Get the free Eligibility for Travel at Government Expense

Show details

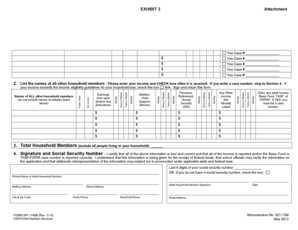

This document outlines the criteria for veterans to receive travel pay from the VA, detailing mileage determination, eligibility requirements, and instructions for requesting travel pay for appointments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eligibility for travel at

Edit your eligibility for travel at form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eligibility for travel at form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing eligibility for travel at online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit eligibility for travel at. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out eligibility for travel at

How to fill out Eligibility for Travel at Government Expense

01

Step 1: Gather all necessary personal information, including your full name, identification number, and contact details.

02

Step 2: Obtain relevant documents that verify your eligibility, such as appointment letters or service records.

03

Step 3: Fill out the eligibility form, ensuring all fields are completed accurately.

04

Step 4: Provide details about the travel purpose and destination.

05

Step 5: Attach any supporting documents required by the form, such as receipts or letters of confirmation.

06

Step 6: Review all information for accuracy and completeness before submission.

07

Step 7: Submit the form via the designated method, whether that be online, by mail, or in-person.

Who needs Eligibility for Travel at Government Expense?

01

Individuals who are government employees and need to travel for official duties.

02

Federal or state officials who require travel for work-related purposes.

03

Employees engaged in training or conferences funded by government resources.

04

Members of government agencies who are eligible for travel reimbursements.

Fill

form

: Try Risk Free

People Also Ask about

When can I claim travel expenses?

Generally, you can claim a transport deduction for travel done: from your workplace/place of business to meetings or events offsite. between two separate workplaces for different jobs. from one job to your second job/an alternative workplace if and when required (you can claim the cost of travelling between locations)

What are the three requirements for a traveling expense deduction?

The IRS has clear-cut criteria for determining whether a travel expense is eligible: Must Be Away From Your Tax Home. Your “tax home” isn't where you live but where your principal place of business or employment is located. Business Must Be the Primary Purpose. Expenses Must Be Ordinary and Necessary.

What expenses are authorized on the government travel card?

The GSA SmartPay Travel card/account may be used for authorized official travel and authorized travel-related expenses ONLY. Official travel expenses include transportation, lodging, meals and incidentals. The travel card/account will be printed in the cardholder's name and must not be used by any other person.

What are the IRS rules for travel reimbursement?

What is the IRS rule for expense reimbursement? To be reimbursed for travel expenses, you must be traveling outside your tax home for longer than a workday, and the trip must require rest to continue working. Your tax home is your main place of work, not necessarily where you live.

What are the criteria for a trip to qualify for the travel expense deduction?

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. A taxpayer is traveling away from home if they are away for longer than an ordinary day's work and they need to sleep to meet the demands of their work while away.

What is not considered a travel expense?

ing to the IRS, you can't deduct anything extravagant or unnecessary, so don't try ordering a private limo service to pick you up from the airport and writing it off. You also have to be traveling away from the general area considered your "tax home" for at least 1 workday to deduct your costs as travel expenses.

Can I use the government rate for personal travel?

An agency may prescribe a mileage radius of not greater than 50 miles to determine whether an employee's travel is within or outside the limits of the employee's official duty station for determining entitlement to overtime pay for travel.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Eligibility for Travel at Government Expense?

Eligibility for Travel at Government Expense refers to the criteria and conditions under which government employees or approved individuals can receive reimbursement for travel expenses incurred while performing official duties.

Who is required to file Eligibility for Travel at Government Expense?

Government employees, contractors, and other individuals authorized to travel for official government business are typically required to file for Eligibility for Travel at Government Expense.

How to fill out Eligibility for Travel at Government Expense?

To fill out the Eligibility for Travel at Government Expense, individuals must complete a specific form provided by the government agency, ensuring to include all required information such as personal details, purpose of travel, estimated costs, and relevant dates.

What is the purpose of Eligibility for Travel at Government Expense?

The purpose of Eligibility for Travel at Government Expense is to establish a standardized process for determining which travel expenses are permissible and ensure accountability and transparency in the use of government funds.

What information must be reported on Eligibility for Travel at Government Expense?

Information that must be reported includes the traveler's name, position, travel dates, destination, purpose of travel, anticipated costs, and any other details as required by the specific agency's policies.

Fill out your eligibility for travel at online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eligibility For Travel At is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.