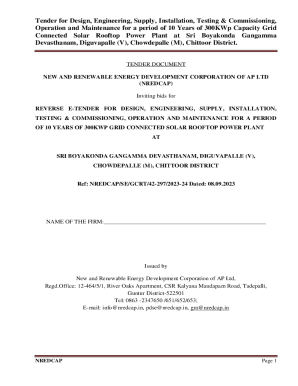

Edit and sign in one place

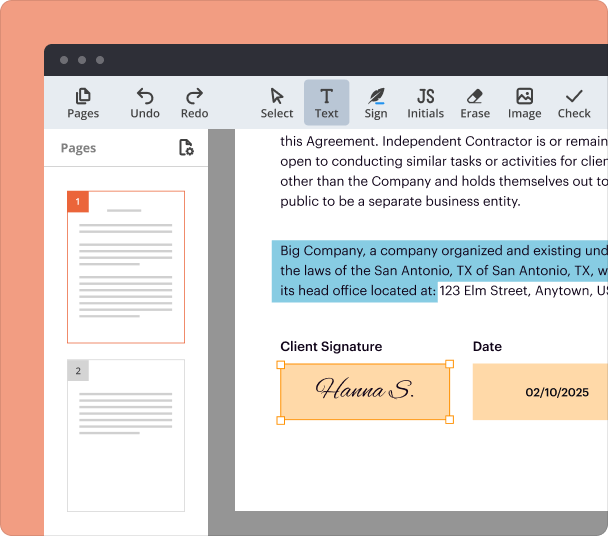

Create professional forms

Simplify data collection

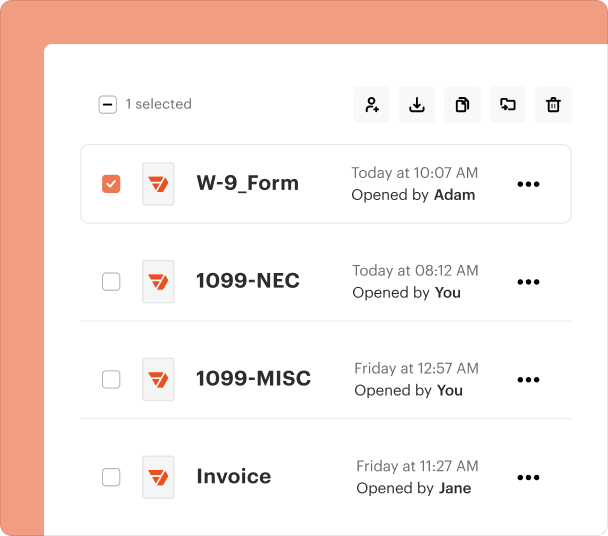

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to fill out the housing education program form

Overview of the Housing Education Program

The MI Housing Education Program aims to prepare individuals for successful homeownership by providing essential knowledge and resources. Participants gain insights into the home buying process, making informed decisions while maximizing their opportunities. Notably, the program offers benefits such as access to resources, financial literacy, and guidance tailored to first-time homebuyers.

-

Participants enjoy extensive resources that enhance their understanding of homeownership, with a focus on financial preparedness and navigating the housing market.

-

To participate, applicants typically need to meet certain income guidelines and first-time homebuyer status.

-

The program is specifically designed to educate and empower prospective buyers, providing tools and support throughout their journey.

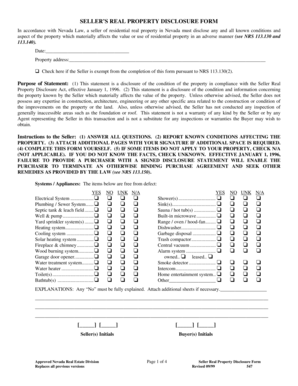

Understanding the MSHDA Household Profile Form

The Household Profile Form is crucial for expressing your information accurately within the MI Housing Education Program. This form helps assess your eligibility based on financial and household factors. Accurate reporting ensures that your application is processed efficiently and appropriately.

-

This form establishes your household's financial status, which is critical in determining potential assistance eligibility.

-

You will need to provide details such as income, household size, and demographics to complete the form.

-

Filling the form correctly can expedite your application and avoid delays or disqualification.

