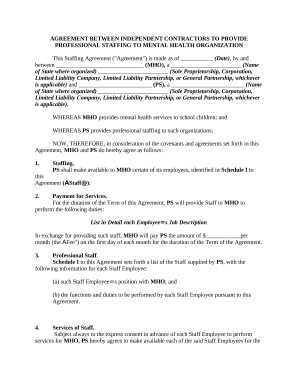

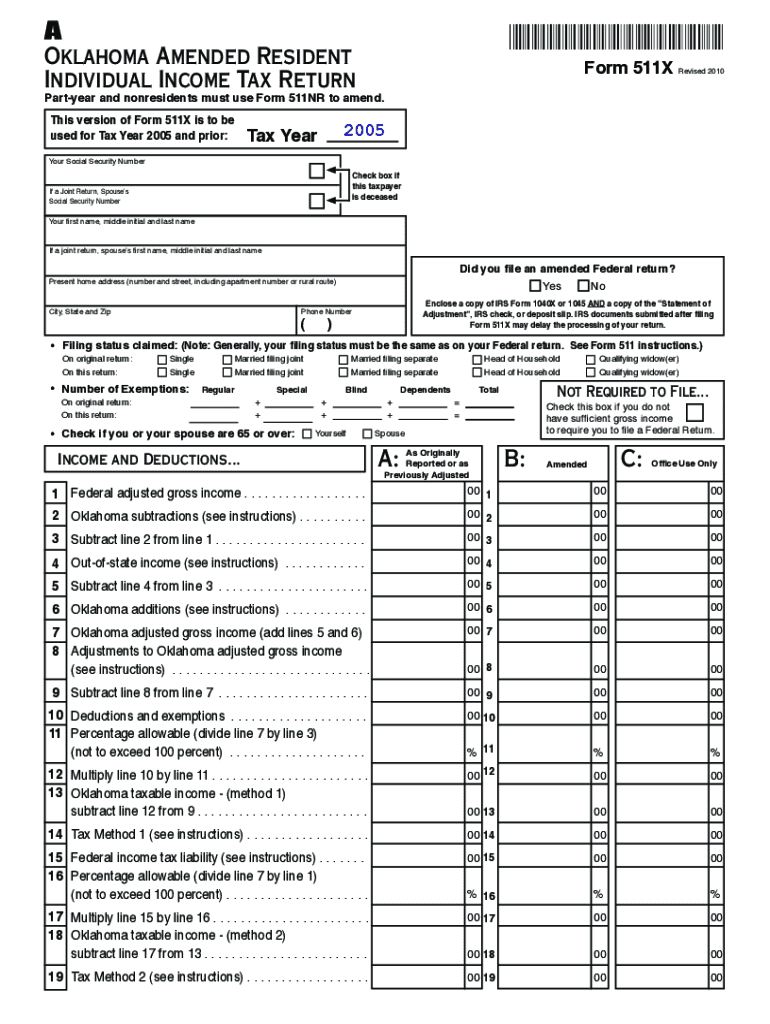

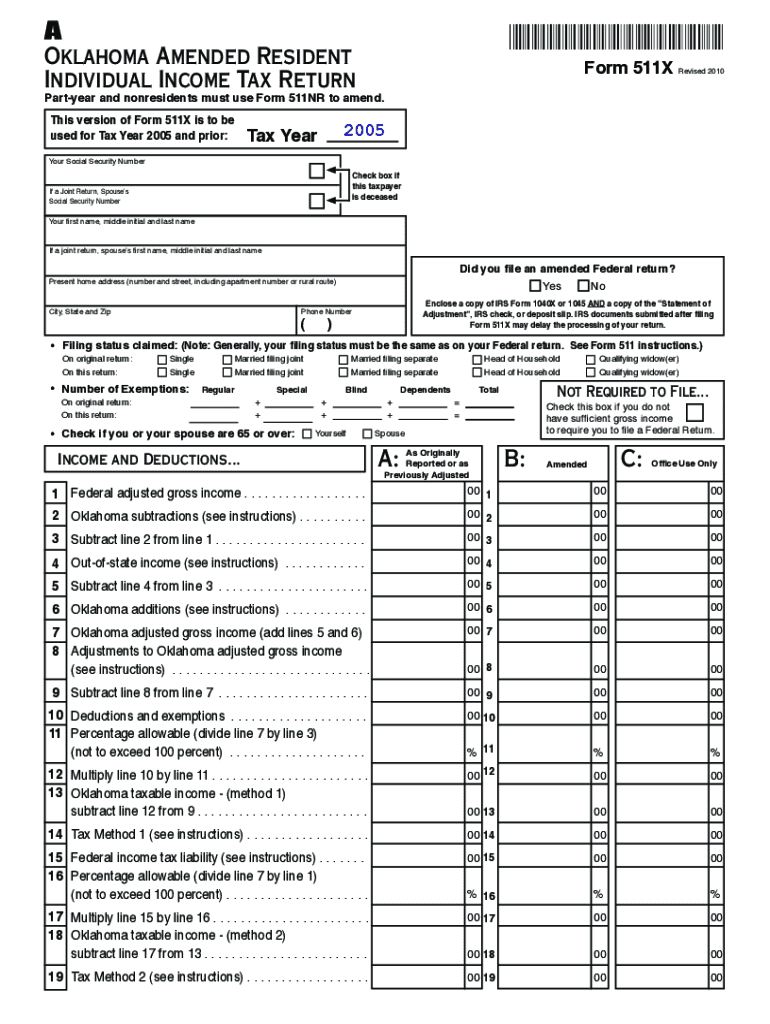

OK 511X 2005 free printable template

Show details

STOP! Please read the following important information before completing this form: If you filed an amended Federal return, please enclose: A copy of IRS Form 1040X or 1045A copy of the IRS Statement

