SG HSBC G0101835 2015-2026 free printable template

Show details

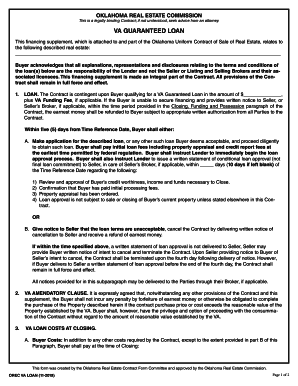

FULL / PARTIAL REDEMPTION OF UNSECURED PERSONAL Installment LOAN I understand that: A one-month notice period is required to redeem my personal installment loan. Upon receipt of this redemption request,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign SG HSBC G0101835

Edit your SG HSBC G0101835 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SG HSBC G0101835 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SG HSBC G0101835 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SG HSBC G0101835. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out SG HSBC G0101835

How to Fill out HSBC Full Partial Redemption:

01

Visit the HSBC website or access your online banking platform.

02

Log in to your account using your username and password.

03

Navigate to the "Accounts" or "Investments" section, where you can manage your investments.

04

Locate the option for full or partial redemption of your HSBC investments.

05

Select the specific investment or account you wish to redeem.

06

Choose whether you want a full or partial redemption. If opting for a partial redemption, specify the desired amount or percentage.

07

Review the details of your redemption request, including any fees or penalties that may apply.

08

Confirm your redemption request.

09

Check your account or investment balance to ensure that the redemption has been processed successfully.

Who needs HSBC Full Partial Redemption?

01

Investors who want to withdraw funds from their HSBC investment accounts partially or completely.

02

Individuals who have reached specific financial goals and wish to liquidate their investments.

03

Customers who require immediate access to cash for personal or financial reasons.

04

People who want to reallocate their investment portfolio or diversify their assets.

05

Investors who no longer wish to hold certain HSBC investments and want to exit their positions.

It is important to note that HSBC's specific policies and procedures for full or partial redemption may vary, so it is advisable to contact HSBC customer support or refer to the bank's official website for accurate and up-to-date instructions.

Fill

form

: Try Risk Free

People Also Ask about

How much CPF can I use for monthly installment?

Limitations on the amount you can use from your CPF savings to pay is limited by many factors including your monthly repayment must be no more than 30% of your monthly income as it is subject to Mortgage Servicing Ratio (MSR) terms and the Total Debt Servicing Ratio (TDSR) calculation.

Does HSBC Singapore have an IBAN number?

Do banks in Singapore use IBANs? No. Banks in Singapore don't use IBANs to identify specific banks or account numbers. We use SWIFT codes instead.

Can I pay off my HSBC personal loan early?

If you have an HSBC Personal Loan, you can make as many overpayments as you like, including paying off the loan early, without facing any fees or charges.

How do I increase my daily transfer limit on HSBC Singapore?

To update your daily limits, log on to HSBC Online Banking, select > 'Move Money' > 'Online banking limits' > 'Manage your daily limits' > 'Edit'. Then enter your new limits and select 'Continue'.

How do I increase my daily transfer limit on HSBC?

0:00 0:44 How to Change Online Banking Limit | HSBC Online Banking - YouTube YouTube Start of suggested clip End of suggested clip Online banking. Step 1 select change internet banking limit step 2 click on edit and adjust yourMoreOnline banking. Step 1 select change internet banking limit step 2 click on edit and adjust your daily limit ing to your preference. Step 3 click update to proceed.

What is the maximum transfer HSBC Singapore?

How much money can I send each day using HSBC Global Money Transfers? Sending toAccounts held in other banksMaximum daily limitUp to USD10,000 (with a single transaction limit of USD3,000)Sending toOther third-party HSBC accountsMaximum daily limitUp to SGD250,000 (or its equivalent in foreign currency)*4 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SG HSBC G0101835 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your SG HSBC G0101835 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit SG HSBC G0101835 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign SG HSBC G0101835 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete SG HSBC G0101835 on an Android device?

Complete SG HSBC G0101835 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is hsbc full partial redemption?

HSBC full partial redemption is a process where a borrower repays a portion of their loan before the maturity date.

Who is required to file hsbc full partial redemption?

Anyone who has taken a loan from HSBC and wishes to make a partial repayment before the loan maturity date is required to file for HSBC full partial redemption.

How to fill out hsbc full partial redemption?

To fill out HSBC full partial redemption, the borrower must contact HSBC and request the necessary forms to make a partial repayment. The borrower must provide information about the loan they wish to partially repay.

What is the purpose of hsbc full partial redemption?

The purpose of HSBC full partial redemption is to reduce the outstanding balance of a loan and potentially save on interest payments.

What information must be reported on hsbc full partial redemption?

The borrower must report the loan account number, the amount they wish to repay, and any other relevant information requested by HSBC.

Fill out your SG HSBC G0101835 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SG HSBC g0101835 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.