Filling Out the Household Profile Form

Completing the Household Profile Form may seem daunting, but with a step-by-step guide, it becomes manageable. Start by gathering all necessary documentation you'll reference while filling in the form.

-

Follow the designated flow of the form, filling in personal information as you go along.

-

Pay particular attention to the Applicant and Co-Applicant details, ensuring all data matches your documents.

-

Provide accurate entries for ethnicity and income, as this information affects eligibility and aids in processing.

-

Use the most recent pay stubs, tax returns, and other financial documents to ensure accuracy.

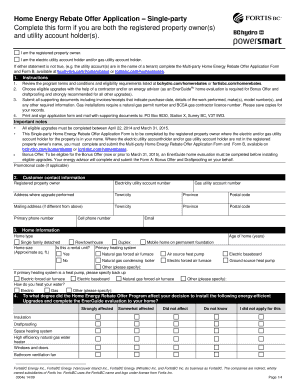

Submitting the Form Online through pdfFiller

Submitting your completed form doesn't have to include cumbersome processes. With pdfFiller, you can upload, edit, and submit your form conveniently online.

-

Simply create an account at pdfFiller, upload your form, and use the intuitive interface to make edits.

-

Utilize pdfFiller's eSignature functionality to sign your document digitally, ensuring it is both legal and compliant.

-

Review the guidelines for MI Housing Program submissions to ensure all your documents meet necessary requirements before submission.

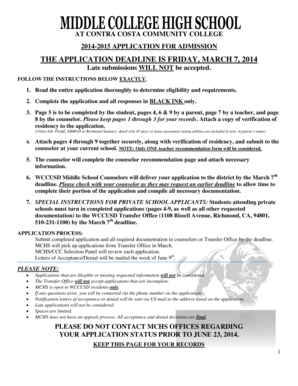

Eligibility Questions and Support

Understanding the eligibility requirements for the MI Housing Education Program is vital for potential applicants. Access to support resources can alleviate concerns regarding the application.

-

Questions often include income limits, first-time homebuyer status, and required documentation.

-

Utilize online portals or local housing agencies for guidance through any uncertainties.

-

Reach out to MI Housing representatives for personalized support related to your application.

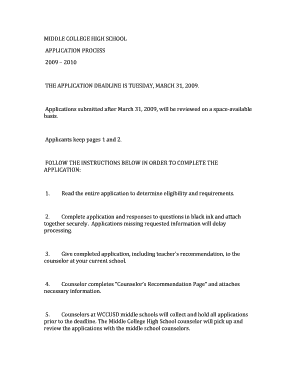

Continued Education and Resources

Homeownership education doesn't stop at filling out forms; ongoing learning opportunities are essential. Access additional resources to help you throughout your journey.

-

Engage in workshops or online courses focused on financial literacy and homeownership.

-

Sign up for structured courses designed to enhance your understanding of the entire home buying process.

-

Completion of specific courses may result in certificates that improve your qualifications for certain housing loans.

Program Policies and Housing Assistance Details

Understanding housing policies is crucial for any participant in the MI Housing Education Program. By knowing what types of assistance are available, you can fully leverage the program.

-

Explore how the MI Housing Program operates and its goals for assisting low- to moderate-income families.

-

Assistance can include down payment assistance, closing cost assistance, and low-interest loans.

-

Learn how to navigate challenges related to program policies and who to contact for help.

Frequently Asked Questions about household profile form

What is the MI Housing Education Program?

The MI Housing Education Program is designed to assist first-time homebuyers by providing educational resources and support throughout the buying process. It aims to prepare applicants for successful homeownership.

How can I access the Household Profile Form?

The Household Profile Form can typically be found on the Michigan State Housing Development Authority (MSHDA) website or through local housing agencies. You can also access it via document management tools like pdfFiller for ease of use.

What if I make a mistake on the form?

If you discover an error after submission, contact program representatives immediately. They will provide guidance on how to correct any inaccuracies that may affect your application.

Is there a fee associated with the MI Housing Education Program?

Typically, the program itself is offered at no cost, but if you choose additional courses or services, those may have associated fees. Always check the latest information on the official MSHDA site.

How does pdfFiller assist with form submission?

pdfFiller allows users to upload, edit, and digitally sign forms, making the process seamless. Its cloud-based platform enables easy access to your documents from anywhere.

pdfFiller scores top ratings on review platforms