Canada CTS3884 - Alberta 2011 free printable template

Show details

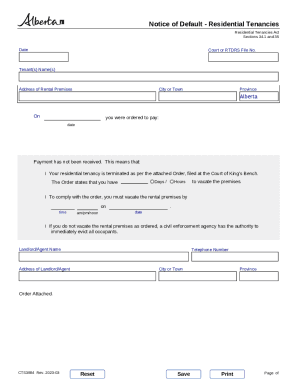

NOTICE OF DEFAULT See sections 34.1 and 35 of the Residential Tenancies Act Date:, 20 Month Tenant(s) Name(s): Day Year Address of Rental Premises:, Alberta Full Address Court or RT DRS file #: City

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada CTS3884 - Alberta

Edit your Canada CTS3884 - Alberta form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CTS3884 - Alberta form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada CTS3884 - Alberta online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Canada CTS3884 - Alberta. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CTS3884 - Alberta Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CTS3884 - Alberta

How to fill out Canada CTS3884 - Alberta

01

Obtain a copy of Canada CTS3884 form from the Canada Revenue Agency or online.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide the necessary financial information, including your income sources and relevant deductions.

04

Carefully read the instructions provided with the form for specific requirements related to your situation.

05

Double-check all entries for accuracy and completeness before submitting.

06

Submit the completed form to the appropriate tax authority by the deadline.

Who needs Canada CTS3884 - Alberta?

01

Individuals residing in Alberta who need to report their income or claim deductions.

02

Taxpayers in Alberta seeking assistance with their tax obligations.

03

Persons who are filing a tax return in Canada and have specific claims to make.

Fill

form

: Try Risk Free

People Also Ask about

How much notice does a landlord have to give in Alberta?

A landlord must give the tenant three months written notice. Notice is to be served on or before the first day of the three-month notice period. An example: Joe has a month-to-month tenancy. It begins on the first day of the month and ends on the last day of the month.

How much does it cost to evict a tenant in Alberta?

Cost of Evicting a Tenant in Alberta Overall, you can expect the cost of an eviction in Alberta to range around $3,300. Given the highest expense is the missed rent payments, some landlords consider rental income insurance to guarantee income when their tenants don't pay.

How long does it take to evict a tenant in Alberta?

If a tenant commits a substantial breach, the landlord can apply to the RTDRS or Court to end the tenancy, or give the tenant at least 14-days' notice to end the tenancy. A tenant must be given the notice at least 14 clear days before the tenancy is to end.

Is it hard to evict a tenant in Alberta?

It's difficult, especially if you're a first-time landlord, but sometimes necessary. The Alberta landlord-tenant law is clear on the process that must be followed when evicting tenants.

What is the eviction process in Alberta?

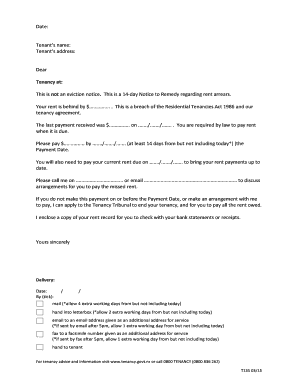

Non-payment of rent If a tenant fails to make their rent payment, a landlord can evict them. In this case, the landlord must give their tenant 14 days to pay their rent, known as a 14-Day Eviction Notice. A 14 Day Eviction Notice needs to be in writing and includes the following: The address of the property.

How do I file an eviction notice in Alberta?

All notices must: be in writing. give the address of the residential premises. be signed by the landlord or the landlord's agent. set out the rent that is due and any additional rent that may become due during the notice period. state the reasons for the eviction. state the date the tenancy ends.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute Canada CTS3884 - Alberta online?

pdfFiller has made filling out and eSigning Canada CTS3884 - Alberta easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the Canada CTS3884 - Alberta electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your Canada CTS3884 - Alberta in seconds.

Can I create an electronic signature for signing my Canada CTS3884 - Alberta in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your Canada CTS3884 - Alberta right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is Canada CTS3884 - Alberta?

Canada CTS3884 - Alberta is a form used by businesses in Alberta to report the collection and remittance of specific taxes.

Who is required to file Canada CTS3884 - Alberta?

Businesses that collect certain taxes in Alberta, such as the Alberta Sales Tax, are required to file Canada CTS3884 - Alberta.

How to fill out Canada CTS3884 - Alberta?

To fill out Canada CTS3884 - Alberta, businesses must provide their tax identification number, calculate the total taxes collected, and report any exemptions.

What is the purpose of Canada CTS3884 - Alberta?

The purpose of Canada CTS3884 - Alberta is to ensure compliance with tax regulations by reporting taxes collected by businesses operating in Alberta.

What information must be reported on Canada CTS3884 - Alberta?

The information that must be reported includes total sales, amount of tax collected, any exemptions claimed, and the business's tax identification number.

Fill out your Canada CTS3884 - Alberta online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada cts3884 - Alberta is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.