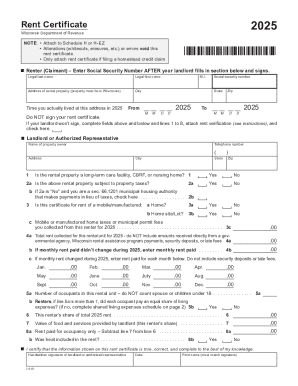

WI I-017i 2021 free printable template

Show details

CAUTION: Schedule H or HE must be completed and filed with this rent certificate A 2021 Schedule H or HE may not be filed prior to January 1, 2022InstructionsSaveTab to navigate within form. Use mouse

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI I-017i

Edit your WI I-017i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI I-017i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI I-017i online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI I-017i. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI I-017i Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI I-017i

How to fill out WI I-017i

01

Begin with personal information: Fill in your full name, address, and contact details at the top of the form.

02

Provide your Social Security number if you have one.

03

Indicate your citizenship status by checking the appropriate box.

04

Complete the sections regarding your employment history, including names of employers, duration of employment, and job titles.

05

List any income you receive from other sources, such as unemployment benefits, social security, or pensions.

06

Fill out the section that pertains to your household members and their earnings, if applicable.

07

Review the instructions for any additional required information or documentation.

08

Sign and date the form at the bottom.

Who needs WI I-017i?

01

Individuals applying for financial assistance through Wisconsin's income maintenance programs.

02

Those who need to report changes in income or household composition.

Fill

form

: Try Risk Free

People Also Ask about

What is renters credit?

The Nonrefundable Renter's Credit program is a non-refundable tax credit. The majority (87%) of persons claiming the credit reported an adjusted gross income of less than $49,999. To be eligible, an individual must be a resident of California and must have paid rent for at least half of the tax year.

Do you have to pay taxes on rental income in Wisconsin?

In Wisconsin, short-term rentals are subject to state sales tax as well as local taxes, depending on the jurisdiction. Before you can begin collecting short-term rental taxes, you need to know the correct rate to charge.

Does Wisconsin have a renter's credit?

Below are credits that are available on your Wisconsin return: Renter's and Homeowner's School Property Tax Credit: Available if you paid rent during 2022 for living quarters that was used as your primary residence OR you paid property taxes on your home.

What is a homestead property in Wisconsin?

Your homestead is the Wisconsin home you occupy, whether you own it or rent it, and up to one acre of land adjoining it (or up to 120 acres of land if the homestead is part of a farm). For example, it may be a house, an apartment, a rented room, a mobile home, a farm, or a nursing home room.

Who qualifies for Wisconsin homestead credit?

You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2022. You are a legal resident of Wisconsin for all of 2022. You are 18 years of age or older on December 31, 2022. Your household income was less than $24,680 for 2022.

Do you get a tax credit for renting in Wisconsin?

You may be able to claim homestead credit if: You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2022. You are a legal resident of Wisconsin for all of 2022. You are 18 years of age or older on December 31, 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find WI I-017i?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the WI I-017i in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit WI I-017i on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing WI I-017i.

How do I fill out WI I-017i on an Android device?

On an Android device, use the pdfFiller mobile app to finish your WI I-017i. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is WI I-017i?

WI I-017i is a form used by certain organizations or individuals to report specific information required by the Wisconsin Department of Revenue.

Who is required to file WI I-017i?

Individuals or entities that meet certain criteria established by the Wisconsin Department of Revenue must file WI I-017i.

How to fill out WI I-017i?

To fill out WI I-017i, you need to provide the requested information in the appropriate sections of the form, ensuring accuracy and completeness.

What is the purpose of WI I-017i?

The purpose of WI I-017i is to collect information necessary for the Wisconsin Department of Revenue to monitor compliance with state tax regulations.

What information must be reported on WI I-017i?

The information that must be reported on WI I-017i typically includes identification details, financial data, and any other information specific to the reporting requirements.

Fill out your WI I-017i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI I-017i is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.