Canada SC ISP-1200 2021 free printable template

Show details

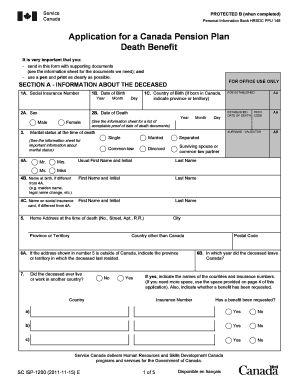

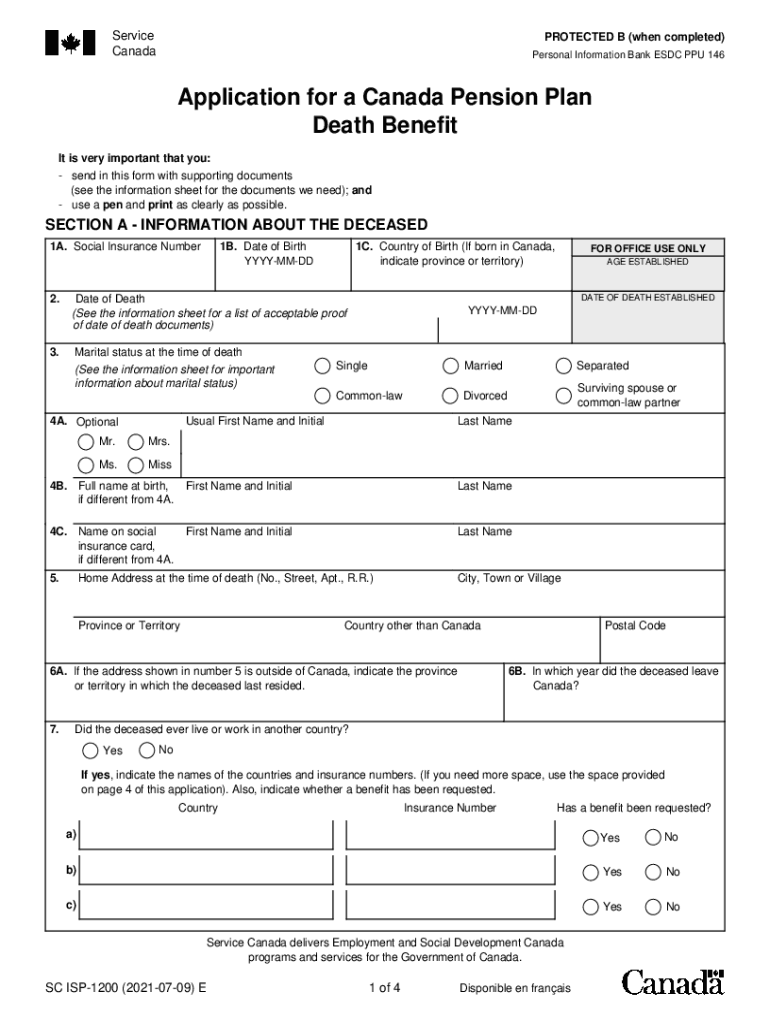

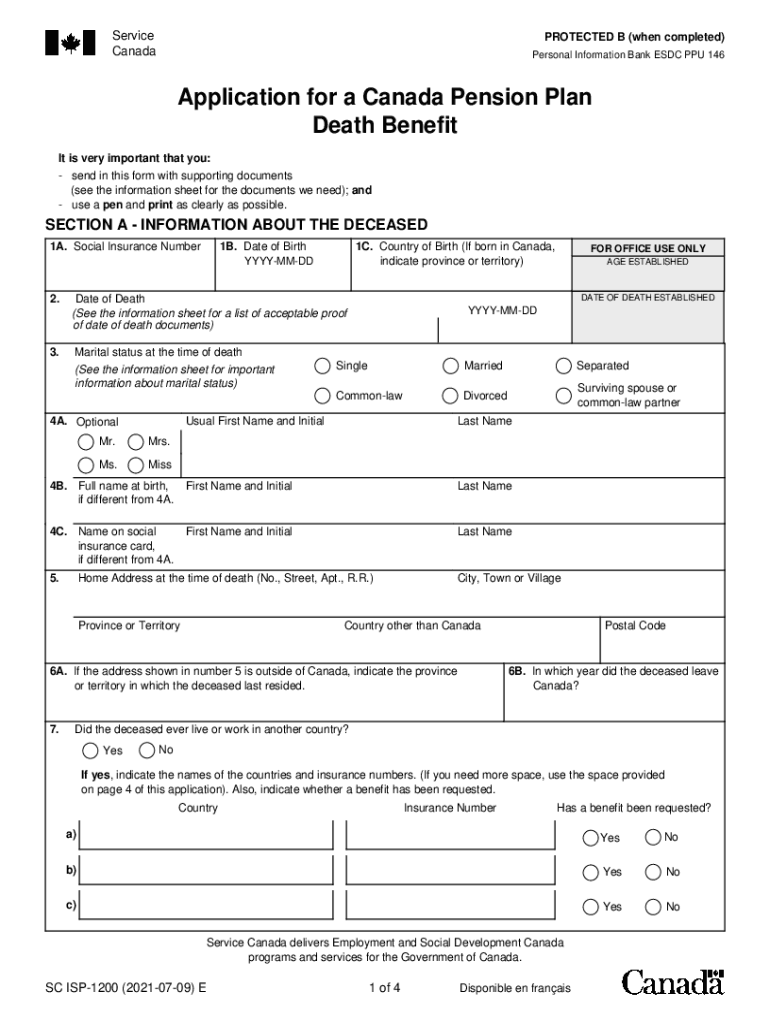

Service CanadaPROTECTED B (when completed) Personal Information Bank ESC PPU 146Application for a Canada Pension Plan Death Benefit It is very important that you: send in this form with supporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canada canada pension plan

