Get the free 2008 MICHIGAN Individual Income Tax Return MI-1040

Show details

Este formulario es la Declaración de Impuestos sobre la Renta de Michigan para el año 2008, que debe presentarse antes del 15 de abril de 2009. Incluye información para contribuciones opcionales,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2008 michigan individual income

Edit your 2008 michigan individual income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2008 michigan individual income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2008 michigan individual income online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2008 michigan individual income. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

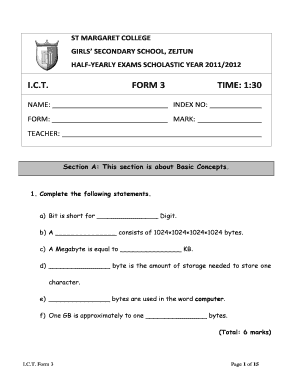

How to fill out 2008 michigan individual income

How to fill out 2008 MICHIGAN Individual Income Tax Return MI-1040

01

Obtain the 2008 MI-1040 form from the Michigan Department of Treasury website or a local office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Enter your filing status (single, married filing jointly, married filing separately, head of household).

04

Report your income by filling out Schedule 1 for Michigan sources of income.

05

Calculate your Michigan taxable income by subtracting any allowable deductions and exemptions from your total income.

06

Complete the Tax Computation section to determine your tax liability based on your taxable income.

07

Fill out the Michigan credits section, if eligible, to reduce your tax liability.

08

Calculate your total tax due or refund by comparing the total tax liability to the amount of tax withheld or paid.

09

Sign and date the form, and if filing jointly, have your spouse sign as well.

10

Submit the completed form by mail to the address specified in the instructions or electronically if eligible.

Who needs 2008 MICHIGAN Individual Income Tax Return MI-1040?

01

Residents of Michigan who earned income in 2008.

02

Individuals who need to report income from various sources, including wages, pensions, or business income.

03

Those eligible for credits or deductions specific to Michigan state tax law.

04

Taxpayers seeking a refund for overpaid taxes or those with a tax liability for the year.

Fill

form

: Try Risk Free

People Also Ask about

Who doesn't have to file a 1040?

The minimum income amount to file taxes depends on your filing status and age. For 2024, the minimum income for Single filing status for filers under age 65 is $14,600 . If your income is below that threshold, you generally do not need to file a federal tax return.

Can I file my 2008 taxes?

It's not too late to file 2008 taxes! * The IRS does not allow electronic filing of prior year tax returns, and the deadline for 2008 electronic filing has passed on October 15, 2009. You may still prepare your 2008 taxes using our website.

Who has to file an MI 1040?

You must file a Michigan Individual Income Tax return if you have income that would be included in federal adjusted gross income that exceeds your allowed Michigan exemption allowance(s).

How do I get a copy of my 2008 tax return?

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return. Refer to the form for instructions and for the processing fee.

Who is exempt from filing 1040?

So, if your income is less than the Standard Deduction, and you don't have other income to report, you won't need to file a tax return. An example of income that you would need to report, regardless of the amount, is self-employment income.

Do seniors have to file Michigan state taxes?

Michigan is moderately tax-friendly for retirees, with no tax on Social Security, estates or most inheritances and a lower sales tax compared with other states. Retirement income is partially taxable depending on your age, but it will be fully exempt from the state tax by 2026.

Where do I get my MI 1040?

Commonly used Michigan income tax forms are also available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Who is required to use Form 1040?

Most U.S. citizens or permanent residents who work in the U.S. have to file a tax return. Generally, you need to file if: Your income is over the filing requirement. You have over $400 in net earnings from self-employment (side jobs or other independent work)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2008 MICHIGAN Individual Income Tax Return MI-1040?

The 2008 MICHIGAN Individual Income Tax Return MI-1040 is a tax form used by residents of Michigan to report their individual income and calculate their state tax liability for the tax year 2008.

Who is required to file 2008 MICHIGAN Individual Income Tax Return MI-1040?

Individuals who resided in Michigan for any part of the year, individuals who had income earned in Michigan, and those who received wages or had other income subject to Michigan tax are generally required to file the 2008 MI-1040.

How to fill out 2008 MICHIGAN Individual Income Tax Return MI-1040?

To fill out the MI-1040, taxpayers should provide personal information, including their name and address, report all sources of income, claim deductions and credits, and calculate their total tax liability. Instructions provided with the form should be followed closely.

What is the purpose of 2008 MICHIGAN Individual Income Tax Return MI-1040?

The purpose of the 2008 MICHIGAN Individual Income Tax Return MI-1040 is to allow individuals to report their income, determine the amount of state taxes they owe, and enable the Michigan Department of Treasury to assess and collect taxes appropriately.

What information must be reported on 2008 MICHIGAN Individual Income Tax Return MI-1040?

Taxpayers must report personal identification information, total income from all sources, applicable deductions, tax credits, and the final amount of tax due or refund expected on the 2008 MI-1040.

Fill out your 2008 michigan individual income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2008 Michigan Individual Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.