IL DoR IL-1040 2021 free printable template

Show details

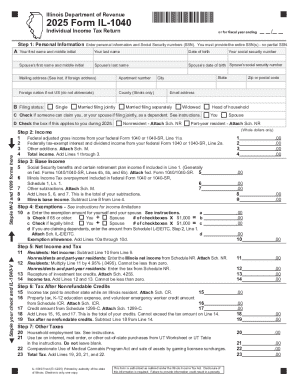

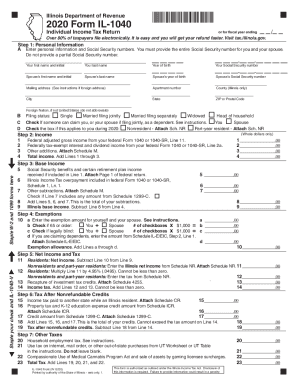

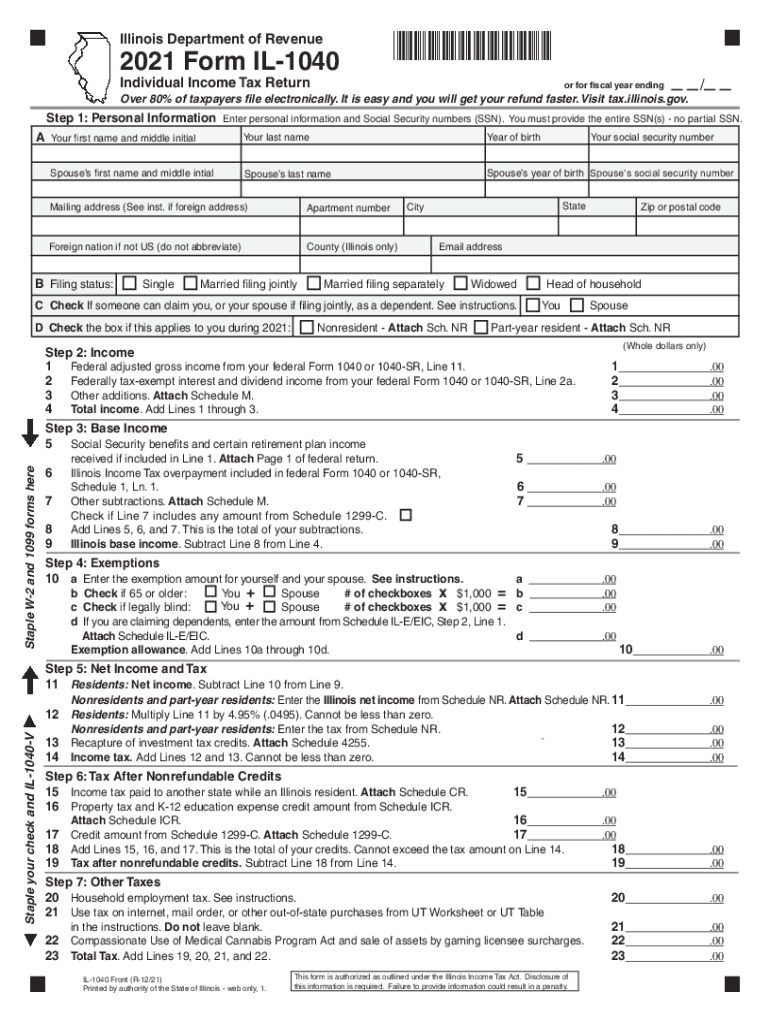

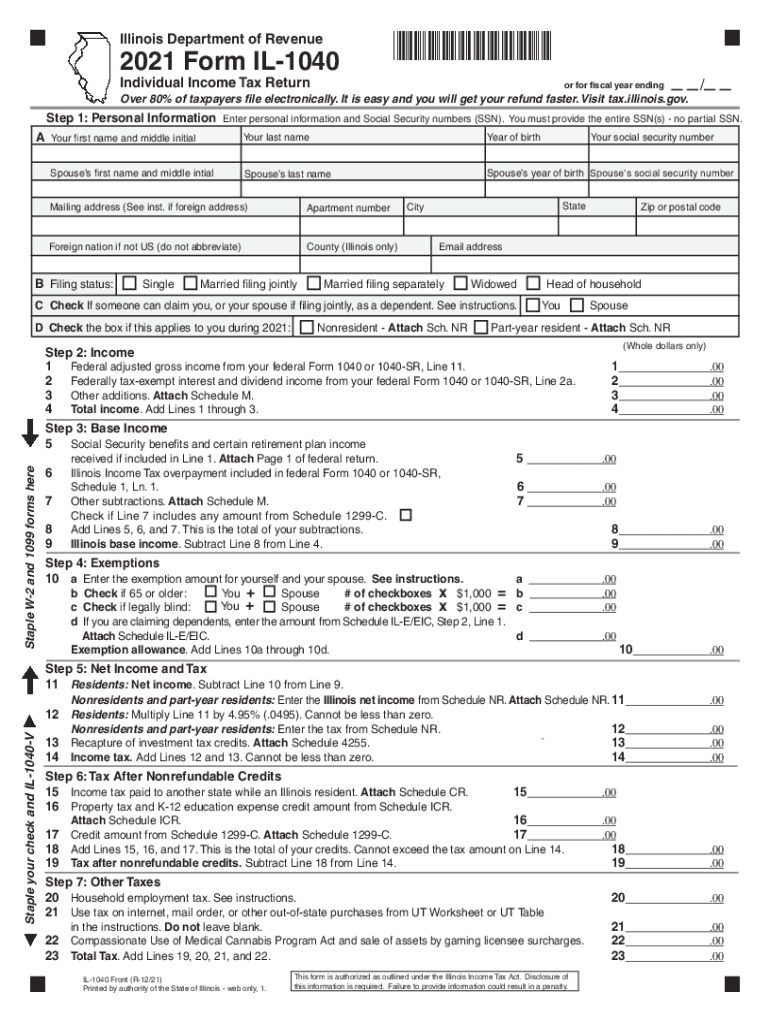

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of Revenue2021 Form IL1040Individual Income Tax Return×60012211W*

or for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-1040

Edit your IL DoR IL-1040 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-1040 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-1040 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IL DoR IL-1040. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-1040 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-1040

How to fill out IL DoR IL-1040

01

Gather all necessary documents, including W-2s, 1099s, and other income records.

02

Obtain the IL-1040 form from the Illinois Department of Revenue website or your local tax office.

03

Fill out your personal information at the top of the form, including name, address, and Social Security number.

04

Enter your income details in the appropriate sections, including wages, dividends, and any other sources of income.

05

Calculate your total income and complete the adjustments section if applicable.

06

Fill out the deductions and exemptions section, ensuring you take all eligible deductions.

07

Calculate your tax based on the Illinois tax rates and any applicable credits.

08

Review your calculations for accuracy, ensuring all sections are filled out correctly.

09

Sign and date the form before submitting it to the Illinois Department of Revenue.

10

Keep a copy of the completed IL-1040 form and all related documents for your records.

Who needs IL DoR IL-1040?

01

Residents of Illinois who earn income and are required to file a state income tax return.

02

Individuals who have income from sources within Illinois, including wages, business income, and pensions.

03

Those who need to report their tax liability and claim any applicable tax credits.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact my Illinois tax?

MyTaxHelp@illinois . gov or call Taxpayer Assistance at 1 800 732-8866 .

Who has to pay Illinois taxes?

Who Pays Illinois Tax? If you earn an income or live in Illinois, you must pay Illinois income taxes. As a traditional W-2 employee, your Illinois taxes will be withheld and deposited from each paycheck automatically. You will see this on your paycheck, near or next to the federal taxes.

How do I find out if I owe Illinois state taxes?

Do you owe income tax in Illinois? State: Illinois. Refund Status Website: My Refund – Illinois State Comptroller. Refund Status Phone Support: Individual Returns: 800 732-8866. Hours: Mon. General Illinois Tax Information: 1-800-877-8078. Online Contact Form: Contact Us | Illinois Department of Revenue.

