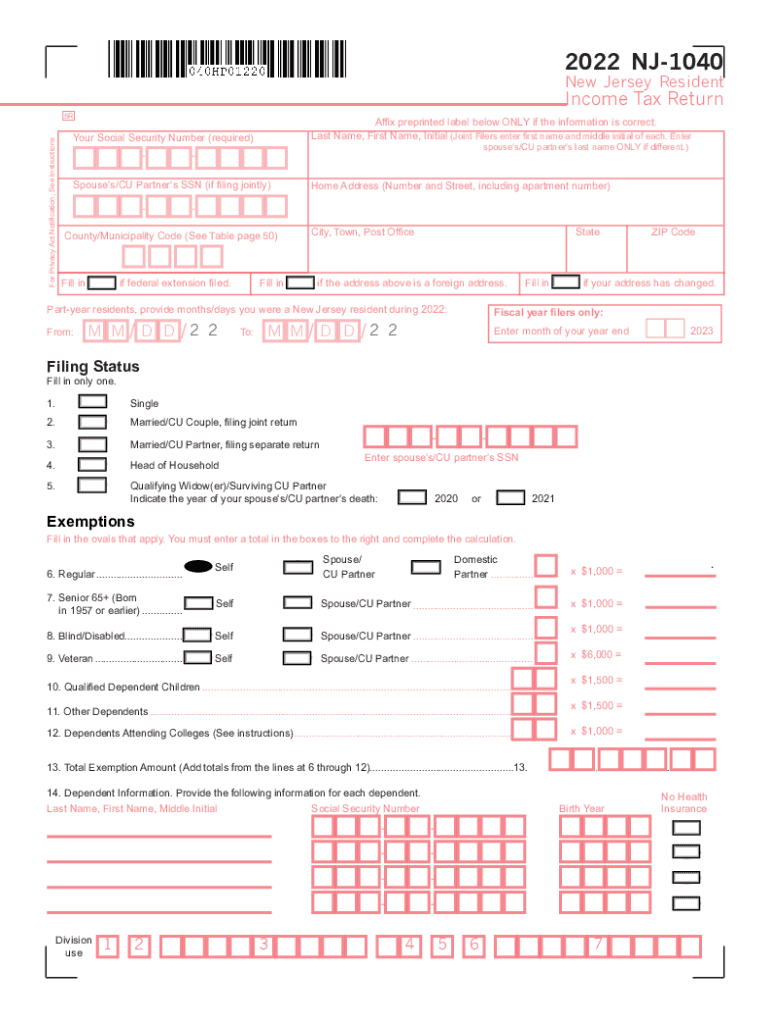

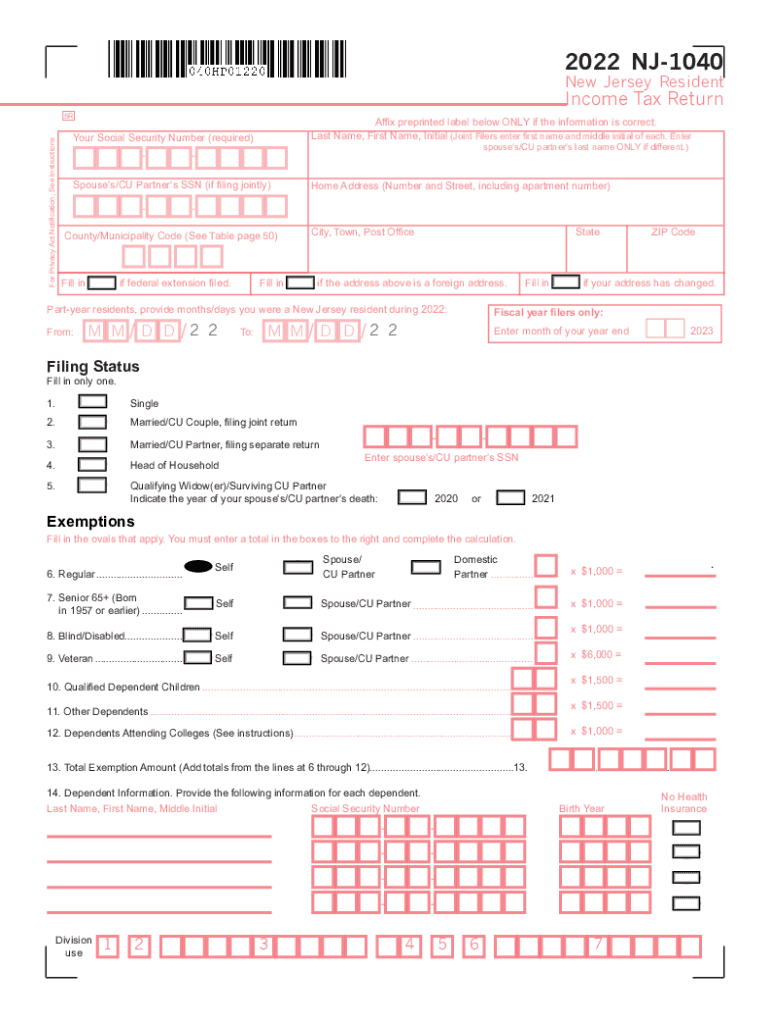

NJ NJ-1040 2022 free printable template

Show details

28c. 29. New Jersey Gross Income Subtract line 28c from line 27 b. NJCLASS c. NJ Higher Ed. Tuition Ded. 39. 21. 22. Net pro rata share of S Corporation Income Schedule NJ-BUS-1 Part III line 4 Schedule NJ-BUS-1 Part IV line 4. 20a. 20b. Excludable pension annuity and IRA distributions/withdrawals. 20b. 21. Distributive Share of Partnership Income Schedule NJ-BUS-1 Part II line 4 Enclose Schedule NJK-1 or federal Schedule K-1. Division use Social Security Number Birth Year. No Health...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ NJ-1040

