WI I-017i 2022 free printable template

Show details

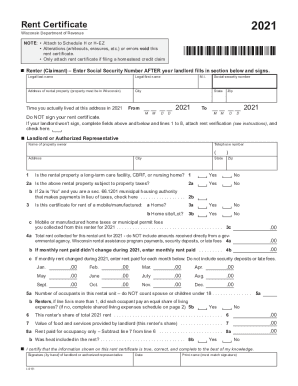

Signature by hand of landlord or authorized representative I-017i Date Print name must match signature Renter s 2022 Rent Certificate name SSN Page 2 of 2 Shared Living Expenses Schedule To be completed by renter only if line 5b on page one is No. Step 1 List name s of other occupants Step 3 Using the amounts listed in Step 2 compute your allowable rent paid for occupancy only 1 Total rent paid line 1a. CAUTION Schedule H or H-EZ must be completed and filed with this rent certificate A 2022...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI I-017i

Edit your WI I-017i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI I-017i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI I-017i online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WI I-017i. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI I-017i Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI I-017i

How to fill out WI I-017i

01

Obtain Form WI I-017i from the Wisconsin Department of Workforce Development website or a local office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Provide details regarding your employment history as requested in the form.

05

Complete any additional sections that apply to your situation, such as reason for application or specific benefits requested.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form either online, by mail, or in person as per the instructions provided.

Who needs WI I-017i?

01

Individuals who are applying for unemployment benefits in Wisconsin.

02

People seeking to claim specific benefits under Wisconsin's unemployment assistance programs.

03

Anyone who has been recently employed and has lost their job through no fault of their own.

Fill

form

: Try Risk Free

People Also Ask about

What is a rent certificate in WI?

A rent certificate or property tax bill is used to verify the amount of rent paid or property tax accrued you are claiming for purposes of homestead credit. If a copy of the property tax bill is not available, you may use a printout from the county or municipal treasurer or their website.

Do I have to file CRP in MN?

You must include all CRPs with your return. The CRP shows how much rent you paid during the previous year. You must include all CRPs when applying for your Renter's Property Tax Refund. Your landlord must give you a completed CRP by January 31.

Where do I file my CRP in MN?

You can get it from a library, call (651) 296-3781, or write to: MN Tax Forms, Mail Station 1421, St. Paul, MN 55146-1421. You can also get all forms and information to file online at .revenue.state.mn.us.

How do I file my CRP in MN?

If your landlord does not provide a CRP by March 1, 2021, call the Minnesota Department of Revenue at 651-296-3781 or 1-800-652-9094. To fill out the Certificate of Rent Paid information in the TaxAct program: From within your TaxAct return (Online or Desktop), click State, then click Minnesota (or MN).

Does PA rent certificate need to be notarized?

Your Rental Occupancy Affidavit must be notarized.

What is a certificate of rent paid in Wisconsin 2022?

A rent certificate is a form that your landlord fills out as proof of the rent you paid during 2022. If your landlord hasn't completed one, you can download a rent certificate , fill it out, and ask your landlord to sign it.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in WI I-017i?

The editing procedure is simple with pdfFiller. Open your WI I-017i in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the WI I-017i in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your WI I-017i in minutes.

How can I edit WI I-017i on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing WI I-017i, you can start right away.

What is WI I-017i?

WI I-017i is a specific form used for reporting certain tax-related information in Wisconsin.

Who is required to file WI I-017i?

Organizations and entities that meet specific criteria related to income or expenditures in Wisconsin are required to file WI I-017i.

How to fill out WI I-017i?

To fill out WI I-017i, provide the necessary organizational details, income data, and any deductions or credits, following the form's instructions.

What is the purpose of WI I-017i?

The purpose of WI I-017i is to ensure compliance with state taxation laws by reporting relevant financial information.

What information must be reported on WI I-017i?

Information such as the organization's name, address, federal employer identification number, income, deductions, and credits must be reported on WI I-017i.

Fill out your WI I-017i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI I-017i is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.