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK 511X

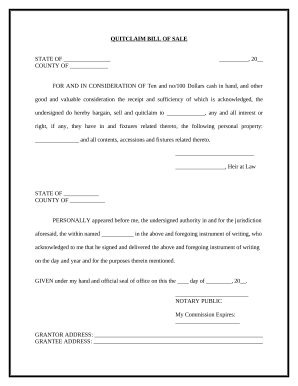

Edit your OK 511X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK 511X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OK 511X online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OK 511X. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK 511X Form Versions

Version

Form Popularity

Fillable & printabley

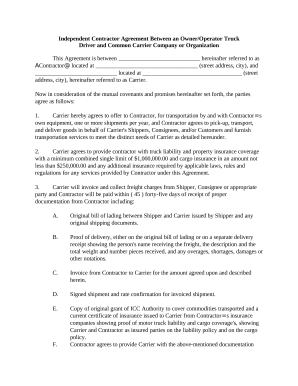

How to fill out OK 511X

How to fill out OK 511X

01

Gather necessary information, including your name, address, and identification details.

02

Begin filling out the form by entering your personal information in the designated fields.

03

Fill in the details regarding your tax situation for the reporting period.

04

Include any relevant income sources and deductions applicable to your situation.

05

Double-check your entries for accuracy and completeness before finalizing.

06

Sign and date the form as required.

07

Submit the form according to the instructions provided, either electronically or via mail.

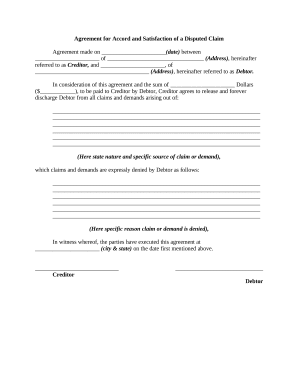

Who needs OK 511X?

01

Individuals or entities required to report specific tax information to the state.

02

Taxpayers who need to disclose their income and deductions for compliance purposes.

03

Those seeking any applicable deductions or tax credits during the tax season.

Fill

form

: Try Risk Free

People Also Ask about

What is the lowest amount of LIC policy?

What is the minimum sum assured for LIC Term Plans? The minimum sum assured under the various term plans from LIC is INR 10000 and that is available under the New Jeevan Mangal Plan.

What is the death benefit of LIC term plan?

Death Benefit: 250 times the monthly premium together with loyalty additions, if any, and return of premiums excluding first year premiums and extra/rider premium, if any, is payable in lump sum on death of the life assured during the term of the policy.

What is option 1 and option 2 in LIC term plan?

7 Top Features of LIC Tech Term Plan The policy term ranges from 10 to 40 years. There is no maximum limit on the coverage that you can choose, but the minimum sum assured is Rs 50 lakhs. You can receive the death benefits under two options: Option 1: Level sum assured & Option 2: Increasing sum assured.

What is Option 1 and Option 2 in LIC term insurance?

7 Top Features of LIC Tech Term Plan The policy term ranges from 10 to 40 years. There is no maximum limit on the coverage that you can choose, but the minimum sum assured is Rs 50 lakhs. You can receive the death benefits under two options: Option 1: Level sum assured & Option 2: Increasing sum assured.

What is the grace period for Jeevan Amar?

Grace period: Policyholders are given additional time to pay the premium after the premium due date when the insurance policy is in force. LIC Jeevan Amar policy offers a grace period of 30 days for policies with yearly and half-yearly premium payment mode.

What is LIC term rider option?

What is LIC Term Rider Policy? The LIC Term Rider Policy is an add-on benefit to the base policy that provides the beneficiary with the Sum Assured in case of the sudden demise of the insured within the policy period. This can only be added to non-linked plans at the commencement of the base policy at a nominal cost.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OK 511X to be eSigned by others?

When your OK 511X is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get OK 511X?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific OK 511X and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the OK 511X in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is OK 511X?

OK 511X is an amended income tax return form used to correct errors or make changes to a previously filed Oklahoma state income tax return.

Who is required to file OK 511X?

Individuals who have previously filed an Oklahoma state income tax return and need to make corrections, such as changing income, deductions, or filing status, are required to file OK 511X.

How to fill out OK 511X?

To fill out OK 511X, obtain the form, provide personal information, indicate the changes from the original return, and include any necessary supporting documents before submitting it to the Oklahoma Tax Commission.

What is the purpose of OK 511X?

The purpose of OK 511X is to provide taxpayers with a means to correct errors or amend their previous Oklahoma tax returns to ensure accuracy and compliance with state tax laws.

What information must be reported on OK 511X?

The information that must be reported on OK 511X includes the taxpayer's name, address, social security number, the original return details, the reasons for amendments, and the corrected amounts for income, deductions, or credits.

Fill out your OK 511X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK 511x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.