NY DTF IT-2 2022 free printable template

Show details

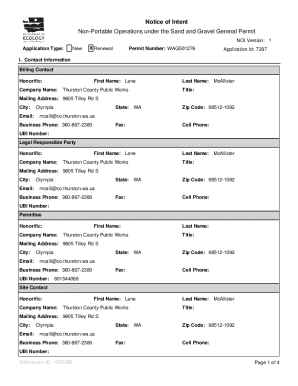

IT2Department of Taxation and FinanceSummary of W2 Statements York State New York City Yonkers Do not detach or separate the W2 Records below. File Form IT2 as an entire page with your return. See

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF IT-2

Edit your NY DTF IT-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF IT-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF IT-2 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY DTF IT-2. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF IT-2

How to fill out NY DTF IT-2

01

Obtain Form IT-2 from the New York State Department of Taxation and Finance website or your local tax office.

02

Ensure you have your personal information ready, including your name, Social Security number, and address.

03

Fill out the section for 'Employee Information' by entering your details as they appear on your tax documents.

04

Complete the 'Employer Information' section with your employer's name, address, and identification number.

05

Report the amounts from your W-2 forms, specifically the New York State wages and tax withheld.

06

Provide any other required income information if applicable, such as unemployment or other compensation.

07

Review all completed sections for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the completed form to the appropriate New York State tax agency by the deadline.

Who needs NY DTF IT-2?

01

Any employee who worked in New York State and earned income during the tax year.

02

Individuals who receive a W-2 form from their employer in New York.

03

Anyone needing to report their state tax withheld from their earnings.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get NYS tax forms?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

What is at 2 tax form?

Form T-2 shall be used for statements of eligibility of individuals designated to act as trustees under trust indentures to be qualified pursuant to Sections 305 or 307 of the Trust Indenture Act of 1939.

What is an IT 2 form New York?

Form IT-2, Summary of W-2 Statements, is a tax form that was released by the New York State Department of Taxation and Finance - a government authority operating within the state of New York. This is the latest version of the form released by the department and is applicable for filing 2019 taxes.

Does the W-2 form include both federal and state tax information?

The federal Internal Revenue Service (IRS) requires employers to report employees' wage and salary information on Form W-2. The Form W-2 also reports the amount of federal, state and other income taxes withheld from the employee's paycheck during the calendar year.

Do I need to attach w2 to New York tax return?

You need it for filing federal and New York State tax returns. The taxable wages consist of the gross wages and other compensation paid to you during the year, including the following taxable fringe benefits: Union Legal Service Benefit.

What is a 1040?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF IT-2 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NY DTF IT-2 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I edit NY DTF IT-2 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign NY DTF IT-2. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit NY DTF IT-2 on an Android device?

You can edit, sign, and distribute NY DTF IT-2 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is NY DTF IT-2?

NY DTF IT-2 is a New York State form used to report the information about income and withholding for employees who have received wages. It is typically provided by employers to their employees.

Who is required to file NY DTF IT-2?

Employers who pay wages to employees in New York State are required to file the NY DTF IT-2 form.

How to fill out NY DTF IT-2?

To fill out NY DTF IT-2, employers must provide their company information, the employee's information, and details regarding the wages paid and the amount of taxes withheld during the year.

What is the purpose of NY DTF IT-2?

The purpose of NY DTF IT-2 is to report and summarize the income and withholding taxes related to wages paid to employees for a tax year, allowing employees to have accurate information for their tax filings.

What information must be reported on NY DTF IT-2?

The NY DTF IT-2 must report the employer's details, employee's name and Social Security number, total wages paid to the employee, and total withholding tax amounts for the employee.

Fill out your NY DTF IT-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.