WI DoR 1NPR 2021 free printable template

Show details

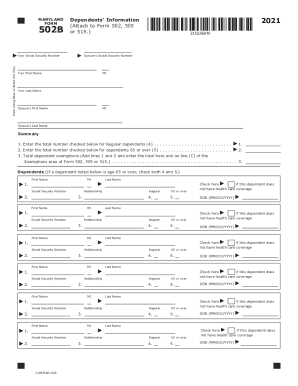

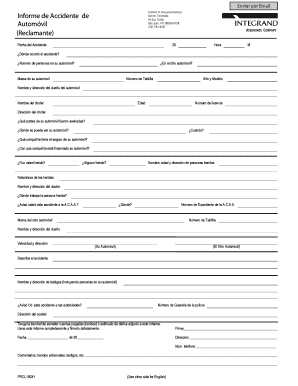

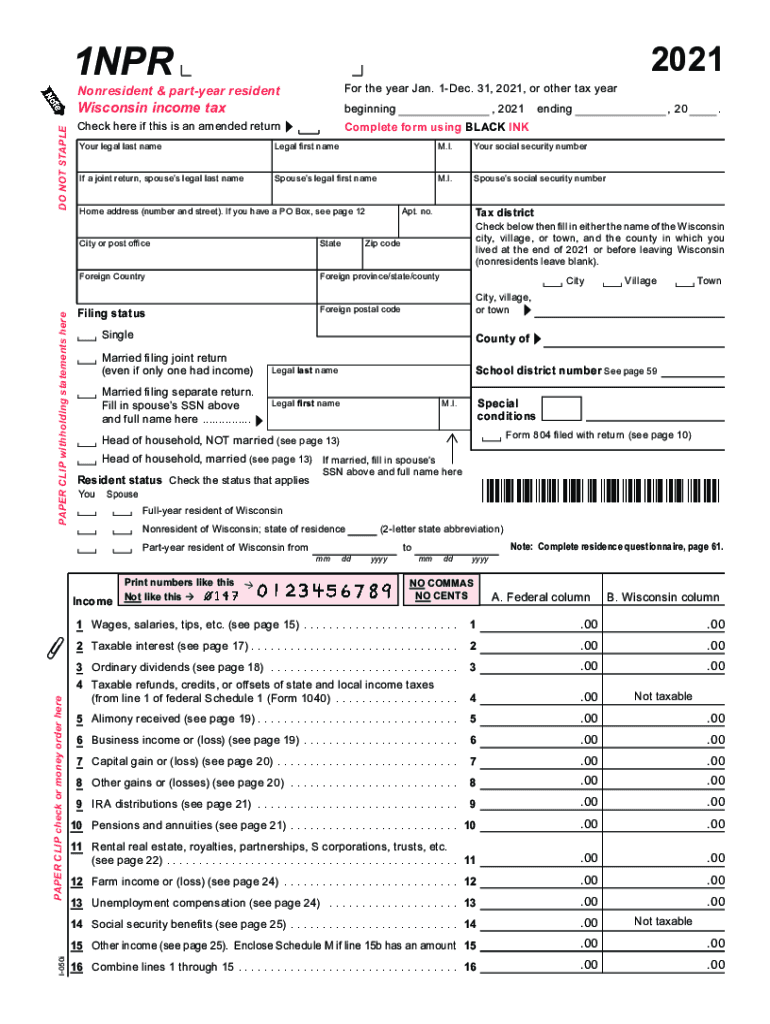

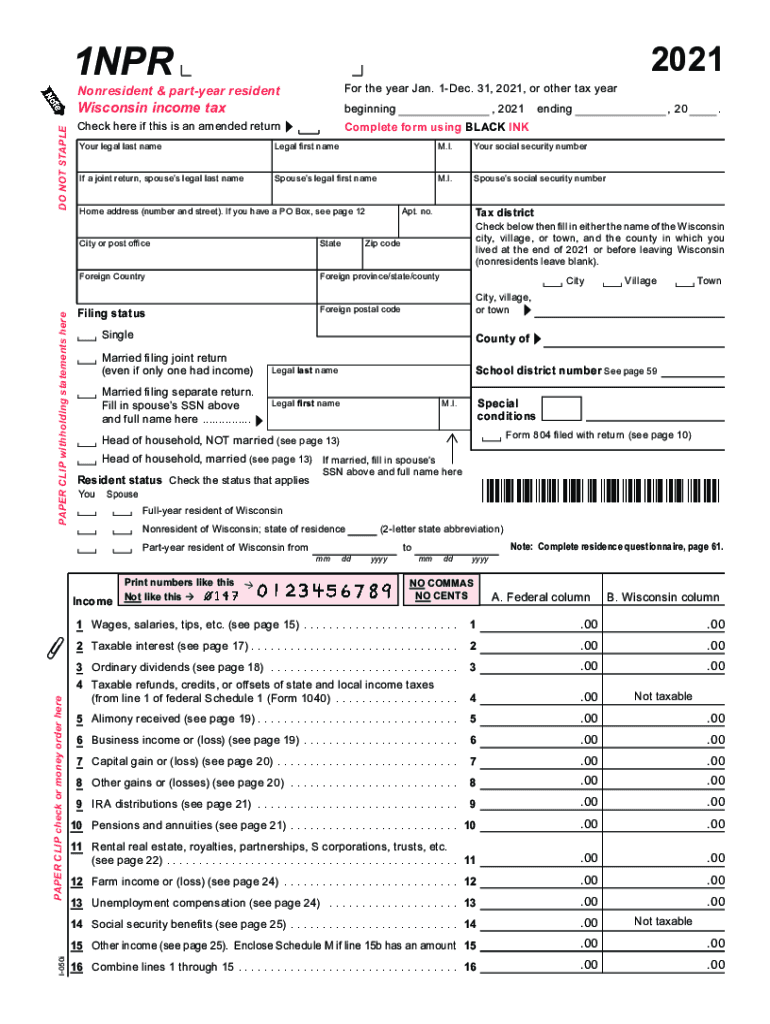

1NPRFor the year Jan. 1Dec. 31, 2021, or other tax yearNonresident & part year residentPAPER CLIP withholding statements hairdo NOT STAPLE Wisconsin income taxbeginningCheck here if this is an amended

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DoR 1NPR

Edit your WI DoR 1NPR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DoR 1NPR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DoR 1NPR online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI DoR 1NPR. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DoR 1NPR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DoR 1NPR

How to fill out WI DoR 1NPR

01

Obtain the WI DoR 1NPR form from the Wisconsin Department of Revenue website or your local office.

02

Start by filling out your personal information, including your name, address, and Social Security number.

03

Indicate the type of tax for which you are filing by checking the appropriate boxes.

04

Report your income accurately in the designated sections, using supporting documentation as necessary.

05

Carefully review any deductions or credits you wish to claim and enter them in the specified parts of the form.

06

Double-check all calculations to ensure accuracy before submitting.

07

Sign and date the form to certify its authenticity.

08

Submit the completed form either electronically or via mail, as per instructions provided.

Who needs WI DoR 1NPR?

01

Individuals and businesses in Wisconsin who are required to report non-resident income.

02

Tax professionals assisting clients with non-resident tax filings.

03

Anyone who has earned income from Wisconsin but resides outside the state.

Fill

form

: Try Risk Free

People Also Ask about

Can I get tax forms at my local library?

Yes, library staff will print a specific form upon request but you will need to view instructions, tables, and schedules online.

What is form 1NPR Wisconsin?

1NPR. Wisconsin Income Tax for. Nonresidents and Part-Year Residents.

What do I attach to my Wisconsin tax return?

In addition to your federal return, you may attach other forms, schedules, and explanations to support your Wisconsin return. If claiming the homestead credit, we require you to attach your property tax bill or proof of rent paid, along with proof of your income.

Do I need to file a Wi tax return?

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

Do you need to attach federal return to Wisconsin state return?

