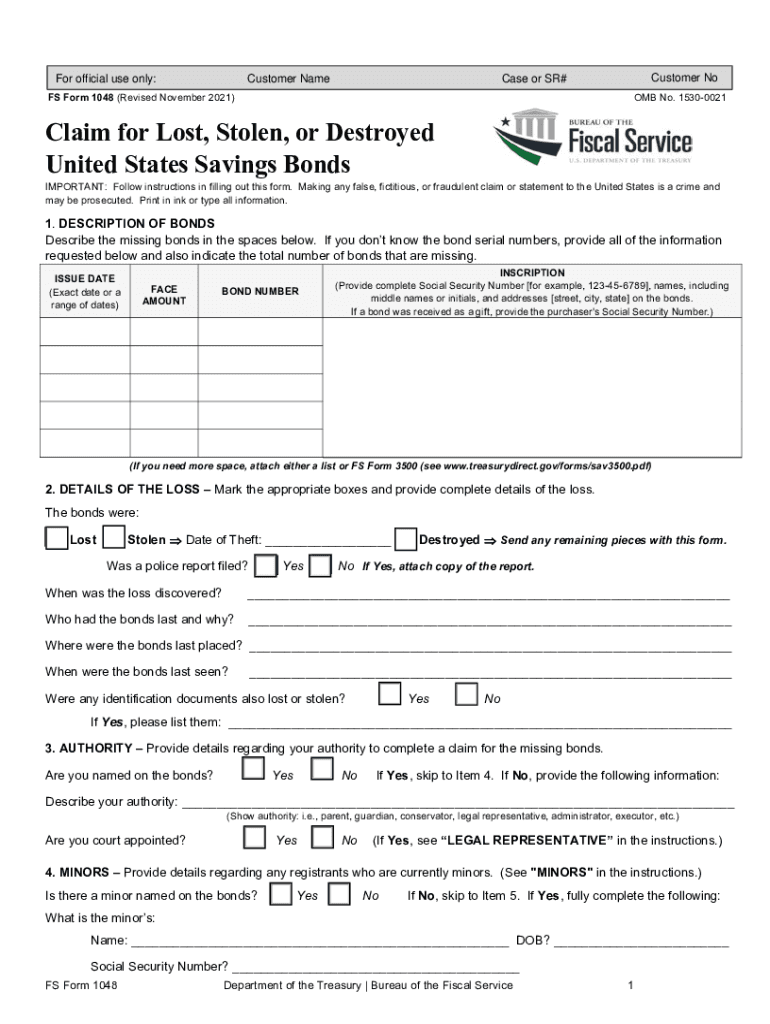

Treasury FS 1048 2021 free printable template

Get, Create, Make and Sign 1048 tax form

How to edit form 1048 online

Uncompromising security for your PDF editing and eSignature needs

Treasury FS 1048 Form Versions

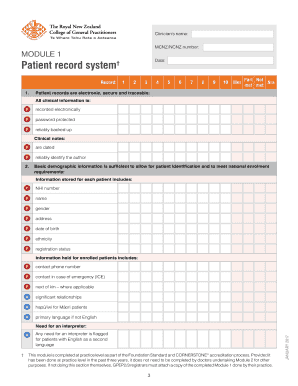

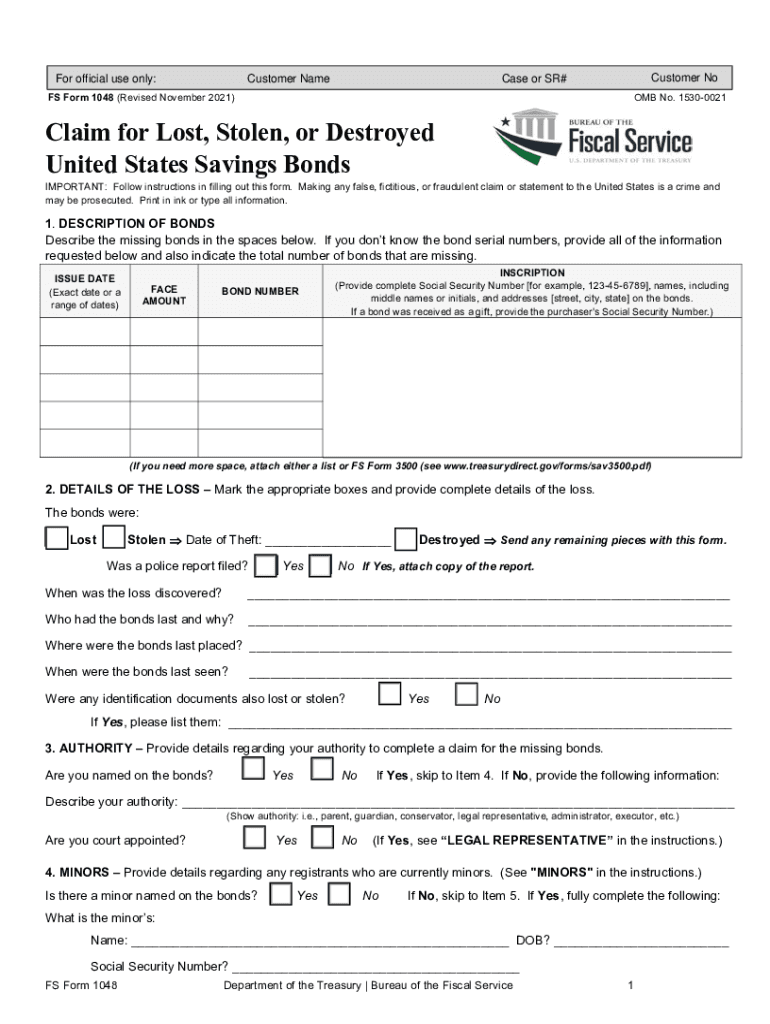

How to fill out form 1048 lost savings bond

How to fill out Treasury FS 1048

Who needs Treasury FS 1048?

Video instructions and help with filling out and completing fs form 1048

Instructions and Help about us treasury form 1048

Hey there Alessandra ever here the home this tax lady and with this video I'going to show you how to fill out a1040x which is a form you need to file an amendment so first the things you need you the latest version of the 1040X you need the original return thatyou'’d like to amend you need this mailing address for your state because that does vary, and you need about an hour of your time so let×39’s get to the form okay so as you can see here this is the 1040 X okay, and we're starting at the top enter the calendar year that you want to amend okay, so you can only do one at a time so then we×39’re going to put in your information here let me grab my keyboards you can kind of see what this lookslikeokay type today and then go to your last name, and then you put in your social okay, so you put on your social bear now if you are filing a joint return if you filed a joint return then you need to tout your spouse×39’s information here as well your current home address doesn't×39’t matter if when you file the return if you live somewhere differently you put your current home address here your phone number now let×39’s get to the filing status you have to select failing status even if you are not changing it, so you click one of those here, so we're going to be single for this okay, and you have to answer the health care coverage so let×39’s get down to this because this is the part where we know where people get confused okay so first is this column an is all the original amounts that were on your 1040 whichever form that you used okay whether it was a 1040 a 1040 EZwhat-have-you you find your