Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

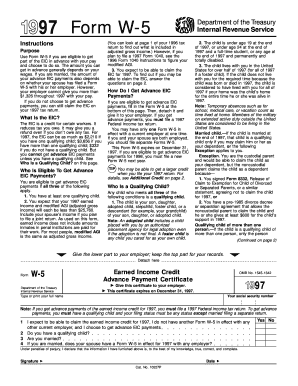

What is w5 form?

The W-5 form is an Internal Revenue Service (IRS) form used to claim the Earned Income Tax Credit (EITC). The EITC is a refundable tax credit for low-income working individuals and families. The W-5 form is used to provide information about eligibility and to determine if the taxpayer is eligible for the credit.

Who is required to file w5 form?

The W-5 form is most commonly used by employees who wish to claim the Earned Income Tax Credit (EITC). In order to qualify for the EITC, taxpayers must meet certain criteria, including having earned income from employment. Therefore, any employee wishing to claim the EITC must file a W-5 form.

How to fill out w5 form?

1. Enter your name, address, and Social Insurance Number (SIN).

2. Write your employer’s name and address.

3. Check the box to indicate your marital status.

4. Enter the date you began working with your employer.

5. Indicate the type of income you earned: employment income, commissions, tips, etc.

6. Enter the total amount of income you earned from your employer.

7. Enter the total amount of deductions you claimed on your income tax return.

8. Enter the amount of federal and provincial tax you paid.

9. Enter the total amount of other deductions, such as CPP, EI, union dues, etc.

10. Sign and date the form.

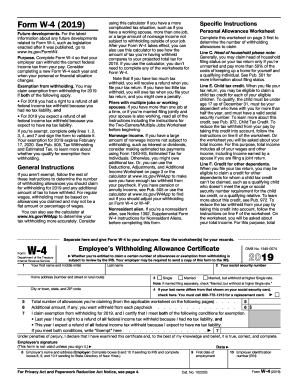

What is the purpose of w5 form?

The W-5 form is not a commonly recognized form by the Internal Revenue Service (IRS) in the United States. It is possible that you are referring to a form in a different country or a form specific to a certain organization.

If you are referring to the W-4 form, this is a form used by employees in the United States to inform their employers about how much federal income tax to withhold from their paychecks. The purpose of the W-4 form is to determine the employee's tax withholding rate based on factors like their filing status, number of dependents, and other deductions.

What information must be reported on w5 form?

The W5 form, also known as the Canadian Workers' Compensation Application form, typically requires the following information to be reported:

1. Personal Information: Name, address, phone number, email address, social insurance number, date of birth, and marital status.

2. Employment Information: Details of current and previous employment, including company name, address, phone number, job title, and dates of employment.

3. Injury Information: Description and details of the work-related injury or illness, including the date and time of occurrence, location, and how the injury occurred.

4. Medical Information: Information about medical treatment received for the injury, such as doctors' names, clinics or hospitals visited, dates of treatment, and any medications prescribed.

5. Wage Information: Current and previous wage details, including the average weekly earnings prior to the injury.

6. Insurance Information: Details of any workers' compensation or disability insurance coverage, including the policy number and insurer's contact information.

7. Witnesses: Names and contact information of any witnesses to the injury or accident.

It is important to note that the specific requirements may vary depending on the jurisdiction in which the W5 form is being filled out. It is recommended to consult the relevant workers' compensation authority or legal professional for accurate and up-to-date information.

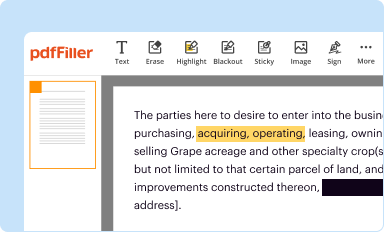

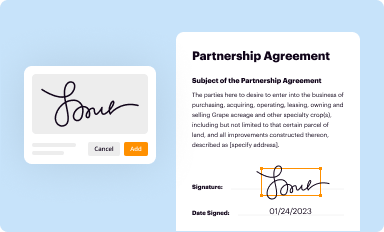

How do I edit 2010 w5 income certificate online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your w5 certificate form blank to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

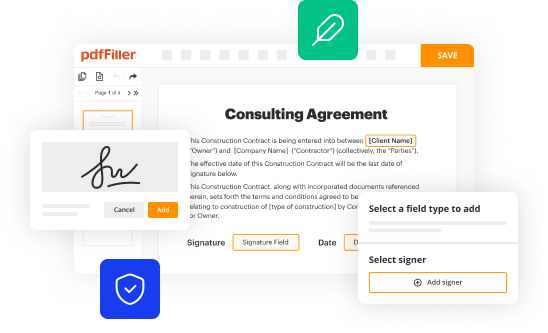

How do I edit w5 income certificate online on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as w5 income certificate latest. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete irs w 5 form on an Android device?

Complete w5 form 2025 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IRS W-5?

The IRS W-5 form, also known as the Earned Income Credit Advance Payment Certificate, is a form used by eligible taxpayers to apply for advance payments of the Earned Income Tax Credit (EITC).

Who is required to file IRS W-5?

Individuals who qualify for the Earned Income Tax Credit and want to receive advance payments of the credit must file the IRS W-5 form.

How to fill out IRS W-5?

To fill out the IRS W-5, taxpayers need to provide their name, address, Social Security number, and information about their qualifying child(ren) if applicable. They should also indicate if they wish to receive advance payments of the EITC.

What is the purpose of IRS W-5?

The purpose of the IRS W-5 is to allow eligible workers to receive part of their Earned Income Tax Credit in the form of advance payments, thereby helping them manage their finances throughout the year.

What information must be reported on IRS W-5?

The IRS W-5 requires reporting personal information such as name, address, Social Security number, as well as information about qualifying dependents and eligibility for the Earned Income Tax Credit.