OK 511X 2012-2026 free printable template

Show details

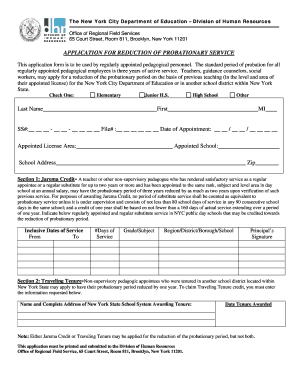

#1695#Oklahoma Amended Resident

Individual Income Tax Returner 511X 2012Partyear and nonresidents must use Form 511NR to amend. Tax Year 2012

Your Social Security NumberCheck box if

this taxpayer

is

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oklahoma 511 form

Edit your 511x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma state tax form 2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma tax form 511 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ok form 511. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK 511X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out t2 summary form

How to fill out OK 511X

01

Obtain a blank OK 511X form from the appropriate state tax agency or website.

02

Fill out your personal information, including your name, address, and social security number.

03

Provide the income details by documenting all sources of income for the tax year.

04

Deduct any applicable adjustments or credits as allowed by the tax regulations.

05

Calculate your total tax liability based on the provided guidelines.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form to the designated tax agency by the specified deadline.

Who needs OK 511X?

01

Individuals who have specific tax situations that require reporting through the OK 511X.

02

Those who are filing an amended return for previous tax years.

03

Taxpayers claiming certain credits or deductions that necessitate the use of this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the lowest amount of LIC policy?

What is the minimum sum assured for LIC Term Plans? The minimum sum assured under the various term plans from LIC is INR 10000 and that is available under the New Jeevan Mangal Plan.

What is the death benefit of LIC term plan?

Death Benefit: 250 times the monthly premium together with loyalty additions, if any, and return of premiums excluding first year premiums and extra/rider premium, if any, is payable in lump sum on death of the life assured during the term of the policy.

What is option 1 and option 2 in LIC term plan?

7 Top Features of LIC Tech Term Plan The policy term ranges from 10 to 40 years. There is no maximum limit on the coverage that you can choose, but the minimum sum assured is Rs 50 lakhs. You can receive the death benefits under two options: Option 1: Level sum assured & Option 2: Increasing sum assured.

What is Option 1 and Option 2 in LIC term insurance?

7 Top Features of LIC Tech Term Plan The policy term ranges from 10 to 40 years. There is no maximum limit on the coverage that you can choose, but the minimum sum assured is Rs 50 lakhs. You can receive the death benefits under two options: Option 1: Level sum assured & Option 2: Increasing sum assured.

What is the grace period for Jeevan Amar?

Grace period: Policyholders are given additional time to pay the premium after the premium due date when the insurance policy is in force. LIC Jeevan Amar policy offers a grace period of 30 days for policies with yearly and half-yearly premium payment mode.

What is LIC term rider option?

What is LIC Term Rider Policy? The LIC Term Rider Policy is an add-on benefit to the base policy that provides the beneficiary with the Sum Assured in case of the sudden demise of the insured within the policy period. This can only be added to non-linked plans at the commencement of the base policy at a nominal cost.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit OK 511X in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your OK 511X, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the OK 511X in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your OK 511X right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out OK 511X on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your OK 511X. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is OK 511X?

OK 511X is an amended individual income tax return form used by residents of Oklahoma to correct the information submitted on their original 511 form.

Who is required to file OK 511X?

Taxpayers who need to correct their Oklahoma individual income tax return are required to file OK 511X.

How to fill out OK 511X?

To fill out OK 511X, taxpayers must provide their identifying information, indicate the tax year being amended, and include details of the amendments and any supporting documentation.

What is the purpose of OK 511X?

The purpose of OK 511X is to allow taxpayers to amend their previously filed Oklahoma income tax returns to correct errors or omissions.

What information must be reported on OK 511X?

The information that must be reported on OK 511X includes the taxpayer's name, address, Social Security Number, the original return details, any changes being made, and reasons for the amendments.

Fill out your OK 511X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK 511x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.