Get the free Credit Card Authorization Form - International Restaurant ...

Show details

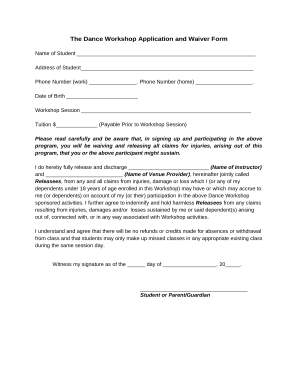

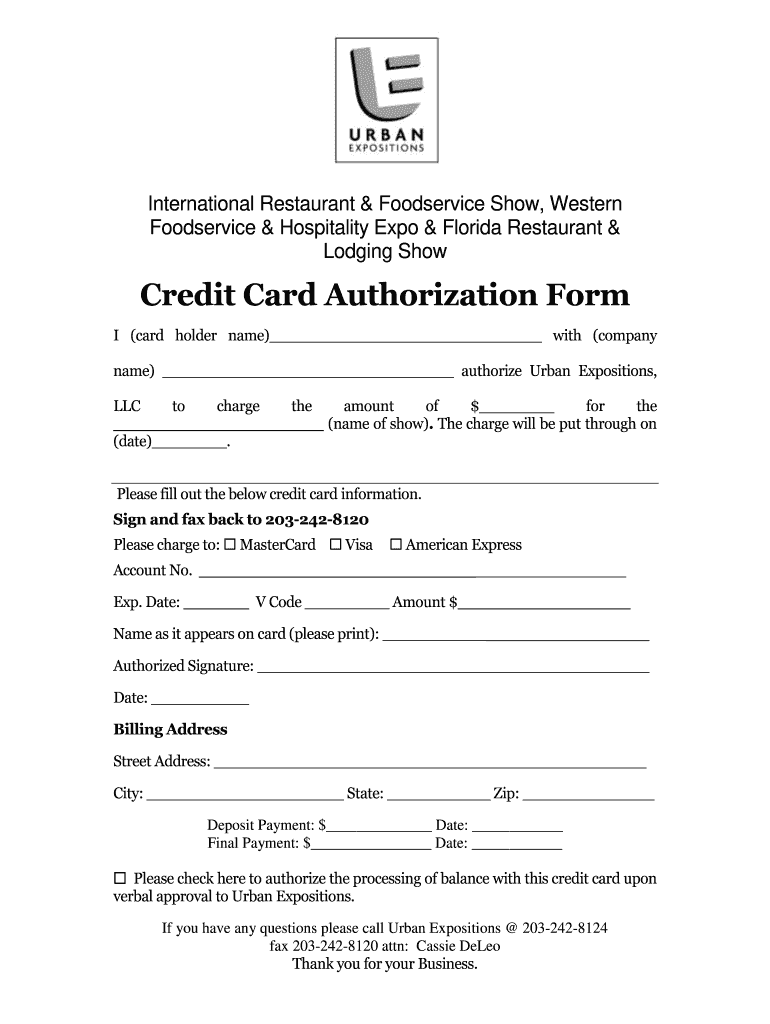

International Restaurant & Food service Show, Western Food service & Hospitality Expo & Florida Restaurant & Lodging Show Credit Card Authorization Form I (cardholder name) with (company name) authorize

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card authorization form

Edit your credit card authorization form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card authorization form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card authorization form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit card authorization form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card authorization form

How to fill out credit card authorization form:

01

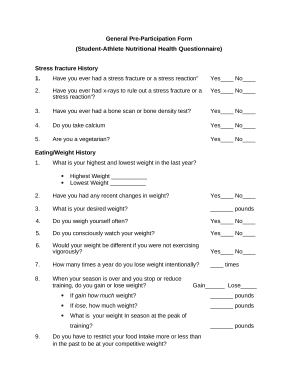

Gather the necessary information: you will need the credit cardholder's name, billing address, credit card number, expiration date, and CVV code.

02

Provide the merchant details: include the merchant's name, address, and contact information.

03

Specify the transaction details: indicate the purpose of the transaction, the amount to be charged, and any other relevant information.

04

Sign and date the form: the credit cardholder must sign and date the form to authorize the transaction.

05

Submit the completed form: send the form to the merchant or follow their specific instructions for submission.

Who needs a credit card authorization form:

01

Merchants or service providers: businesses and organizations that accept credit card payments may require a credit card authorization form to ensure they have proper authorization to charge the card.

02

Customers: individuals who wish to authorize someone else to make a payment using their credit card may need to fill out a credit card authorization form. This is often required for situations where the cardholder cannot be physically present to make the payment themselves.

03

Financial institutions: credit card authorization forms may be needed by banks or other financial institutions to verify and process transactions.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a simple letter of authorization?

How to Write an Authorization Letter Step 1: Write Your Name and Address. Step 2: Mention the Date. Step 3: Include the Recipient's Name and Address. Step 4: Write the Salutation. Step 5: Specify Duties, Reason, and Key Dates. Step 6: Finalize the Letter.

What is an example of a card authorization letter?

I have given him this card and the card number is 5490-8745-0934-1289. Please authorize Joseph to use this card to purchase items from your store from March 28, 2022 until December 31, 2022. Any purchases after this time period will not be approved by me and will be disputed to the credit card company.

What should be on a credit card authorization form?

The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file.

Should I fill out a credit card authorization form?

Written By If you want to use your credit card for recurring transactions or pre-authorize a future payment, you may need to sign a credit card authorization form.

Why do hotels require credit card authorization form?

Credit card authorization forms are standard at most hotels when the guest's name differs from the cardholder's — as is common with business accounts. The form protects the hotel by ensuring funds are available to pay for the room and that the charges will be approved.

How do I write a letter of authorization for a credit card?

How Do I Write a Credit Card Authorization Letter? Your full name. Your contact information. The date. Your credit card information and billing address (exclude the CVV code) The amount you are authorizing. The reason for the authorization (be specific!) The business or institution that is authorized to use it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card authorization form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign credit card authorization form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I fill out credit card authorization form using my mobile device?

Use the pdfFiller mobile app to fill out and sign credit card authorization form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete credit card authorization form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your credit card authorization form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is credit card authorization form?

A credit card authorization form is a document that allows a merchant or service provider to charge a customer's credit card for payments. It typically includes the cardholder's information and consent to charge their card.

Who is required to file credit card authorization form?

Any business or service provider that requires payment by credit card usually asks customers to fill out a credit card authorization form to obtain permission for charging the card.

How to fill out credit card authorization form?

To fill out a credit card authorization form, you need to provide details such as the cardholder's name, credit card number, expiration date, CVV code, billing address, and the amount to be charged. Additionally, you should sign and date the form to authorize the transaction.

What is the purpose of credit card authorization form?

The purpose of a credit card authorization form is to secure consent from the cardholder for a transaction. It protects both the merchant and the customer by ensuring that the transaction is authorized and documented.

What information must be reported on credit card authorization form?

The essential information on a credit card authorization form includes the cardholder's name, credit card number, expiration date, CVV code, billing address, transaction amount, and the cardholder's signature and date.

Fill out your credit card authorization form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Authorization Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.