MI MI-1040CR-7 2021 free printable template

Fill out, sign, and share forms from a single PDF platform

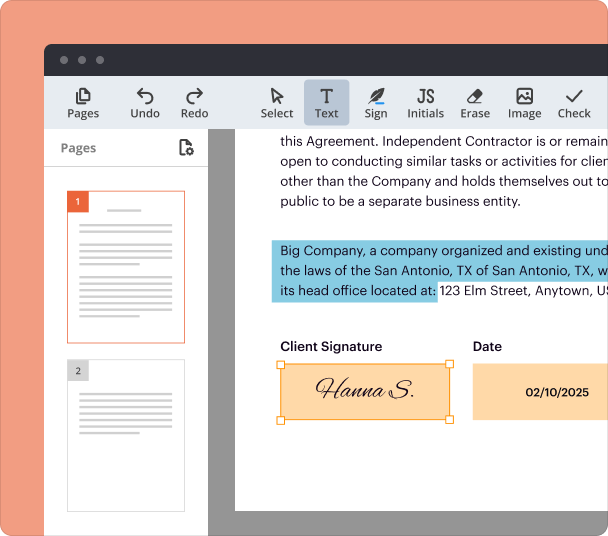

Edit and sign in one place

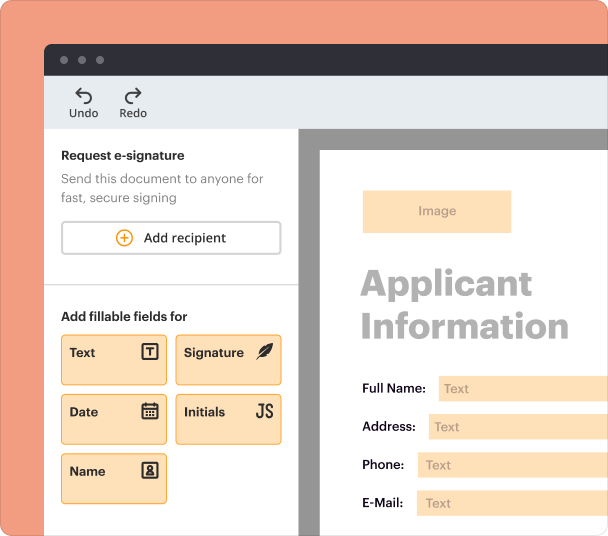

Create professional forms

Simplify data collection

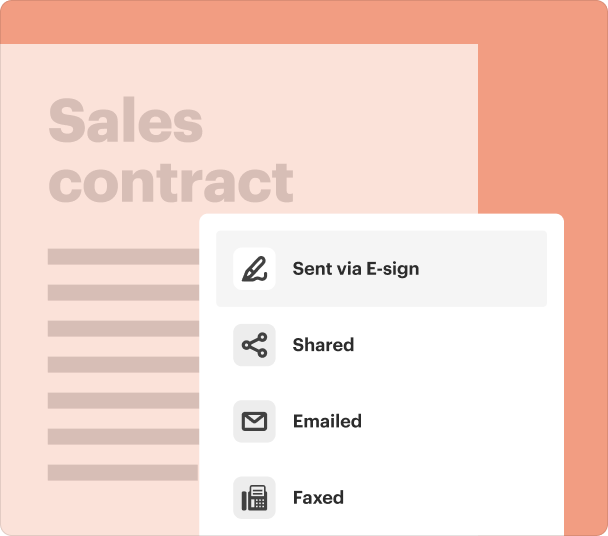

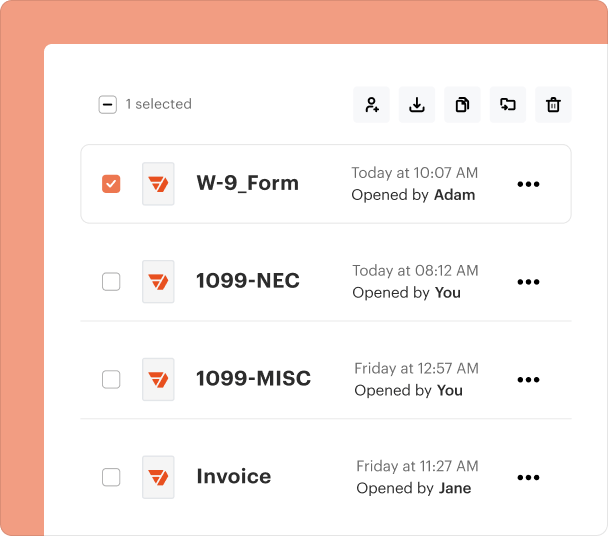

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

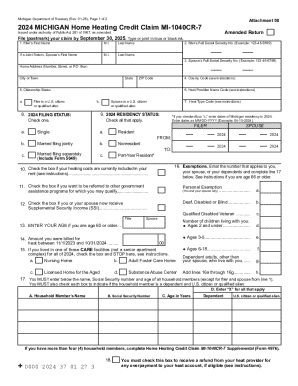

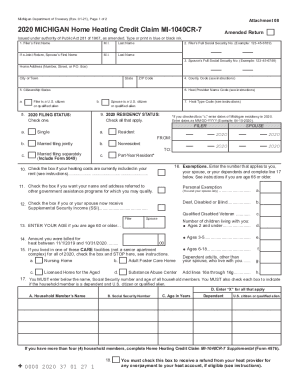

Comprehensive Guide to the -1040CR-7 2 Printable Form on pdfFiller

How do you understand the -1040CR-7 form?

