Who needs IRS form 433-B?

To start with, there are series of forms 433 used by the taxpayers of different groups. In this article we will be reviewing form 433 -B designed for businesses.

What is IRS form 433-B for?

Form 433-B is used to report about specific financial situation that doesn't allow business to pay tax when it is due. Otherwise, called Collection Information Statement for Businesses, form 433-B reports about hardships that prevent a business from paying taxes timely or serves as a request to fill out offer in compromise.

Consequently, the form allows business to provide reasoning for not paying taxes on time and allows IRS to define business liability to pay taxes in full.

Is IRS form 433-B accompanied by other forms?

Form 433-B requires some attachments. These are copies of the documents that for a 3-month period. The required attachments are as follows:

-

bank statements alongside investment account statements

-

monthly payments, copies of UCC financing statements and depreciation schedules

-

monthly statements for rent, utilities, insurance premiums, telephones, property taxes, and court-ordered payments

-

credit card statements, profit and loss statements

-

copies of the last income tax return

Besides these copies there may be some specific documents required by the IRS.

When is IRS form 433-B due?

Form 433-B is due when it is needed.

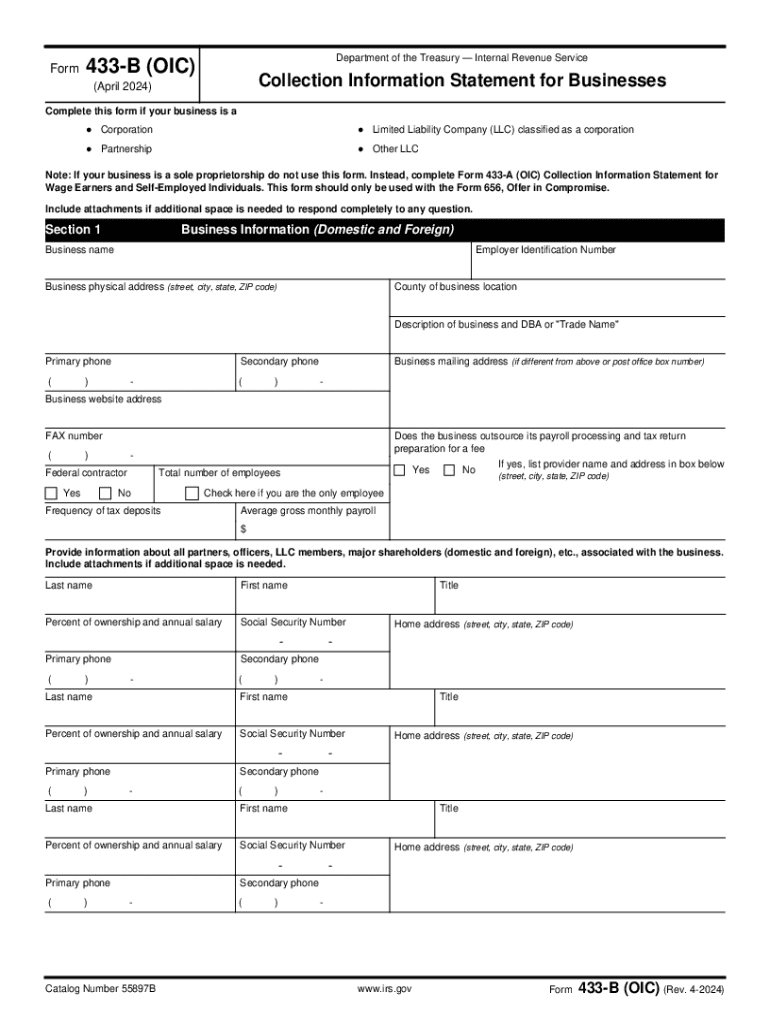

How do I fill out IRS form 433-B?

Form 433-B is divided into section. Each section accounts for specific kind of information:

-

Business information

-

Staff and contacts

-

Financial information

-

Liability information

-

Income and expenses information

Where do I send IRS form 433-B?

Once you've filled out form 433-B send to the Department of the Treasury Revenue Service.