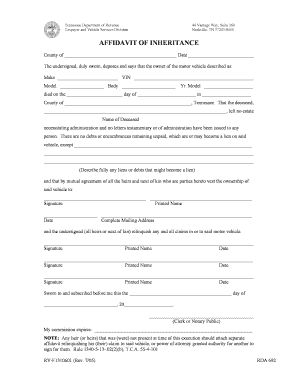

Get the free beneficiary form for inheritance

Show details

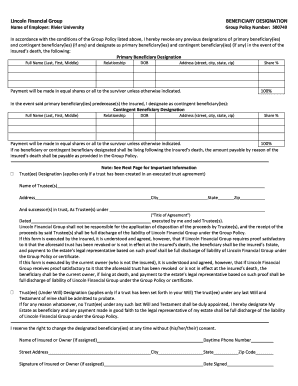

*Consult IRS publication 590 and other IRS materials for an explanation of trust beneficiary requirements. BENEFICIARY DISTRIBUTION REQUEST FORM ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign inheritance beneficiary form

Edit your beneficiary form for inheritance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficiary form for inheritance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing beneficiary form for inheritance online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit beneficiary form for inheritance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary form for inheritance

How to fill out an inheritance beneficiary form?

01

Obtain the necessary form from the relevant authority or institution handling the inheritance.

02

Fill in your personal details accurately, including your full name, contact information, and relationship to the deceased.

03

Provide the required information about the deceased, such as their full name, date of birth, and date of death.

04

Specify the type or nature of the inheritance, whether it's financial assets, property, or other forms of assets.

05

Indicate your desired distribution or division of the inheritance, including any specific instructions or conditions.

06

If necessary, provide information about any co-beneficiaries, joint beneficiaries, or secondary beneficiaries.

07

Attach any relevant supporting documents, such as a death certificate or legal documentation proving your relationship to the deceased.

08

Review the filled-out form carefully to ensure accuracy and completeness.

09

Sign and date the form, following any additional instructions provided by the authority or institution.

10

Submit the completed form along with any required supporting documents to the designated recipient or authority.

Who needs an inheritance beneficiary form?

01

Beneficiaries of an estate or inheritance need an inheritance beneficiary form.

02

Family members who are entitled to receive a portion of the deceased's assets.

03

Individuals named as beneficiaries in a will or trust document.

04

People who have been designated as beneficiaries by the deceased through a life insurance policy, retirement account, or other financial instruments.

05

Anyone who wants to ensure their rightful share of an inheritance or estate is properly documented and distributed.

06

Executors or administrators of an estate who need to gather information and allocate assets to designated beneficiaries according to the deceased's wishes.

Fill

form

: Try Risk Free

People Also Ask about

What form is used for inheritance?

Form 8971, along with a copy of every Schedule A, is used to report values to the IRS. One Schedule A is provided to each beneficiary receiving property from an estate. Form 8971 InstructionsPDF.

Do you need to fill out a beneficiary form?

If you get married or divorced, or have children or other life changes, standard sequence will follow those life changes. If you never file a beneficiary designation, your benefit will be paid ing to standard sequence at the time of your death.

What is the purpose of a beneficiary form?

The beneficiary designation forms allow you to name primary and secondary beneficiaries. Your “primary beneficiaries” are the first people or entities that you want to receive your benefit after you die.

What is a K 1 form for inheritance?

Purpose of Form Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc., on your Form 1040 or 1040-SR. Keep it for your records.

What form do I need to name a beneficiary?

There are two beneficiary designation forms: The basic Beneficiary Designation (ET-2320) allows you to name primary and secondary beneficiaries. The Beneficiary Designation - Alternate (ET-2321) allows you to name primary and secondary beneficiaries. You can also name specific successors to those beneficiaries.

Are beneficiary forms required?

Must I complete designation of beneficiary forms? No, these forms are not required.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficiary form for inheritance directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your beneficiary form for inheritance and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get beneficiary form for inheritance?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the beneficiary form for inheritance in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the beneficiary form for inheritance electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your beneficiary form for inheritance in seconds.

What is inheritance beneficiary form?

The inheritance beneficiary form is a legal document that designates who will inherit an individual's assets or benefits upon their death.

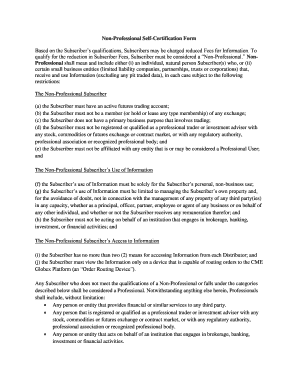

Who is required to file inheritance beneficiary form?

Typically, individuals who have assets that are subject to inheritance laws, such as life insurance policies, retirement accounts, or trusts, are required to file an inheritance beneficiary form.

How to fill out inheritance beneficiary form?

To fill out the inheritance beneficiary form, one must provide personal information about the decedent and beneficiaries, including names, contact information, and relationship to the decedent, and specify the distribution of assets.

What is the purpose of inheritance beneficiary form?

The purpose of the inheritance beneficiary form is to ensure that an individual's wishes regarding asset distribution after their death are formally documented and legally recognized.

What information must be reported on inheritance beneficiary form?

The form must include the decedent's name, date of death, details of the assets, beneficiaries' names and relationships to the decedent, and the percentage of assets each beneficiary is entitled to receive.

Fill out your beneficiary form for inheritance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Form For Inheritance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.