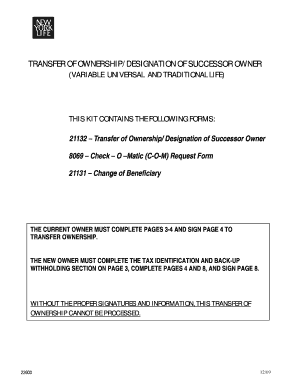

NY Life Transfer of Ownership/Designation of Successor Owner Kit 2021-2026 free printable template

Show details

New York Life or its subsidiaries may require a copy of the corporate board minutes which authorized the change of ownership. Partnership This request must be signed by two partners with their titles as partner other than the Insured. In the case of a limited partnership we will require only the signature of a general partner with the title of general partner. Please attach a copy of the partnership agreement. 2. The Person s With Right to Design...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new york life change of ownership form

Edit your new york life transfer of ownership form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york life change of beneficiary form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new york life insurance change of beneficiary form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new york life beneficiary change form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY Life Transfer of Ownership/Designation of Successor Owner Kit Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out successor owner life insurance policy form

How to fill out NY Life Transfer of Ownership/Designation of Successor Owner Kit

01

Obtain the NY Life Transfer of Ownership/Designation of Successor Owner Kit from your NY Life representative or their website.

02

Read the instructions provided in the kit carefully to understand the requirements.

03

Complete the Transfer of Ownership form by filling in the current owner's details and the new owner's details.

04

If designating a successor owner, fill in their information in the designated section.

05

Sign and date the form in the appropriate areas.

06

Gather any required supporting documents as specified in the kit.

07

Submit the completed form and any supporting documents to NY Life by mail or electronically as per the instructions.

Who needs NY Life Transfer of Ownership/Designation of Successor Owner Kit?

01

Current policyholders of NY Life who wish to transfer ownership of their policy.

02

Individuals looking to designate a successor owner for their life insurance policy.

03

Beneficiaries or financial advisors involved in the management of a policyholder's estate or financial planning.

Fill

form

: Try Risk Free

People Also Ask about

What are the tax consequences of changing ownership of life insurance policy?

In general, life insurance death benefits are exempt from taxation. If, however, you transfer a life insurance policy to another party in exchange for money or any other kind of material consideration, the death benefit proceeds may become fully or partially taxable. This is known as the transfer-for-value rule.

Why should people be careful about transferring ownership of a life insurance policy?

Third, when you transfer a life insurance policy to another person you lose all legal control over it. The new owner can change the beneficiary, take the cash value, or even cancel the insurance.

What happens when you transfer ownership of life insurance policy?

Transferring ownership of a policy is easy: Simply complete a change-of-ownership form provided by your insurance company. Remember, though, that even if you transfer ownership of an existing policy to another individual, it may be included in your estate if you die within three years of the transfer.

How do I change ownership of NY Life?

Contacting us at 1-800-CALL-NYL for assistance from a Customer Service Professional. A completed W-8 or W-9 is required. A copy of the Title, Signature, and Notary pages of the trust agreement, including the pages showing the trustee and successor trustee information is required.

Who should be the owner of a life insurance policy?

That is, the insured party should not be the owner of the policy, but rather, the beneficiary should purchase and own the policy. If your beneficiary (such as your spouse or children) purchases the policy and pays the premiums, the death benefit should not be included in your federal estate.

How do I transfer ownership of my life insurance policy?

Transferring ownership of a policy is easy: Simply complete a change-of-ownership form provided by your insurance company. Remember, though, that even if you transfer ownership of an existing policy to another individual, it may be included in your estate if you die within three years of the transfer.

Can I transfer my whole life insurance policy from one company to another?

In general, it is not possible to transfer a life insurance policy from one insurance provider to another. This is because of the underwriting involved in the approval process as well as factors that can affect the cost of life insurance over time, such as age and health conditions.

How do I change my name on my life insurance policy?

You can change the beneficiaries of your life insurance by contacting your insurance company. You'll need to submit a change of beneficiary form online, on paper, or over the phone. The form will ask for personal information about your beneficiary, such as: Contact information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NY Life Transfer of OwnershipDesignation of Successor Owner without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing NY Life Transfer of OwnershipDesignation of Successor Owner and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my NY Life Transfer of OwnershipDesignation of Successor Owner in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your NY Life Transfer of OwnershipDesignation of Successor Owner right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out NY Life Transfer of OwnershipDesignation of Successor Owner on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your NY Life Transfer of OwnershipDesignation of Successor Owner, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is NY Life Transfer of Ownership/Designation of Successor Owner Kit?

The NY Life Transfer of Ownership/Designation of Successor Owner Kit is a set of forms and documents provided by New York Life Insurance Company that allows policyholders to transfer ownership of their insurance policies or designate a successor owner.

Who is required to file NY Life Transfer of Ownership/Designation of Successor Owner Kit?

Policyholders who wish to transfer ownership of their insurance policies or designate a successor owner are required to file the NY Life Transfer of Ownership/Designation of Successor Owner Kit.

How to fill out NY Life Transfer of Ownership/Designation of Successor Owner Kit?

To fill out the NY Life Transfer of Ownership/Designation of Successor Owner Kit, policyholders should complete all required fields in the forms, providing accurate information regarding the current owner, the new owner (if applicable), and any successor owners. It's important to follow the instructions provided in the kit carefully.

What is the purpose of NY Life Transfer of Ownership/Designation of Successor Owner Kit?

The purpose of the NY Life Transfer of Ownership/Designation of Successor Owner Kit is to legally document the transfer of ownership of an insurance policy or to designate a successor owner, ensuring that the policy benefits are correctly managed and passed on according to the policyholder's wishes.

What information must be reported on NY Life Transfer of Ownership/Designation of Successor Owner Kit?

The information that must be reported includes the names and contact details of the current owner and the new owner, the policy number, details regarding any designated successor owners, and any pertinent additional information as required by the forms.

Fill out your NY Life Transfer of OwnershipDesignation of Successor Owner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY Life Transfer Of OwnershipDesignation Of Successor Owner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.