When filing a Form 1, Form 1NPR or Form 2 the Department of Revenue requires you to attach a complete copy of your federal income tax return. You will receive this message when you attempt to submit a Wisconsin Form 1, Form 1NPR or Form 2 without this attachment: 3.

Where can I pick up paper IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Where can I pick up Canadian income tax forms?

view, download, and print the package from canada.ca/taxes-general-package. order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

Can I submit my T1 online?

Log in to My Account and select Change my return. Adjust a T1 tax return online with certified EFILE or NETFILE software.

How do I submit a T1?

The easiest way is to complete the T1 form submission online through services like SimpleTax. Online form submission is facilitated using NETFILE, the CRA-recommended service for submitting CRA-issued taxpayer forms. You can also download the PDF form, fill and mail it to CRA offices in your province.

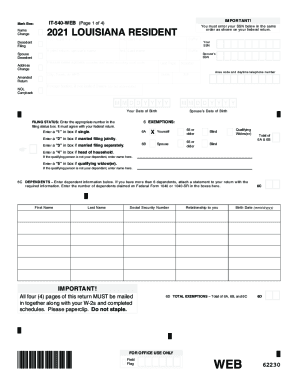

What is a Form 1 NR PY?

2021 Form 1-NR/PY Massachusetts Nonresident/Part-Year Tax Return.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find WI DoR 1NPR?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific WI DoR 1NPR and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my WI DoR 1NPR in Gmail?

Create your eSignature using pdfFiller and then eSign your WI DoR 1NPR immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the WI DoR 1NPR form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign WI DoR 1NPR and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is WI DoR 1NPR?

WI DoR 1NPR is a form used in Wisconsin for reporting certain tax obligations and transactions related to nonresident individuals or entities doing business in the state.

Who is required to file WI DoR 1NPR?

Nonresident individuals and entities that earn income from Wisconsin sources are required to file the WI DoR 1NPR.

How to fill out WI DoR 1NPR?

To fill out WI DoR 1NPR, provide personal details, income information, applicable deductions, and tax credits based on Wisconsin tax laws, ensuring accurate reporting of all required sections.

What is the purpose of WI DoR 1NPR?

The purpose of WI DoR 1NPR is to facilitate the reporting of tax obligations for nonresidents and to ensure proper taxation of their income earned in Wisconsin.

What information must be reported on WI DoR 1NPR?

Information that must be reported includes personal identification details, income earned from Wisconsin sources, deductions, credits, and any other relevant financial data as required by Wisconsin tax law.

Fill out your WI DoR 1NPR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI DoR 1npr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.