The MI-1040CR-7 form is essential for Michigan residents seeking to claim their heating credit for the year. Understanding its purpose can help expedite the application process and ensure you receive the qualifying credits available. This form is particularly important for low to moderate-income households that rely on assistance to manage utility costs.

-

Be aware of the deadlines for submission; generally, it must be filed by July 1 of the following year.

-

Filing accurately can prevent delays or denials of your heating assistance.

What are the key sections of the -1040CR-7 form?

The MI-1040CR-7 form comprises several key sections that require careful completion. Accurate information in each section makes it easier for the Michigan Department of Treasury team to process your form without disputes.

-

This section includes personal details such as name and address, which are vital for identification.

-

For those filing jointly, accurate representation of both parties' income is crucial.

How do you identify your filing and residency status?

Understanding your filing status is critical because it affects your tax obligations and potential refunds. The MI-1040CR-7 form has designated areas for delineating your residency status and filing type.

-

Includes Single, Married Filing Jointly, and others, which dictate the credits available to you.

-

Ensure to fill in residency codes and dates accurately, as this can influence credit eligibility.

What exemptions and benefits are available?

Claiming exemptions is vital for maximizing your benefits on the MI-1040CR-7 form. This includes various circumstances that qualify for reduced heating costs or additional state assistance.

-

Specific conditions can qualify you for exemptions; checking the state guidelines can help ensure you maximize credits.

-

Proper paperwork is needed to substantiate claims, like proof of income or previous tax forms.

How do you complete the -1040CR-7 form using pdfFiller?

Using pdfFiller simplifies the process of filling out the MI-1040CR-7 form. The platform provides step-by-step guidance that makes navigation intuitive and the submission quicker.

-

Follow the prompts for each section. pdfFiller is designed to guide you through, ensuring you don’t miss any crucial information.

-

Utilizing electronic signatures speeds up your submission, allowing you to bypass the traditional mailing process.

What tools does pdfFiller provide for editing and managing your -1040CR-7 form?

pdfFiller offers various functionalities to help manage your MI-1040CR-7 form efficiently. Editing capabilities ensure that you can make necessary modifications without hassle, enhancing collaboration if needed.

-

Make changes swiftly—correct errors, add notes, or adjust figures as required.

-

Share the form with team members for review, ensuring everyone’s input is considered for complete accuracy.

How can you troubleshoot common issues?

Mistakes can occur when completing the MI-1040CR-7 form. Knowing how to troubleshoot common issues will save you time and avoid setbacks in the submission process.

-

Double-check for inaccuracies in Social Security numbers, addresses, and income figures to prevent delays.

-

pdfFiller provides customer support that can assist you in addressing issues, ensuring your paperwork is submitted correctly.

How do you navigate government resources effectively?

Navigating government resources ensures that you have the most up-to-date information regarding the MI-1040CR-7 form. Direct links and accessible resources can facilitate your understanding of the requirements.

-

Access the Michigan Department of Treasury for the latest regulations regarding heating credits.

-

Periodical updates to the MI-1040CR-7 should be reviewed; staying informed helps in correct form completion.

Frequently Asked Questions about Mi Mi-1040Cr-7

What is the MI-1040CR-7 form used for?

The MI-1040CR-7 form is utilized by Michigan residents to apply for heating assistance credits. It helps eligible individuals reduce their utility costs, especially during harsh winters.

Who is eligible to file the MI-1040CR-7?

Eligibility generally includes low to moderate-income households. Specific criteria may include income levels, residency status, and necessary documentation related to heating costs.

How do I fill out the MI-1040CR-7 form online?

You can fill out the MI-1040CR-7 form using pdfFiller, which offers a simple digital interface for completion. The platform allows easy editing and includes eSignature options for efficient submission.

What is a common mistake when filing the MI-1040CR-7?

Common mistakes include inaccuracies in Social Security numbers or income figures. These errors can lead to processing delays, so double-checking all entries is essential.

Where can I find resources related to the MI-1040CR-7 form?

Resources can be found on the Michigan Department of Treasury website, which provides guidelines and direct information about the MI-1040CR-7 and related assistance programs.

pdfFiller scores top ratings on review platforms