Get the free Increase Margin Loan Facility Credit Limit

Show details

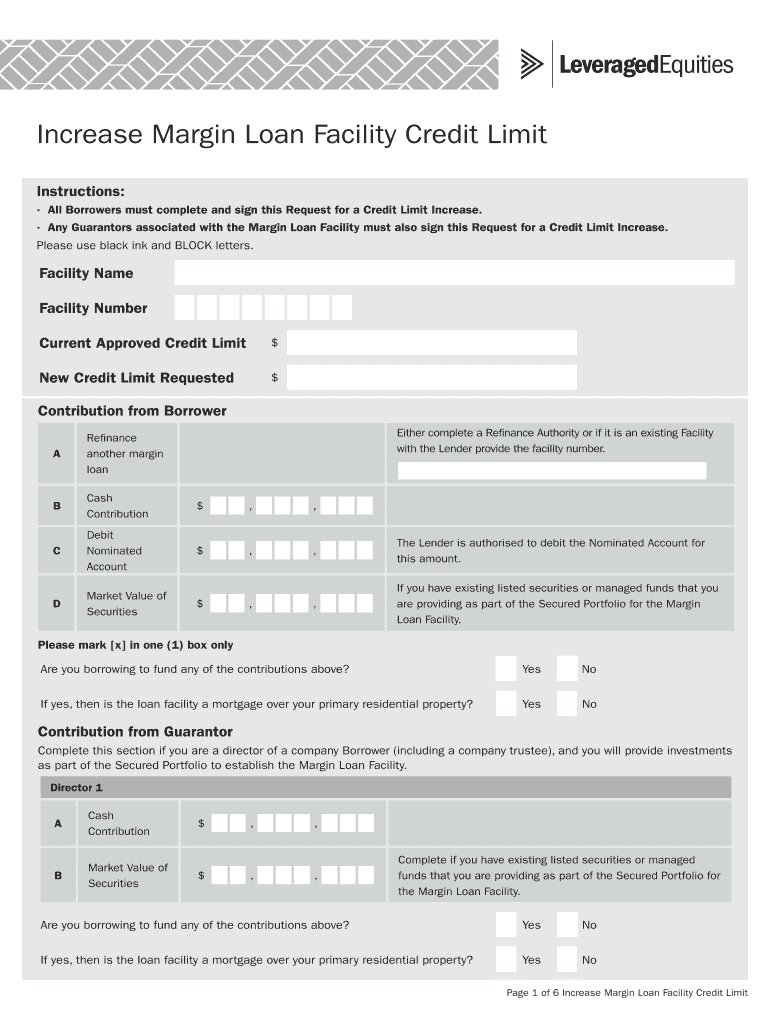

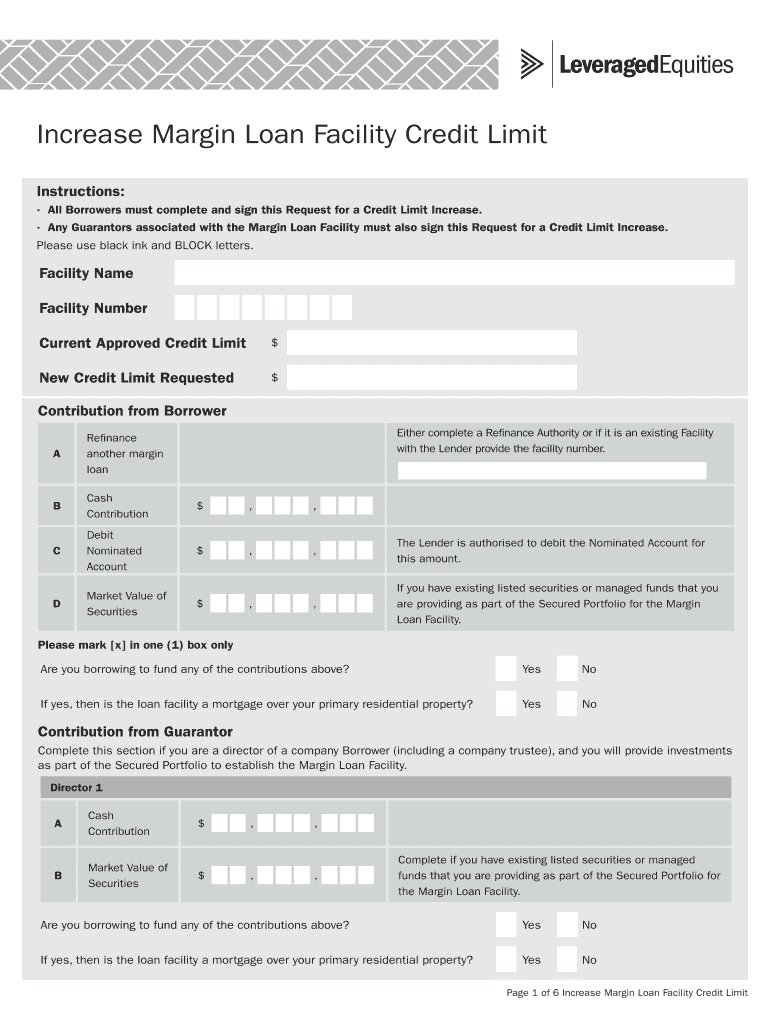

Increase Margin Loan Facility Credit Limit Instructions: All Borrowers must complete and sign this Request for a Credit Limit Increase. Any Guarantors associated with the Margin Loan Facility must

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign increase margin loan facility

Edit your increase margin loan facility form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your increase margin loan facility form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit increase margin loan facility online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit increase margin loan facility. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out increase margin loan facility

How to fill out increase margin loan facility:

01

Contact your financial institution or lender to inquire about the possibility of increasing the margin loan facility. Provide them with all the necessary details such as your account information, loan agreement number, and desired increase amount.

02

Review the terms and conditions for increasing the margin loan facility. Understand the interest rates, repayment terms, and any additional fees or charges that may apply.

03

Complete any required application forms or documentation provided by your lender. This may include providing updated financial information, identification documents, and signed agreements.

04

Submit the completed application forms and required documentation to your lender via the preferred method specified by them. This could be through email, mail, or in-person at a branch office.

05

Wait for the approval and processing of your request. Depending on the lender, this may take a few days to a few weeks. Ensure that you continue making regular payments on your existing margin loan facility during this period.

06

Once approved, carefully review the terms of the increased margin loan facility. Make note of any changes in interest rates, repayment terms, or borrowing limits.

07

If you are satisfied with the terms, sign any new agreements or contracts provided by your lender. Return these documents to the lender in the specified manner.

08

Begin utilizing the increased margin loan facility as per your needs and within the agreed terms and conditions.

Who needs increase margin loan facility:

01

Investors looking to expand their investment portfolio by leveraging their existing assets. Increasing the margin loan facility allows them to borrow against their securities to invest in additional assets.

02

Individuals or businesses in need of additional funds for personal or business purposes but do not want to liquidate their existing investments. The increase in the margin loan facility provides a solution to access funds without selling assets.

