SC SC 3911 2021 free printable template

Show details

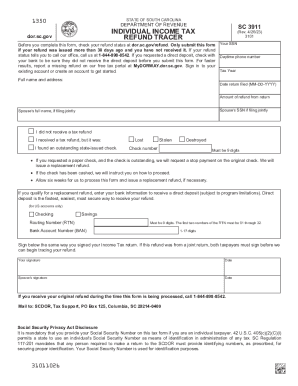

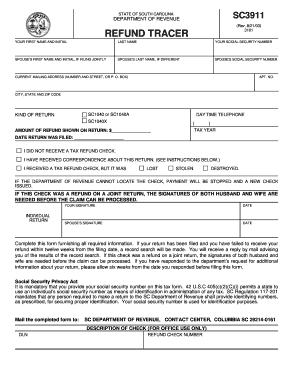

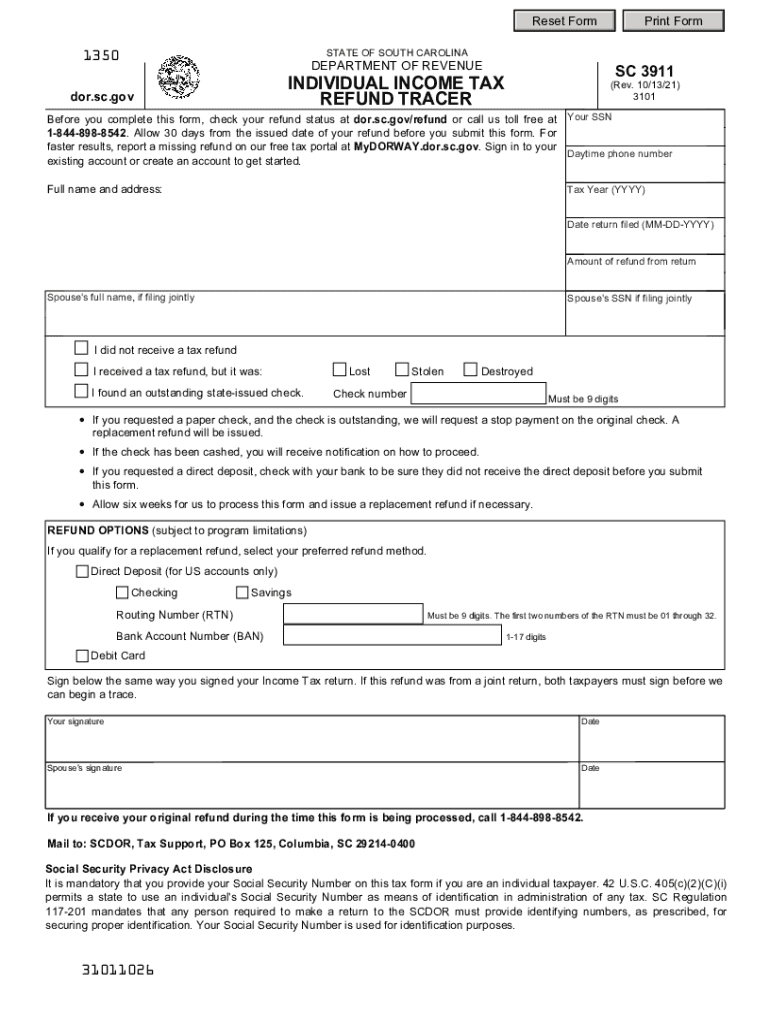

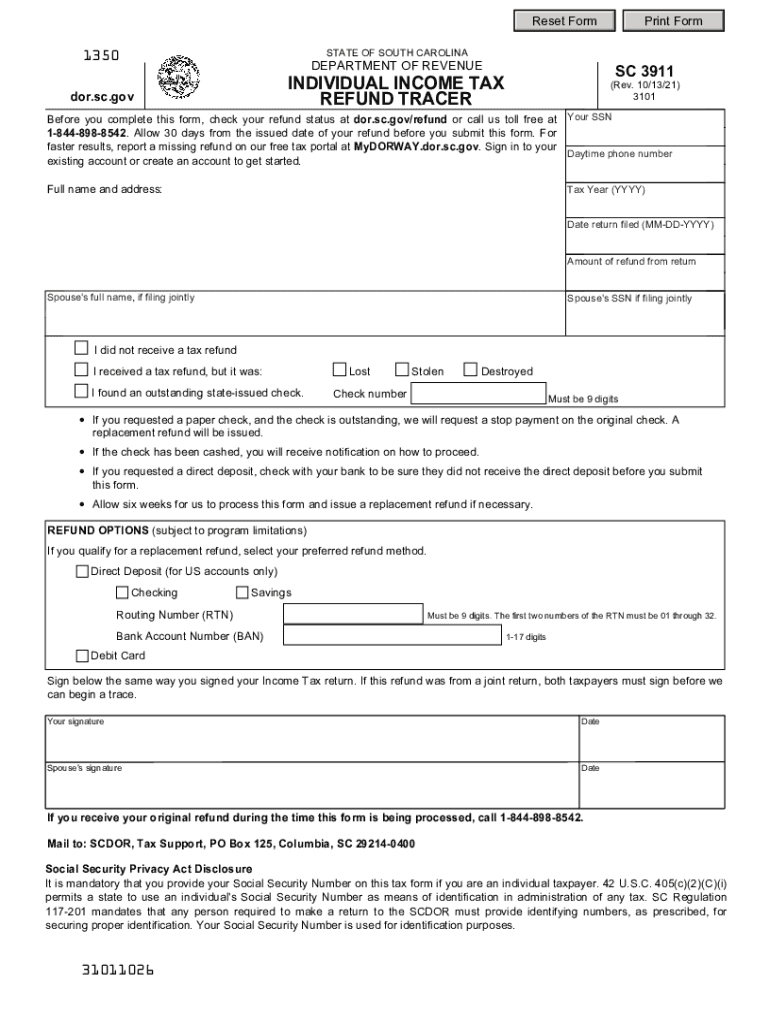

Reset Footprint Formulate OF SOUTH CAROLINA1350DEPARTMENT OF REVENUES 3911INDIVIDUAL INCOME TAX

REFUND Traced.SC.gov(Rev. 10/13/21)

3101Before you complete this form, check your refund status at dor.sc.gov/refund

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC SC 3911

Edit your SC SC 3911 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC SC 3911 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC SC 3911 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SC SC 3911. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SC 3911 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC SC 3911

How to fill out SC SC 3911

01

Obtain Form SC SC 3911 from the relevant agency or their website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Specify the details of the benefits or services you are requesting.

04

Provide any additional information or documentation that may support your request.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the form by mail or electronically, following the instructions provided.

Who needs SC SC 3911?

01

Individuals who believe they are eligible for specific benefits and are seeking to request or appeal a decision regarding those benefits.

02

People who have experienced issues with their Social Security benefits and need to provide additional information to resolve the matter.

Fill

form

: Try Risk Free

People Also Ask about

Is the $800 South Carolina rebate taxable?

The good news is South Carolina's rebate checks are not being taxed by the state, so your state filing is in the clear.

What is a sc8453 form?

About Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return | Internal Revenue Service.

What is the SC surplus refund for 2023?

