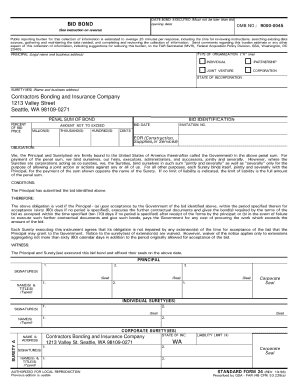

GSA SF 24 1998 free printable template

Get, Create, Make and Sign bid bond template

Editing bid bond template online

Uncompromising security for your PDF editing and eSignature needs

GSA SF 24 Form Versions

How to fill out bid bond template

How to fill out bid bond template:

Who needs bid bond template:

Instructions and Help about bid bond template

Hello. IN×39’m Professor On Schmo hawk and welcome to Why U. So far we have studied three common forms of linear equations. Any of these forms can be used to describe any non-vertical line in the plane. The most convenient form to use depends upon what information is known about the line. The slope-intercept form contains the constants' quot’m” and “b” which specify the line×39’s slope and y-intercept. The point-slope form also uses quot’m” to specify slope but instead of the line×39’s elevation being determined by the y-interceptthe elevation is determined by constants x-one and Goethe coordinates of any point which lies on the line. The two-point form, unlike the other two forms does not contain a constant which specifies the line×39’s slope. However, like the point-slope form, it includes the coordinates of one point on the line constants x-one and OnePlus the coordinates of a second point x-two and y-twowhich also lies on the line. In this lecture, we will introduce one additional and important form of linear equation called the “standard form”. The standard form has several advantages over the other linear forms we have studied. One advantage is that, unlike the other forms, the standard form can describe vertical lines. Therefore, any line in the xy-planecan be described by a linear equation written in standard form. The standard form for the equation of a line in the xy-planeis usually written as quot;Ax + By C”. Individually, the constants' quot;A”, “B”, and “C” have no special meaning. However, in combination these constants can tell us a number of things about a line×39’s graph. For example, the constants “Pequot; and “B” together determine the line×39’s slope. We can show that this is true by rearranging the standard form to look like the point-slope Normand seeing which part of the equation corresponds to the slope quot’m”. We start by subtracting the term quot;Ax” from both sides which eliminates the quot;Ax” term on the left. Furthermore, we then divide both sides by quot;B” and cancel the B's in the numerator and denominator of the fraction on the left. Furthermore, we then separate the fraction on the right into two fractions with the same denominator and swap the positions of the two fractions so that the x term is on the left and the forms look more similar. Finally, we move the x in the numerator outside the fraction. Comparing these two forms we can see that the top equation is now written in point-slope form except instead of the constants “m” and quot;b” the top equation contains constant expressions formed from combinations of the constants' quot;A”, “B”, and “C”. In particular, the slope “m” corresponds to the constant expression quot;negative A over B”. Therefore, for linear equations written in standard form” negative A over Pequot; is the slope of the line. We also see that quot;b” in the slope-intercept form which determines the y-interceptcorresponds to the constant expression quot;C over B” in the standard form. So...

People Also Ask about

What is an example of a bid bond?

What type of bond is a bid bond?

What percentage should a bid bond be?

What is bid bond in simple words?

How is bid bond calculated?

What is a bid bond letter?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my bid bond template directly from Gmail?

How can I send bid bond template for eSignature?

How do I edit bid bond template online?

What is GSA SF 24?

Who is required to file GSA SF 24?

How to fill out GSA SF 24?

What is the purpose of GSA SF 24?

What information must be reported on GSA SF 24?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.