IRS 8949 Instructions 2022 free printable template

Show details

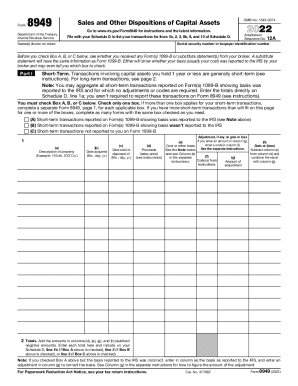

Instructions for Form 8949 Department of the Treasury Internal Revenue Service Sales and Other Dispositions of Capital Assets Section references are to the Internal Revenue Code unless otherwise noted. Future Developments For the latest information about developments related to Form 8949 and its instructions such as legislation enacted after they were published go to IRS.gov/Form8949. What s New Estates and trusts. Both grantor and non-grantor trusts must use Form 8949. Foreign corporate...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8949 Instructions

Edit your IRS 8949 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8949 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8949 Instructions online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 8949 Instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8949 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8949 Instructions

How to fill out IRS 8949 Instructions

01

Obtain IRS Form 8949 from the IRS website or your tax software.

02

Enter your name, Social Security number, and the tax year at the top of the form.

03

Determine the type of transactions you need to report (short-term or long-term) and select the appropriate section.

04

List each transaction individually, providing details such as the date acquired, date sold, description of the asset, sales price, cost basis, and any adjustments.

05

Calculate the gain or loss for each transaction by subtracting the cost basis from the sales price.

06

If applicable, indicate any adjustments (e.g., for disallowed wash sales) in the appropriate column.

07

Totals for short-term and long-term transactions should be calculated and carried over to Schedule D (if filing with Form 1040).

08

Review your entries for accuracy before submitting.

Who needs IRS 8949 Instructions?

01

Individuals and businesses who have sold capital assets such as stocks, bonds, or real estate must fill out IRS Form 8949.

02

Taxpayers claiming capital gains or losses on their tax returns, particularly those who have multiple transactions to report, need to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to list every stock transaction on form 8949?

Regarding reporting trades on Form 1099 and Schedule D, you must report each trade separately by either: Including each trade on Form 8949, which transfers to Schedule D. Combining the trades for each short-term or long-term category on your Schedule D. Include a separate attached spreadsheet showing each trade.

Do I need to report 8949 form?

Individuals use Form 8949 to report the following. The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business. Nonbusiness bad debts.

How do I know if I need to file form 8949?

Anyone who has received one or more Forms 1099-B, Forms 1099-S, or IRS-allowed substitutions should file a Form 8949. You may not need to file Form 8949 if the basis for all of your transactions was reported to the IRS, and if you don't need to make any adjustments to those figures.

Who must file form 8949?

Anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete Form 8949. Both short-term and long-term transactions must be documented on the form.

What transactions are not reported on form 8949?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I have to report every stock transaction 1099-B?

Even though the stock was sold in a single transaction, you must report the sale of the covered securities on two separate 2023 Forms 1099-B (one for the securities bought in April 2022 with long-term gain or loss and one for the securities bought in August 2022 with short-term gain or loss).

Do you have to file a 8949 and Schedule D?

Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

Do I have to report every stock transaction on form 8949?

What you may not realize, is that you'll need to report every transaction on an IRS Form 8949 in addition to a Schedule D. And if you sold stocks for less than you paid for them , you need to report those losses too.

In what circumstance would form 8949 not have to be filed?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I need to send 8949?

You don't need to manually fill out Form 8949, because we automatically do that when you enter your investment sales or exchanges. If you're paper-filing your return, Form 8949 will simply be included with all your other tax forms when you print them out.

Do I have to list all stock transactions on my tax return?

In general, individual traders and investors who file Form 1040 tax returns are required to provide a detailed list of each and every trade closed in the current tax year.

Do I need to submit form 8949?

If you e-file your return but choose not to report each transaction on a separate row on the electronic return, you must either (a) include Form 8949 as a PDF attachment to your return, or (b) attach Form 8949 to Form 8453 (or the appropriate form in the Form 8453 series) and mail the forms to the IRS.

Is Schedule D the same as form 8949?

Schedule D of Form 1040 is used to report most capital gain (or loss) transactions. But before you can enter your net gain or loss on Schedule D, you have to complete Form 8949.

Do I have to include Schedule D on my tax return?

Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

When can I skip form 8949?

Taxpayers can omit transactions from Form 8949 if: They received a Form 1099-B that shows that the cost basis was reported to the IRS, and. You did not have a non-deductible wash sale loss or adjustments to the basis, gain or loss, or to the type of gain or loss (short term or long term).

Do I have to report every stock transaction on form 8949?

Enter all sales and exchanges of capital assets, including stocks, bonds, and real estate (if not reported on line 1a or 8a of Schedule D or on Form 4684, 4797, 6252, 6781, or 8824). Include these transactions even if you didn't receive a Form 1099-B or 1099-S (or substitute statement) for the transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 8949 Instructions from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including IRS 8949 Instructions, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find IRS 8949 Instructions?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the IRS 8949 Instructions. Open it immediately and start altering it with sophisticated capabilities.

How do I complete IRS 8949 Instructions on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your IRS 8949 Instructions by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is IRS 8949 Instructions?

IRS 8949 Instructions provide guidance on how to report sales and exchanges of capital assets, such as stocks, bonds, and real estate, on your federal tax return.

Who is required to file IRS 8949 Instructions?

Taxpayers who have sold or exchanged capital assets during the tax year must file IRS 8949. This includes individuals, partnerships, and corporations that have capital gains or losses.

How to fill out IRS 8949 Instructions?

To fill out IRS 8949, you need to provide details of each transaction, including the date acquired, date sold, proceeds, cost or other basis, and adjustments. Follow the format prescribed in the instructions, ensuring accuracy to report gains or losses.

What is the purpose of IRS 8949 Instructions?

The purpose of IRS 8949 Instructions is to ensure that taxpayers accurately report their capital gains and losses, which are essential for calculating taxable income and determining tax liability.

What information must be reported on IRS 8949 Instructions?

The information that must be reported includes each transaction's description, date acquired, date sold, proceeds from the sale, cost or other basis, any adjustments to gain or loss, and the type of gain or loss (short-term or long-term).

Fill out your IRS 8949 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8949 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.