TX Comptroller 05-163 2022 free printable template

Show details

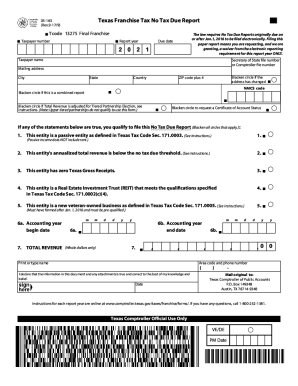

RESET FORM PRINT FORM Texas Franchise Tax No Tax Due Report 05-163 Rev.9-17/9 FILING REQUIREMENTS Tcode 13275 Final FinalFranchise Taxpayer number Report year The law requires No Tax Due Reports originally due on or after Jan.1 2016 to be filed electronically. Filing this paper report means you are requesting and we are granting a waiver from the electronic reporting requirement for this report year ONLY. Due date Mailing address City State Country Blacken circle if the address has changed...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 05-163

Edit your TX Comptroller 05-163 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 05-163 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 05-163 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX Comptroller 05-163. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 05-163 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 05-163

How to fill out TX Comptroller 05-163

01

Download Form 05-163 from the Texas Comptroller’s website.

02

Fill in your name, address, and other identification details at the top of the form.

03

Indicate the type of tax you are applying for by checking the appropriate box.

04

Provide a detailed explanation of your request or transaction in the designated sections.

05

Attach any necessary documentation to support your request.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form via mail or electronically according to the instructions provided.

Who needs TX Comptroller 05-163?

01

Businesses seeking to claim a tax exemption in Texas.

02

Individuals applying for a refund of sales tax paid.

03

Organizations that qualify for exemptions under specific categories.

04

Taxpayers needing to document transactions for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

How much do you have to make to pay Texas franchise tax?

Key Takeaways. In Texas, businesses with $1.18 million to $10 million in annual receipts pay a franchise tax of 0.375%. Businesses with receipts less than $1.18 million pay no franchise tax. The maximum franchise tax in Texas is 0.75%.

What is the no tax due threshold for Texas franchise in 2023?

For the 2023 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of $1,230,000; an entity that has zero Texas gross receipts; an entity that is a Real Estate Investment Trust (REIT) meeting the

What is the Texas franchise no tax due threshold?

The no tax due threshold is as follows: $1,230,000 for reports due in 2022-2023. $1,180,000 for reports due in 2020-2021. $1,130,000 for reports due in 2018-2019.

What is the Texas franchise tax no tax due threshold?

Tax Rates, Thresholds and Deduction Limits ItemAmountNo Tax Due Threshold$1,000,000Tax Rate (retail or wholesale)0.5%Tax Rate (other than retail or wholesale)1.0%Compensation Deduction Limit$320,0002 more rows

What is Texas Form 05 163?

Form 05-163 “No Tax Due Report” generates automatically if the following occurs: Taxpayer is a passive entity. Taxpayer is a newly established Texas Veteran Owned Business (must be pre-qualified). Taxpayer is a Real Estate Investment Trust that meets the qualifications.

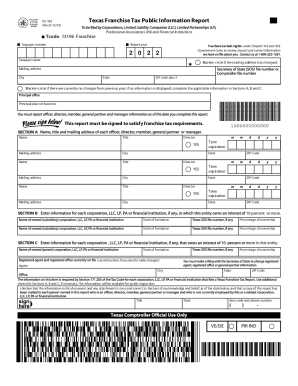

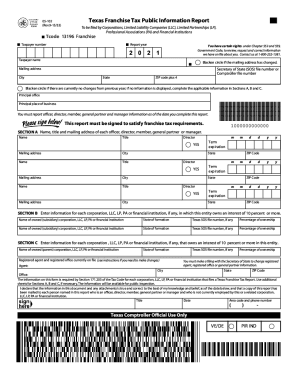

What is Texas Form 05 167?

Form 05-167 - Texas Franchise Tax Ownership Information Report — The Ownership Information Report (OIR) is to be filed for each taxable entity other than a legally formed corporation, limited liability company, limited partnership, professional association, or financial institution.

Can I file no tax due franchise tax in Texas?

If annualized total revenue is less than the no-tax-due threshold amount, then the taxable entity files Form 05-163, Texas Franchise Tax No Tax Due Report (PDF). If the tax due is less than $1,000, but annualized total revenue is greater than the no-tax-due threshold amount, then a No Tax Due Report cannot be filed.

How do I reinstate a forfeited LLC in Texas?

An entity forfeited under the Tax Code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all franchise taxes, penalties, and interest, and (3) filing an application for reinstatement (Form 801 Word 178kb, PDF 87kb),

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find TX Comptroller 05-163?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific TX Comptroller 05-163 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in TX Comptroller 05-163?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your TX Comptroller 05-163 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in TX Comptroller 05-163 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing TX Comptroller 05-163 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is TX Comptroller 05-163?

TX Comptroller 05-163 is a form used in Texas for reporting certain financial information to the state comptroller's office.

Who is required to file TX Comptroller 05-163?

Entities that engage in certain business activities in Texas and are subject to the state's franchise tax are required to file TX Comptroller 05-163.

How to fill out TX Comptroller 05-163?

To fill out TX Comptroller 05-163, one must provide accurate financial information, including income, expenses, and other relevant data as specified in the form's instructions.

What is the purpose of TX Comptroller 05-163?

The purpose of TX Comptroller 05-163 is to gather information necessary for calculating the franchise tax owed by businesses operating in Texas.

What information must be reported on TX Comptroller 05-163?

TX Comptroller 05-163 requires reporting of income, deductions, total revenue, and any applicable credits relevant to the franchise tax calculation.

Fill out your TX Comptroller 05-163 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 05-163 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.