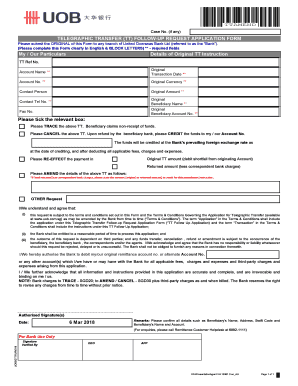

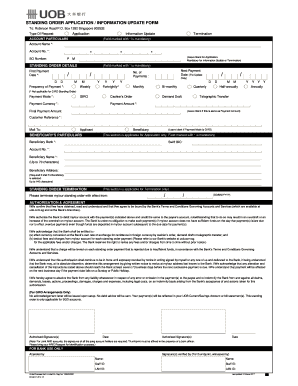

SG UOB Telegraphic Transfer (TT) Follow-Up Request Application Form 2022-2025 free printable template

Show details

*if fund returned less correspondent bank charges, please state the amount (original or returned amount) to remit for this amendment instruction.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uob tt follow up request form

Edit your telegraphic transfer follow up request form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your singapore tt follow up form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tt follow up request form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit uob telegraphic transfer request application form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SG UOB Telegraphic Transfer (TT) Follow-Up Request Application Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tt follow up request form

How to fill out SG UOB Telegraphic Transfer (TT) Follow-Up Request

01

Obtain the SG UOB Telegraphic Transfer (TT) Follow-Up Request form from the UOB website or your nearest UOB branch.

02

Fill in the required personal details, including your name, contact information, and any relevant account numbers.

03

Provide specifics about the telegraphic transfer, such as the transaction reference number and date of the original transaction.

04

Indicate the reason for the follow-up request clearly and concisely.

05

Attach any supporting documents, such as payment receipts or correspondence related to the transaction.

06

Review the form to ensure all information is accurate and complete.

07

Submit the completed form either in person at a UOB branch or via a secure online submission method if available.

08

Request confirmation of receipt from the bank for your records.

Who needs SG UOB Telegraphic Transfer (TT) Follow-Up Request?

01

Customers who have initiated a telegraphic transfer through UOB that requires follow-up for status updates.

02

Individuals or businesses seeking clarification regarding delayed transactions or lost remittances.

03

Clients needing to rectify or inquire about errors in their previous telegraphic transfer requests.

Fill

telegraphic transfer follow up request

: Try Risk Free

People Also Ask about uob tt form

How to transfer money overseas using UOB?

Login to your UOB internet banking portal. Click “Pay and Transfer”, then click on “Overseas Transfer.” Enter and submit the recipient's information as required by UOB along with their banking details. Select your account, enter the currency, and the amount you're to transfer.

What is telegraphic transfer form?

Telegraphic Transfer (TT) is an efficient and secure way of sending electronic payments in a wide range of remittance currencies to your beneficiaries overseas.

What is the telegraphic transfer limit for UOB?

The daily funds transfer limit is $3,000. This limit is shared with funds transfer to other UOB account and OCBC account.

Is telegraphic transfer same as wire transfer?

So, when you hear the term “telegraphic transfers”, all you need to know is that it refers to international money transfers made from one account to another. It's synonymous with terms like bank transfer, wire transfer, or SWIFT transfer, which are now more commonly used to describe the same process.

How do I add a payee to my UOB account?

Log in to UOB TMRW and select "Pay/Transfer". Tap on “Add payee or Biller” at the bottom of the screen. Tap on “Biller” and type biller name or “v” to select biller from the list. Enter the details and tap on “Next”.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tt follow up form uob directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your uob telegraphic transfer form pdf and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find tt form?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the uob singapore telegraphic transfer form. Open it immediately and start altering it with sophisticated capabilities.

How can I fill out uob telegraphic transfer form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your uob tt amendment form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is SG UOB Telegraphic Transfer (TT) Follow-Up Request?

SG UOB Telegraphic Transfer (TT) Follow-Up Request is a formal inquiry submitted to United Overseas Bank (UOB) in Singapore to follow up on the status or completion of a telegraphic transfer transaction.

Who is required to file SG UOB Telegraphic Transfer (TT) Follow-Up Request?

Clients or customers who have initiated a telegraphic transfer through UOB and wish to inquire about the status or resolve issues related to that transfer are required to file the SG UOB Telegraphic Transfer (TT) Follow-Up Request.

How to fill out SG UOB Telegraphic Transfer (TT) Follow-Up Request?

To fill out the SG UOB Telegraphic Transfer (TT) Follow-Up Request, customers need to provide relevant details such as their account information, transaction reference number, transfer amount, beneficiary details, and any specific inquiries or issues they are facing.

What is the purpose of SG UOB Telegraphic Transfer (TT) Follow-Up Request?

The purpose of the SG UOB Telegraphic Transfer (TT) Follow-Up Request is to enable customers to seek clarification or updates on their telegraphic transfer transactions, ensuring they can track their funds and address any concerns efficiently.

What information must be reported on SG UOB Telegraphic Transfer (TT) Follow-Up Request?

The information that must be reported on the SG UOB Telegraphic Transfer (TT) Follow-Up Request includes the customer's full name, contact information, account number, transaction date, transaction reference number, amount transferred, beneficiary's details, and a description of the issue or inquiry.

Fill out your SG UOB Telegraphic Transfer TT Follow-Up online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uob Telegraphic Transfer is not the form you're looking for?Search for another form here.

Keywords relevant to uob remittance form

Related to uob application for telegraphic transfer

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.