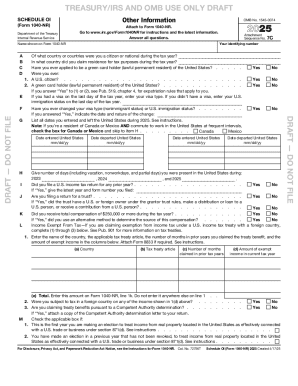

IRS 1040-NR - Schedule OI 2022 free printable template

Show details

Other InformationSCHEDULE OI (Form 1040NR) Department of the Treasury Internal Revenue Service OMB No. 15450074E FG Attachment Sequence No. 7C You're identifying cumbersome shown on Form 1040NRA B

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040-NR - Schedule OI

Edit your IRS 1040-NR - Schedule OI form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040-NR - Schedule OI form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1040-NR - Schedule OI online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1040-NR - Schedule OI. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040-NR - Schedule OI Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040-NR - Schedule OI

How to fill out IRS 1040-NR - Schedule OI

01

Obtain a copy of IRS Form 1040-NR and Schedule OI from the IRS website.

02

Carefully read the instructions provided for Schedule OI to understand what information is required.

03

Fill in your name and identifying information at the top of the form.

04

Complete the questions related to your residency status, including the number of days you were present in the U.S.

05

Provide information about your income from U.S. sources and any applicable deductions.

06

Answer additional questions regarding tax treaties and exemptions if applicable.

07

Review your entries for accuracy before mailing the completed form.

Who needs IRS 1040-NR - Schedule OI?

01

Non-resident aliens who are required to file a U.S. tax return.

02

Individuals who have income from U.S. sources and need to report it to the IRS.

03

Those who wish to claim deductions or exemptions under a tax treaty.

Fill

form

: Try Risk Free

People Also Ask about

What is Schedule NEC for?

SCHEDULE NEC. (Form 1040-NR) 2021. Tax on Income Not Effectively Connected With a U.S. Trade or Business.

Who must file Schedule NEC?

For taxpayers who are categorized by the IRS as non-residents but still have US-sourced income, they may have to file an annual Form 1040-NR tax return — which is the Form 1040 for Non-Resident Aliens, and it may also include Schedule NEC.

What is deductible on schedule A?

If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, contributions, and other expenses. You can also deduct certain casualty and theft losses. If you and your spouse paid expenses jointly and are filing separate returns for 2021, see Pub.

Who needs to file form 1040NR?

Form 1040-NR is often required for nonresident aliens who engaged in a trade or business in the United States or otherwise earned income from U.S. sources. A non-resident alien is somebody who is not American and lives abroad, but who earns taxable income in the U.S.

Do I need to file Schedule?

However, preparation of the schedule is only necessary when your interest or dividend income exceeds the IRS threshold for the year - $1,500 in 2022.

What is Schedule A on 1040NR?

Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

Who should fill schedule?

Generally speaking, the following people must fill out the form: The principal (primary) applicant. The spouse or common-law partner of the principal applicant. Dependent children who are 18 or more.

Who needs to file a schedule A?

Schedule A is required in any year you choose to itemize your deductions. The schedule has seven categories of expenses: medical and dental expenses, taxes, interest, gifts to charity, casualty and theft losses, job expenses and certain miscellaneous expenses.

What is schedule OI used for?

Schedule OI (Form 1040 OI), Other Information If you file Form 1040-NR, use Schedule OI (Form 1040-NR) to provide additional information not directly entered on Form 1040-NR including whether you are claiming a benefit under a tax treaty.

Is Schedule 1 always required?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

What is schedule OI for?

PURPOSE OF SCHEDULE PA-41 Schedule OI is used to provide additional information on the tax status of the estate or trust. NOTE: PA-41 Schedule OI is located on the bottom half of Page 2 of the PA-41, Fiduciary Income Tax Return.

Who should file schedule oi?

If you file Form 1040-NR, use Schedule OI (Form 1040-NR) to provide additional information not directly entered on Form 1040-NR including whether you are claiming a benefit under a tax treaty.

Do I need to fill schedule Oi?

Item L of Schedule OI must be completed to report income that is exempt from U.S. tax by an income tax treaty. Generally, wages paid to an NRA which are exempt under an income tax treaty are reported on Form 1042-S, using Exemption Code 04.

What is tax schedule A?

Schedule A is the tax form where you report the amount of your itemized deductions. Some of the itemized deductions listed on Schedule A include medical and dental expenses, various state taxes, mortgage interest, and charitable contributions.

What is Schedule A form 1040NR?

Schedule A (Form 1040-NR) – Itemized Deductions- namely for Taxes you Pay- State and Local income taxes, Gifts to U.S. Charities, Casualty and Theft Losses, Job Expenses and certain Miscellaneous Jib expenses, and Other Miscellaneous Deductions.

Who fills out Schedule 1?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IRS 1040-NR - Schedule OI straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing IRS 1040-NR - Schedule OI.

How do I complete IRS 1040-NR - Schedule OI on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IRS 1040-NR - Schedule OI. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out IRS 1040-NR - Schedule OI on an Android device?

Complete IRS 1040-NR - Schedule OI and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IRS 1040-NR - Schedule OI?

IRS 1040-NR - Schedule OI is an additional form that non-resident aliens use to provide additional information about their residency status, visa type, and income sources when filing their tax return.

Who is required to file IRS 1040-NR - Schedule OI?

Non-resident aliens who are required to file Form 1040-NR must also complete Schedule OI to provide further details regarding their residency and tax situation.

How to fill out IRS 1040-NR - Schedule OI?

To fill out Schedule OI, individuals need to provide information such as their residency status, type of visa, and other pertinent details that affect their tax obligations, ensuring all sections are completed accurately.

What is the purpose of IRS 1040-NR - Schedule OI?

The purpose of Schedule OI is to collect necessary information about non-resident aliens’ situations to determine their eligibility for certain tax benefits and compliance with U.S. tax laws.

What information must be reported on IRS 1040-NR - Schedule OI?

On Schedule OI, taxpayers must report information such as their visa type, residency status, prior years' presence in the U.S., and any tax treaty benefits they may be claiming.

Fill out your IRS 1040-NR - Schedule OI online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040-NR - Schedule OI is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.