03

Traders or speculators who want to take advantage of market opportunities but require additional capital. The increased margin loan facility allows them to increase their trading positions and potentially amplify their returns.

04

Those who understand the risks associated with margin loans and have a comprehensive understanding of their investment strategy. It is important to have a clear plan to ensure that the borrowed funds are used wisely and without undue risk.

Note: Before opting for an increase in the margin loan facility, it is advisable to seek advice from a financial advisor or professional to assess your individual circumstances and determine if it is a suitable option for your financial goals and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get increase margin loan facility?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific increase margin loan facility and other forms. Find the template you need and change it using powerful tools.

Can I edit increase margin loan facility on an Android device?

With the pdfFiller Android app, you can edit, sign, and share increase margin loan facility on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete increase margin loan facility on an Android device?

Complete your increase margin loan facility and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is increase margin loan facility?

Increase margin loan facility refers to the ability for investors to borrow money from a brokerage firm using the securities held in their investment account as collateral.

Who is required to file increase margin loan facility?

Investors who wish to borrow money from a brokerage firm using their investment account as collateral are required to file an increase margin loan facility.

How to fill out increase margin loan facility?

Increase margin loan facility can be filled out by providing information about the securities held in the investment account, the amount of money requested to borrow, and agreeing to the terms and conditions set by the brokerage firm.

What is the purpose of increase margin loan facility?

The purpose of increase margin loan facility is to provide investors with additional funds to invest in the market or meet other financial needs.

What information must be reported on increase margin loan facility?

Information such as the securities held as collateral, the amount of money borrowed, interest rates, and repayment terms must be reported on increase margin loan facility.

Fill out your increase margin loan facility online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Increase Margin Loan Facility is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.