adjusted gross income so let's say that you are changing your adjusted gross income you got you may have gotten an additional w2in the mail that is going to change your total income and which will in turn change your adjusted gross income sole×39’s say that you reported $60,000 on your original return and you received another $20,000 in income okay so that'the change is going to be teethed difference so then the correct amount that should have been on your return they let me click on that they have been 80,000 okays you've got to show the correct amount so let's just say your itemized deductions change so let's say that your itemized deductions were $14,000 and that they have changed so if you×39;redoing to show a decrease you got to make sure to put the parentheses okay sole×39’s say that changed you know $1000 so that the correct amount would have been×13,000 okay so if you×39’re increasing something you just type the number in you×39’re showing a decrease then you may need to make sure to put the parentheseslike this okay now where it comes down to tax liability because you are doing this on your own and you're done×39’t have programmed you may not know what this is so you might actually have to seek out tax professional or find a tax table which that's a whole other video within itself but in the tax table their×39;different breakdowns for your income to...

People Also Ask about lost us savings bonds

Can you look up savings bonds by Social Security Number?

What is IRS Form 1048?

How do I redeem lost US savings bonds?

What is a FS form 1048?

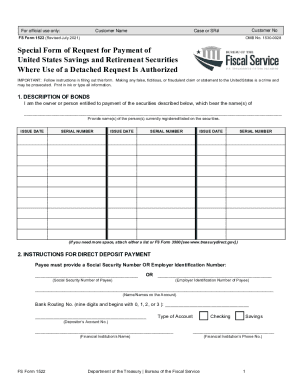

How do I send bonds to TreasuryDirect?

Can you look up savings bonds by Social Security number?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit lost savings bonds search on an iOS device?

Can I edit lost savings bonds on an Android device?

How do I fill out printable 1048 tax form on an Android device?

What is Treasury FS 1048?

Who is required to file Treasury FS 1048?

How to fill out Treasury FS 1048?

What is the purpose of Treasury FS 1048?

What information must be reported on Treasury FS 1048?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.