KY 740-V 2021 free printable template

Show details

Form740 Commonwealth of Kentucky

Department of RevenueINSTRUCTIONS FOR FORM 740 V

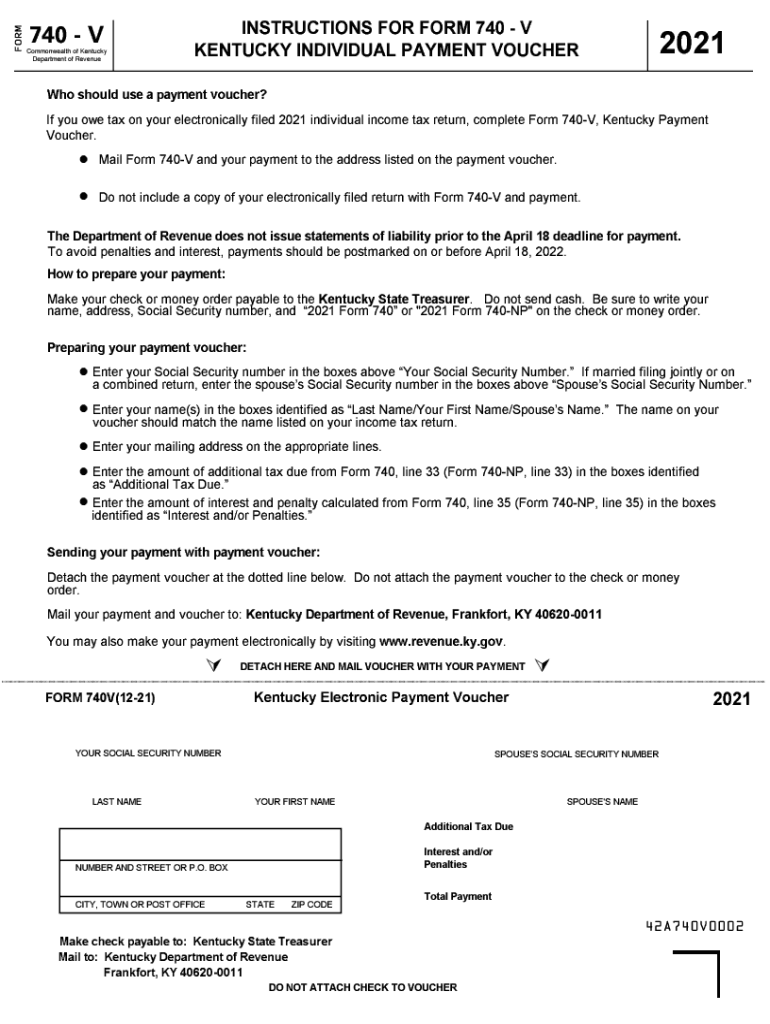

KENTUCKY INDIVIDUAL PAYMENT VOUCHER2021Who should use a payment voucher?

If you owe tax on your electronically filed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 740-V

Edit your KY 740-V form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 740-V form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY 740-V online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY 740-V. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 740-V Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 740-V

How to fill out KY 740-V

01

Obtain the KY 740-V form from the Kentucky Department of Revenue website or a local office.

02

Fill out your personal information at the top of the form, including your name, Social Security Number, and address.

03

Enter the amount of tax you owe on Line 1 based on your calculations from Form 740 or your tax preparation software.

04

If applicable, include any partial payments or credits on Line 2.

05

Calculate your total payment by subtracting any credits from the tax owed and write this amount on Line 3.

06

Choose your payment method by checking the appropriate box for check or money order.

07

Sign and date the form at the bottom.

08

Mail the completed KY 740-V form with your payment to the address specified on the form.

Who needs KY 740-V?

01

Anyone who owes additional tax after filing their Kentucky income tax return (Form 740) needs to fill out KY 740-V.

02

Taxpayers who are making a payment for the tax owed can also use this form.

Fill

form

: Try Risk Free

People Also Ask about

What is a 740-NP form?

Nonresidents who answered “No” to any of the statements above must file Form 740-NP to report Kentucky income. INSTRUCTIONS This form may be used by qualifying full-year nonresidents to claim a refund of Kentucky income taxes withheld.

Who has to file Kentucky state taxes?

COVID-19 Tax Relief Frequently Asked Questions For additional information, please visit our COVID-19 Tax Information page. Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

Do I need to file state taxes if I do not live?

Generally, you'll need to file a nonresident state return if you made money from sources in a state you don't live in. Some examples are: Wages or income you earned while working in that state. Out-of-state rental income, gambling winnings, or profits from property sales.

Are non residents required to file taxes?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

What is a KY Form 740?

Kentucky Income Tax Return Nonresident - Reciprocal State Current, 2021 - Form 740-NP-R - Fill-in. Kentucky Itemized Deduction for Nonresidents or Part-Year Residents Current, 2021 - Form 740-NP Schedule A - Fill-in, Schedule.

Do non residents need to file a tax return?

Nonresident aliens must file and pay any tax due using Form 1040NR, U.S. Nonresident Alien Income Tax Return.

What is K 4 Kentucky withholding form?

Form K-4 is only required to document that an employee has requested an exemption from withholding OR to document that an employee has requested additional withholding in excess of the amounts calculated using the formula or tables. If neither situation applies, then an employer is not required to maintain Form K-4.

Does Kentucky require you to file a tax return?

Answer: Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while earned while in Kentucky and any other income from Kentucky sources.

Do I need to file a Ky state tax return?

Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

What happens if you don't pay Kentucky state taxes?

Not paying your taxes can result in the Department of Revenue taking Collection Actions. Safeguarding your tax information is our number one priority and we will not talk to anyone besides you unless given permission.

Who is exempt from Kentucky income tax?

Up to $31,110 of income from private, government, and military retirement plans (including IRAs and 401(k) plans) is exempt.

Do I have to file a Kentucky nonresident tax return?

¶15-115, Nonresidents Unlike residents, full-year nonresidents are subject to Kentucky income tax from any: tangible property located in Kentucky; intangible property that has a business situs in Kentucky; and.

Who is exempt from filing US taxes?

Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

What is a Kentucky 740 form?

Kentucky Income Tax Return Nonresident - Reciprocal State Current, 2021 - Form 740-NP-R - Fill-in. Kentucky Itemized Deduction for Nonresidents or Part-Year Residents Current, 2021 - Form 740-NP Schedule A - Fill-in, Schedule.

Do I have to file Kentucky state taxes non resident?

A. Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit KY 740-V on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit KY 740-V.

Can I edit KY 740-V on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign KY 740-V on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete KY 740-V on an Android device?

On an Android device, use the pdfFiller mobile app to finish your KY 740-V. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is KY 740-V?

KY 740-V is a payment voucher used for filing individual income tax returns in the state of Kentucky.

Who is required to file KY 740-V?

Taxpayers who are required to pay Kentucky individual income taxes and expect to owe tax after filing their return must use KY 740-V.

How to fill out KY 740-V?

To fill out KY 740-V, you need to provide your name, address, social security number, the amount paid, and any relevant tax year information.

What is the purpose of KY 740-V?

The purpose of KY 740-V is to provide a method for taxpayers to submit a payment when they file their individual income tax returns.

What information must be reported on KY 740-V?

KY 740-V requires reporting your name, address, social security number, payment amount, and the tax year for which the payment is being made.

Fill out your KY 740-V online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 740-V is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.