Edit your canada canada pension plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canada canada pension plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit canada canada pension plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit canada canada pension plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada SC ISP-1200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out canada canada pension plan

How to fill out Canada SC ISP-1200

01

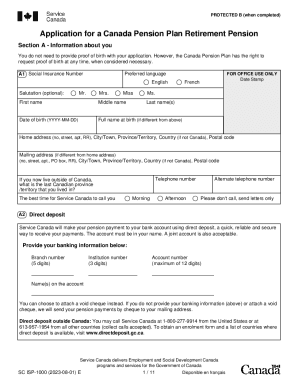

Obtain the Canada SC ISP-1200 form from the official government website or local service center.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information in the designated sections, ensuring accuracy.

04

Provide the necessary supporting documents as specified in the guidelines.

05

Review the completed form for any errors or omissions.

06

Submit the form either online or through the mail, following the submission guidelines.

Who needs Canada SC ISP-1200?

01

Individuals applying for specific services or programs related to Canadian immigration or citizenship.

02

Applicants who need to prove their identity or eligibility for government services in Canada.

Fill

form

: Try Risk Free

People Also Ask about

How many years do you need to live in Canada to receive Canada Pension Plan?

Doing so means a 36% permanent reduction in your monthly benefit, but that's still money in your pocket today. What is this? The maximum payment amount for taking CPP at age 65 is $15,678.84 per year (2023). That amount would be reduced to $10,034.46 per year if you elect to take CPP at 60.

How much is Canadian pension in Canada?

Average and maximum CPP monthly payments Type of pension or benefitAverage monthly amount for new beneficiaries (2022)Monthly maximum amount (2023)Retirement pension, age 65$717.15$1,306.57Retirement pension, delayed to age 70$1,018.35$1,855.33

Can I collect Canada Pension and Social Security?

A CPP/QPP pension may affect your U.S. benefit If you qualify for Social Security benefits from the United States based only on U.S. credits and a CPP/QPP benefit from Canada, the amount of your U.S. benefit will be reduced.

How many years do you have to live in Canada to get a pension?

A pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years - even if you have never worked.

When should I apply for CPP benefits?

A pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years - even if you have never worked.

Does everyone contribute to CPP in Canada?

Contributions to CPP are compulsory for all working Canadians aged 18-70. Employees and employers contribute equally on earnings that are between the Basic Exemption amount and the Year's Maximum Pensionable Earnings (YMPE). In 2022, contributions on those earnings are 5.7% by employees and 5.7% by employers.

Who is eligible for the Canadian old age pension?

If you are living in Canada, you must: be 65 years old or older. be a Canadian citizen or a legal resident at the time we approve your OAS pension application. have resided in Canada for at least 10 years since the age of 18.

Who is eligible for the Canada Pension Plan?

The average monthly amount paid for a new retirement pension (at age 65) in October 2022 is $717.15. Your situation will determine how much you'll receive up to the maximum. You can get an estimate of your monthly CPP retirement pension payments by signing in to your My Service Canada Account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in canada canada pension plan without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your canada canada pension plan, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit canada canada pension plan on an iOS device?

Use the pdfFiller mobile app to create, edit, and share canada canada pension plan from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Can I edit canada canada pension plan on an Android device?

The pdfFiller app for Android allows you to edit PDF files like canada canada pension plan. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is Canada SC ISP-1200?

Canada SC ISP-1200 is a form used for reporting certain income tax and benefit information in Canada, specifically for individuals and entities involved in specific financial activities.

Who is required to file Canada SC ISP-1200?

Individuals and organizations that have income, transactions, or investments that fall under specific categories defined by the Canada Revenue Agency (CRA) must file Canada SC ISP-1200.

How to fill out Canada SC ISP-1200?

To fill out Canada SC ISP-1200, you need to provide accurate financial information as required, follow the instructions provided by the CRA, and submit the form by the deadline mentioned for your specific situation.

What is the purpose of Canada SC ISP-1200?

The purpose of Canada SC ISP-1200 is to ensure compliance with Canadian tax laws by accurately reporting income and related financial information, thus facilitating proper tax assessment and collection.

What information must be reported on Canada SC ISP-1200?

The information that must be reported on Canada SC ISP-1200 includes details about income earned, deductions claimed, and any relevant financial transactions that meet the reporting criteria established by the CRA.

Fill out your canada canada pension plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Canada Pension Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.