Why is Illinois state tax so high?

Illinoisans face the second highest property tax rates in the country, in part because it has so many state employees with salaries and benefits over $100,000, and retirees with six-figure pensions. Answer: True. ing to the Wall Street Journal, Illinois has 132,188 public employees who make over $100K.

How do I contact the state of Illinois about taxes?

Taxpayer Assistance To receive assistance by phone, please call 1 800 732-8866 or 217 782-3336. Representatives are available Monday through Friday, 8 am - 5 pm. Over-the-phone translation services are available. Our TDD (telecommunication device for the deaf) number is 1 800 544-5304.

What is Illinois tax in Chicago?

What is the sales tax rate in Chicago, Illinois? The minimum combined 2023 sales tax rate for Chicago, Illinois is 10.25%. This is the total of state, county and city sales tax rates. The Illinois sales tax rate is currently 6.25%.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IL DoR IL-1040?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific IL DoR IL-1040 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out the IL DoR IL-1040 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IL DoR IL-1040 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete IL DoR IL-1040 on an Android device?

Use the pdfFiller mobile app and complete your IL DoR IL-1040 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is IL DoR IL-1040?

IL DoR IL-1040 is the individual income tax return form used by residents of Illinois to report their income, calculate their tax liability, and request refunds for overpayments.

Who is required to file IL DoR IL-1040?

Individuals who are residents of Illinois and who have earned income, or meet certain income thresholds, are required to file IL DoR IL-1040.

How to fill out IL DoR IL-1040?

To fill out IL DoR IL-1040, individuals should gather their income and deduction information, complete all required sections of the form, ensure accuracy in reporting, and then submit the form either electronically or by mail to the Illinois Department of Revenue.

What is the purpose of IL DoR IL-1040?

The purpose of IL DoR IL-1040 is to enable residents of Illinois to report their income and calculate the appropriate amount of state income tax owed to the state of Illinois.

What information must be reported on IL DoR IL-1040?

The information that must be reported on IL DoR IL-1040 includes personal identification details, income from all sources, claiming of deductions/credits, and the calculation of tax due or refund.

Fill out your IL DoR IL-1040 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-1040 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.