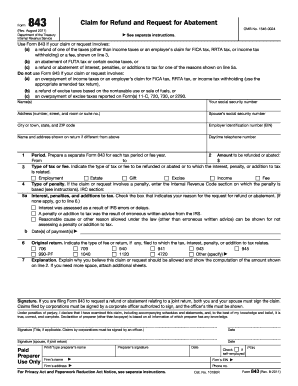

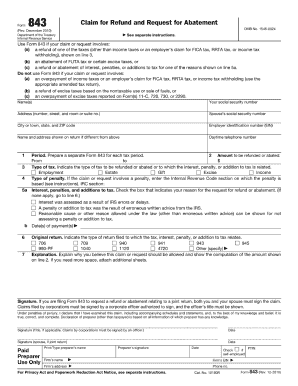

IRS Instruction 843 2021 free printable template

Show details

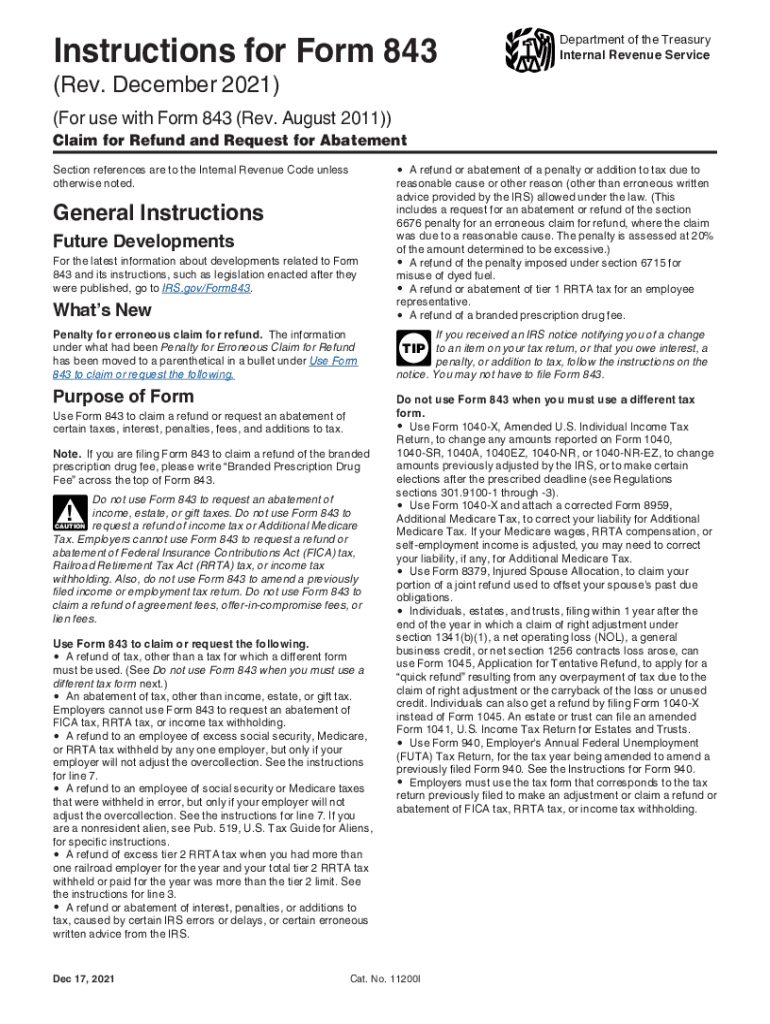

926 Household Employer s Tax Guide for how to correct that form. For more information see Treasury Decision 9405 at www.irs.gov/irb/2008-32IRB/ar13. html. Return to correct Form 1120 or 1120-A as originally filed or as Cat. No. 11200I later adjusted by an amended return a claim for refund or an examination or to make certain elections after the prescribed deadline see Regulations sections 301. 9100-1 through -3. Use Form 720X Amended Quarterly Federal Excise Tax Return to make adjustments to...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instruction 843

Edit your IRS Instruction 843 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instruction 843 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instruction 843 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Instruction 843. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 843 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instruction 843

How to fill out IRS Instruction 843

01

Begin by gathering all necessary information and documents related to your tax situation.

02

Download or request a copy of IRS Form 843 along with its instructions from the IRS website.

03

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

04

In Part I, select the type of request you are making from the options provided.

05

In Part II, provide a detailed explanation of the reason for your request, making sure to include any relevant facts or circumstances.

06

If applicable, attach any supporting documents that may strengthen your case.

07

Review the completed form for accuracy and ensure all required fields are filled in.

08

Sign and date the form at the bottom before submission.

09

Send the completed Form 843 to the appropriate IRS address as specified in the instructions.

Who needs IRS Instruction 843?

01

Individuals or entities seeking a refund or abatement of certain taxes may need IRS Form 843.

02

Taxpayers who have overpaid taxes and are requesting a refund.

03

Those who believe they have paid taxes that should be abated due to reasonable cause.

04

Taxpayers filing for adjustments of penalties and interest.

Fill

form

: Try Risk Free

People Also Ask about

What is form 843 claim for refund and request for abatement?

Form 843 is used to claim a refund of certain assessed taxes or to request abatement of interest or penalties applied in error by the IRS. The form must be filed within two years from the date when taxes were paid or three years from the date when the return was filed, whichever is later.

What is the best explanation for form 843?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

Can you file form 843 online?

Note that Form 843 cannot be e-filed. Check the instructions for Form 843 for where to mail.

What is the 843 form used for?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What is a good reasonable cause for penalty abatement?

Failure to File or Pay Penalties Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.

What is reasonable cause for IRS form 843?

Reasonable cause: A death in the family, inability to obtain records, natural disasters, and other related instances. It's important to note that the IRS will not consider a lack of funds a reasonable cause.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS Instruction 843 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IRS Instruction 843 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for signing my IRS Instruction 843 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your IRS Instruction 843 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out IRS Instruction 843 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IRS Instruction 843. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS Instruction 843?

IRS Instruction 843 is a form and guidance provided by the Internal Revenue Service for taxpayers to claim a refund of overpayment of taxes or to request an adjustment of their tax return.

Who is required to file IRS Instruction 843?

Taxpayers who believe they have overpaid their taxes or who wish to request an adjustment to their tax return are required to file IRS Instruction 843.

How to fill out IRS Instruction 843?

To fill out IRS Instruction 843, taxpayers must provide their identifying information, including Social Security number, specify the reason for the adjustment, detail the amount requested for refund or adjustment, and sign the form.

What is the purpose of IRS Instruction 843?

The purpose of IRS Instruction 843 is to allow taxpayers to formally request a refund or adjustment related to their tax returns for the specific reasons outlined by the IRS.

What information must be reported on IRS Instruction 843?

IRS Instruction 843 requires taxpayers to report their personal identification information, the reasons for the claim, the amounts involved, and any relevant tax return details that support their request.

Fill out your IRS Instruction 843 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instruction 843 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.