Canada T2201 E 2022 free printable template

Show details

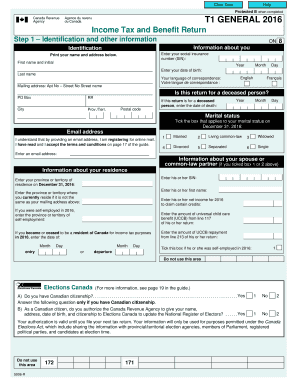

Clear Data Protected B when completed Help Disability Tax Credit Certificate The information provided in this form will be used by the Canada Revenue Agency CRA to determine the eligibility of the individual applying for the disability tax credit DTC. Signature T2201 E 22 Ce formulaire est disponible en fran ais. Page 1 of 16 Protected B when completed 3 Previous tax return adjustments Are you the person with the disability or their legal representative or if the person is under 18 their...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T2201 E

Edit your Canada T2201 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T2201 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada T2201 E online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada T2201 E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T2201 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T2201 E

How to fill out Canada T2201 E

01

Obtain the Canada T2201 E form from the Canada Revenue Agency (CRA) website.

02

Fill out the personal information section, including your name, address, and social insurance number.

03

In Part A, indicate whether you are applying for the Disability Tax Credit for yourself or for someone else.

04

Complete the medical practitioner’s information section if someone else is completing the form on your behalf.

05

In Part B, provide the details of your disability, including how it impairs your ability to perform basic activities of daily living.

06

Gather any necessary supporting documents, such as medical certificates or reports, to validate your claims.

07

Sign and date the form, showing your consent to share information with the CRA.

08

Submit the completed form to the CRA by mail or online via your My Account.

09

Keep a copy of the form and any supporting documents for your records.

Who needs Canada T2201 E?

01

Individuals with disabilities who wish to claim the Disability Tax Credit.

02

Parents or guardians applying for a dependent child who has a disability.

03

Caregivers of individuals with severe disabilities who require assistance.

Fill

form

: Try Risk Free

People Also Ask about

How much refund will I get for disability tax credit?

How much can you claim for the disability tax credit? For 2022, the federal non-refundable disability amount is: $8,870 for an adult. up to $5,174 for an additional supplement,* if the person with the disability is a child under 18.

Who qualifies for disability credit in Canada?

You may be eligible for the DTC if a medical practitioner certifies that you have a severe and prolonged impairment in 1 of the categories, significant limitations in 2 or more categories, or receive therapy to support a vital function.

What is CRA Form T2201?

T2201 Disability Tax Credit Certificate.

Where can I get a T2201 form?

The Disability Tax Credit Certificate T2201 is available to download on the CRA's website. On this page you will find two versions of the T2201 form: The first is a simple PDF version (t2201-21e. pdf), which can be printed and taken to your medical practitioner.

Who claims disability credit?

When completing the income tax return, either the person with the disability (if they have taxable income to be reduced to zero) or the supporting person can claim the credit.

How does the Disability Tax Credit work in Canada?

If you have a severe and prolonged impairment, you may apply for the credit. If you are approved, you may claim the credit at tax time. By reducing the amount of income tax you may have to pay, the DTC aims to offset some of the extra costs related to the impairment.

Does the disability tax credit give you money back?

The disability tax credit (DTC) is a non-refundable tax credit that helps people with impairments, or their supporting family member, reduce the amount of income tax they may have to pay.

What is the benefit of a disability tax credit in Canada?

The DTC helps reduce the income tax that people with physical or mental impairments, or their supporting family members, may have to pay. It aims to offset some of the costs related to the impairment.

Does disability tax credit give you money?

Disability Tax Credits you are eligible for you can follow the formula below: An eligible adult can receive a total of $1,500-$2,500 per year of eligibility. An eligible Minor can receive a total of $3,000-$4,500 per year of eligibility.

How do I get a T2201?

The Disability Tax Credit Certificate T2201 is available to download on the CRA's website. On this page you will find two versions of the T2201 form: The first is a simple PDF version (t2201-21e. pdf), which can be printed and taken to your medical practitioner.

How far back will CRA pay disability tax credit?

The DTC eligibility can go unlimited years in the past but the CRA can only reassess up to 10 years retroactively.

What is a T2201 form?

Medical practitioners may complete Part B of Form T2201, Disability Tax Credit Certificate using the DTC digital application. The digital application was updated to reflect expanded eligibility criteria for mental functions and life-sustaining therapy.

How is DTC refund calculated?

HOW IS THE DTC CALCULATED? Each government allows taxpayers to reduce their taxes payable by a percentage of their non-refundable tax credits. The federal government rate is 15%. The federal DTC is calculated by multiplying by the base amount by 15%.

How much do you get back for disability tax credit Canada?

Claiming for past years YearDisability amountSupplement for children (17 and younger)2020$8,576$5,0032019$8,416$4,9092018$8,235$4,8042017$8,113$4,7337 more rows

Where do I get a T2201 form?

The Disability Tax Credit Certificate T2201 is available to download on the CRA's website. On this page you will find two versions of the T2201 form: The first is a simple PDF version (t2201-21e. pdf), which can be printed and taken to your medical practitioner.

What is a T2201?

Medical practitioners may complete Part B of Form T2201, Disability Tax Credit Certificate using the DTC digital application. The digital application was updated to reflect expanded eligibility criteria for mental functions and life-sustaining therapy.

How much does the disability tax credit reduce taxes?

Once approved for the Disability Tax Credit, you will continue to be eligible to receive the disability tax credit every year. The potential savings for the disability tax credit is $1,900 to $2,200 a year.

Does anxiety qualify for Disability Tax Credit in Canada?

If you are diagnosed with anxiety, you could be eligible to receive a Disability Tax Credit of up to $50,000 from the CRA. Retroactive credit may be applied. Call for a free no-obligation assessment.

How much is the disability credit in Canada?

Amounts you may claim for the past 10 years YearDisability amountSupplement for children (17 and younger)2021$8,662$5,0032020$8,576$5,0032019$8,416$4,9092018$8,235$4,8047 more rows

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T2201 E for eSignature?

When you're ready to share your Canada T2201 E, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find Canada T2201 E?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific Canada T2201 E and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my Canada T2201 E in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your Canada T2201 E and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is Canada T2201 E?

The Canada T2201 E is a form used to determine eligibility for the Disability Tax Credit (DTC) in Canada. It certifies that an individual has a severe and prolonged impairment in physical or mental functions.

Who is required to file Canada T2201 E?

Individuals who wish to claim the Disability Tax Credit must file the T2201 E form. This includes people with disabilities and their representatives if claiming on their behalf.

How to fill out Canada T2201 E?

To fill out the T2201 E, individuals must provide personal information, details of the disability, and have a qualified healthcare professional complete the second part of the form. It is important to ensure all sections are filled out completely and accurately.

What is the purpose of Canada T2201 E?

The purpose of the Canada T2201 E form is to assess and confirm eligibility for the Disability Tax Credit, which can provide significant tax relief for individuals with disabilities or their supporting family members.

What information must be reported on Canada T2201 E?

The T2201 E requires report on personal identification details, the nature of the impairment, its duration, and how it affects daily activities. Additionally, information from a registered medical practitioner who confirms the impairment must also be included.

Fill out your Canada T2201 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t2201 E is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.