Edit your NJ NJ-1040 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ NJ-1040 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ NJ-1040 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ NJ-1040. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ NJ-1040 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ NJ-1040

How to fill out NJ NJ-1040

01

Gather your personal information including Social Security number and address.

02

Collect income documentation such as W-2 forms and 1099 forms.

03

Fill in your filing status (Single, Married, etc.) at the top of the form.

04

Report your total income on the appropriate lines on the form.

05

Claim any deductions you qualify for, like standard deductions or itemized deductions.

06

Calculate your New Jersey taxable income by subtracting deductions from total income.

07

Determine any tax credits you can claim to reduce your tax liability.

08

Calculate the total amount of tax owed or refund due.

09

Provide bank information if you wish to receive your refund via direct deposit.

10

Review the form for accuracy and sign it before submitting.

Who needs NJ NJ-1040?

01

Residents of New Jersey who have earned income during the tax year.

02

Part-time residents who have income sourced from New Jersey.

03

Any individuals who are required to file a federal tax return and meet New Jersey's filing thresholds.

Fill

form

: Try Risk Free

People Also Ask about

What is a NJ-1040 p1?

2021 New Jersey Resident Return, Form NJ-1040. Page 1. New Jersey Resident. Income Tax Return. Division.

What is a form Pit 1?

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

Is everyone required to file a 1040?

Here are the income tax filing requirements for tax year 2021. Not everyone is required to file their taxes. Whether you need to file your taxes depends on four factors: your income, filing status, age, and whether you fall under a special circumstance.

What is NJ Form 1040?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents.

Do I need to file a NJ tax return?

If you were a resident of New Jersey for only part of the year and your income from all sources for the entire year was more than $20,000 ($10,000 if filing status is single or married/CU partner, filing separate return), you must file a New Jersey resident Income Tax return and report any income you received while you

What is an NJ-1040?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents.

Who Must File NJ-1040?

NJ Income Tax – Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return head of household, Qualifying widow(er)/surviving CU partner$20,000 May 12, 2021

What is a 1040 form and where do I get it?

Form 1040. The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

What is a 1040 p1 form?

Form 1040 Schedule 1 is used to report certain types of income that aren't listed on the main 1040 form. It's also used to claim some tax deductions.

Where can I find my NJ-1040?

Individuals To get a copy or transcript of your tax return, complete Form DCC-1 and send it to: You also can get a copy of your NJ-1040, NJ-1040NR or NJ-1041 at a Division of Taxation Regional Information Center. Otherwise, you can get a copy of a previously filed tax return by completing Form DCC-1 and sending it to:

Who files a NJ-1040?

You can file your Form NJ-1040 for 2021 using NJ E-File, whether you are a full-year resident or a part- year resident. Use tax software you purchase, go to an online tax preparation website, or have a tax preparer file your return. (You may file both federal and State Income Tax returns.)

What is a 1040 on a tax return?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is New Jersey 1040?

New Jersey Form NJ-1040 – Personal Income Tax Return for Residents. New Jersey Form NJ-1040NR – Personal Income Tax Return for Nonresidents.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NJ NJ-1040 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including NJ NJ-1040, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an eSignature for the NJ NJ-1040 in Gmail?

Create your eSignature using pdfFiller and then eSign your NJ NJ-1040 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit NJ NJ-1040 on an iOS device?

Create, modify, and share NJ NJ-1040 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is NJ NJ-1040?

NJ NJ-1040 is the state income tax form used by residents of New Jersey to report their annual income and calculate their state income tax liability.

Who is required to file NJ NJ-1040?

Residents of New Jersey who earn income that meets the filing thresholds set by the state are required to file the NJ NJ-1040. This includes individuals, married couples, and certain dependents.

How to fill out NJ NJ-1040?

To fill out NJ NJ-1040, taxpayers should gather all relevant financial documents, enter their income, deductions, and credits on the form, and ensure that all information is accurate before submitting it to the New Jersey Division of Taxation.

What is the purpose of NJ NJ-1040?

The purpose of NJ NJ-1040 is to allow New Jersey residents to report their income, calculate their tax due, and claim any applicable credits or deductions for the tax year.

What information must be reported on NJ NJ-1040?

NJ NJ-1040 requires taxpayers to report their total income, adjustments to income, deductions, tax credits, and any other relevant information that affects their tax liability.

Fill out your NJ NJ-1040 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ NJ-1040 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.