As outlined in the legislation approving the rebates, the SCDOR set the rebate cap – the maximum amount taxpayers can receive – at $800. Rebates issued in March 2023 will also be capped at $800. Tax liability is what's left after subtracting your credits from the Individual Income Tax that you owe.

What is the $800 refund in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

What is the SC form 2210 for 2021?

Use this form to determine if you paid enough Income Tax during the year. If you did not pay enough, you may owe a penalty based on the amount of your underpayment. You may be charged a penalty if: you did not pay enough Estimated Tax.

What is form SC1040?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete SC SC 3911 online?

pdfFiller has made it easy to fill out and sign SC SC 3911. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the SC SC 3911 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your SC SC 3911 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out SC SC 3911 on an Android device?

Use the pdfFiller app for Android to finish your SC SC 3911. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is SC SC 3911?

SC SC 3911 is a form used for specific reporting requirements, typically pertaining to tax or regulatory matters.

Who is required to file SC SC 3911?

Individuals or entities that meet the criteria set by the governing body for tax reporting or regulatory compliance are required to file SC SC 3911.

How to fill out SC SC 3911?

To fill out SC SC 3911, users must follow the instructions provided with the form, ensuring all required fields are accurately completed and necessary documentation is attached.

What is the purpose of SC SC 3911?

The purpose of SC SC 3911 is to collect specific information from filers to ensure compliance with applicable laws and regulations.

What information must be reported on SC SC 3911?

The information that must be reported on SC SC 3911 typically includes personal identification details, financial data, and any relevant disclosures as specified by the form's guidelines.

Fill out your SC SC 3911 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC SC 3911 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.