US Bank Underwriting C1 2002-2025 free printable template

Show details

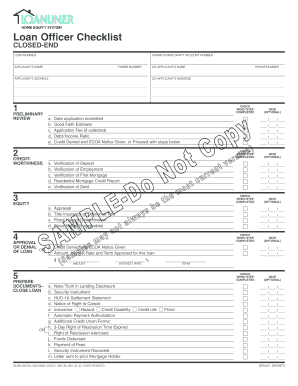

UNDERWRITING CHECKLIST - CONVENTIONAL BORROWER U.S. BANK HOME MORTGAGE LOAN CORRESPONDENT TELEPHONE PROCESSOR CLOSING DATE Cover Letter if applicable Request for Delegated MI Refer to FORMS Section if applicable Buydown Agreement if applicable Transmittal Summary FNMA 1008 Uniform Residential Loan Application Statement of Assets Liabilities Schedule of Real Estate Owned Cash Take Out- purpose of if applicable Handwritten Residential Loan Applicat...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mortgage underwriting checklist template form

Edit your loan officer assistant checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan officer assistant checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan officer assistant checklist online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit loan officer assistant checklist. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan officer assistant checklist

How to fill out a loan officer assistant checklist:

01

Gather all necessary documents and information, such as loan application forms, borrower information, and financial statements.

02

Review each item on the checklist to ensure that all required tasks and documents are completed and included.

03

Fill out the checklist by marking off each item as it is completed. This will help keep track of progress and ensure that nothing is overlooked.

04

Double-check all information and documents for accuracy and completeness before submitting them.

05

Once all items on the checklist are completed, submit the checklist along with the necessary documents to the appropriate department or individual.

Who needs a loan officer assistant checklist:

01

Loan officers or their assistants who are responsible for managing and processing loan applications.

02

Banks, financial institutions, or other lending organizations that handle loan applications and require a systematic approach to ensure all necessary tasks are completed.

03

Borrowers who want to keep track of the required documents and tasks involved in the loan application process.

Fill

form

: Try Risk Free

People Also Ask about

What does a loan officer assistant do?

A Loan Officer Assistant plays a vital role in the administrative upkeep of a loan office. As such, the duties of a Loan Officer Assistant cover the entire loan origination process, including managing paperwork and interacting with everyone involved to keep the process moving efficiently.

What do they check for a loan?

Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

What Does a Loan Officer Assistant do?

A Loan Officer Assistant plays a vital role in the administrative upkeep of a loan office. As such, the duties of a Loan Officer Assistant cover the entire loan origination process, including managing paperwork and interacting with everyone involved to keep the process moving efficiently.

What are the essential skills for a loan officer?

Essential Skills Speak, read and write English. Analyze and interpret financial data. Understand and follow standard accounting procedures. Be very accurate in your work. Use word processing, spreadsheet, database, internet and email software. Use financial and accounting software.

What makes a good loan officer assistant?

The most common important skills required by employers are Proactive, Clerical Skills, Communication Skills, Database, Mortgage Loans, Detail Oriented and Documentation.

What is the typical work schedule for a loan officer?

Work Environment Most loan officers work full time, and some work more than 40 hours per week. Except for consumer loan officers, who spend most of their time in offices, these workers may travel to visit clients.

How can I be a good loan assistant?

You will need excellent customer service skills if you want to excel in this role. Attention to detail and the ability to handle information discreetly will be essential. Analytical thinking and familiarity with banking processes related to loans, mortgages, and liens will also be important.

What is a loan checklist?

Loan Checklist means a list delivered to the Custodian in connection with delivery of a Loan to the Custodian that identifies the items contained in the related Loan File.

What is the difference between a loan officer and a loan officer assistant?

Loan Officer Assistants assist loan officers in processing the loan applications of clients. Loan officer assistants primarily work on the administrative tasks in the departments. They are in charge of managing documents, updating databases, and sorting files.

What skills do you need to be a loan officer assistant?

The most common important skills required by employers are Proactive, Clerical Skills, Communication Skills, Database, Mortgage Loans, Detail Oriented and Documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find loan officer assistant checklist?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the loan officer assistant checklist in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in loan officer assistant checklist without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing loan officer assistant checklist and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete loan officer assistant checklist on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your loan officer assistant checklist. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is US Bank Underwriting C1?

US Bank Underwriting C1 is a form used by US Bank for the purpose of underwriting and assessing the creditworthiness of loan applicants.

Who is required to file US Bank Underwriting C1?

Individuals or entities applying for loans or credit from US Bank are required to file US Bank Underwriting C1.

How to fill out US Bank Underwriting C1?

To fill out US Bank Underwriting C1, applicants should provide accurate personal and financial information as required by the form, ensuring all sections are completed thoroughly.

What is the purpose of US Bank Underwriting C1?

The purpose of US Bank Underwriting C1 is to facilitate the loan underwriting process by collecting necessary information to evaluate the risk of lending to an applicant.

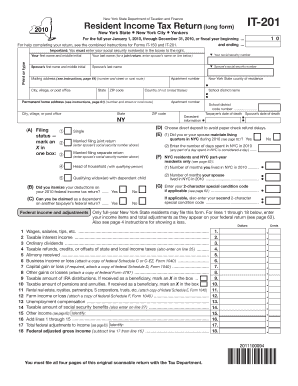

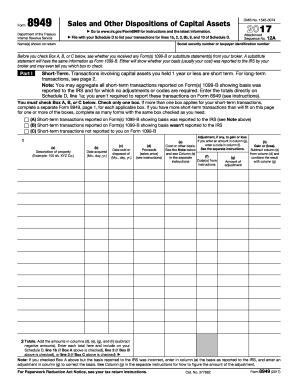

What information must be reported on US Bank Underwriting C1?

The information that must be reported on US Bank Underwriting C1 includes personal identification details, financial history, income, employment information, and details about the loan being requested.

Fill out your loan officer assistant checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Officer Assistant Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.