IRS Instructions 941 2023 free printable template

Get, Create, Make and Sign IRS Instructions 941

How to edit IRS Instructions 941 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 941 Form Versions

How to fill out IRS Instructions 941

How to fill out IRS Instructions 941

Who needs IRS Instructions 941?

Instructions and Help about IRS Instructions 941

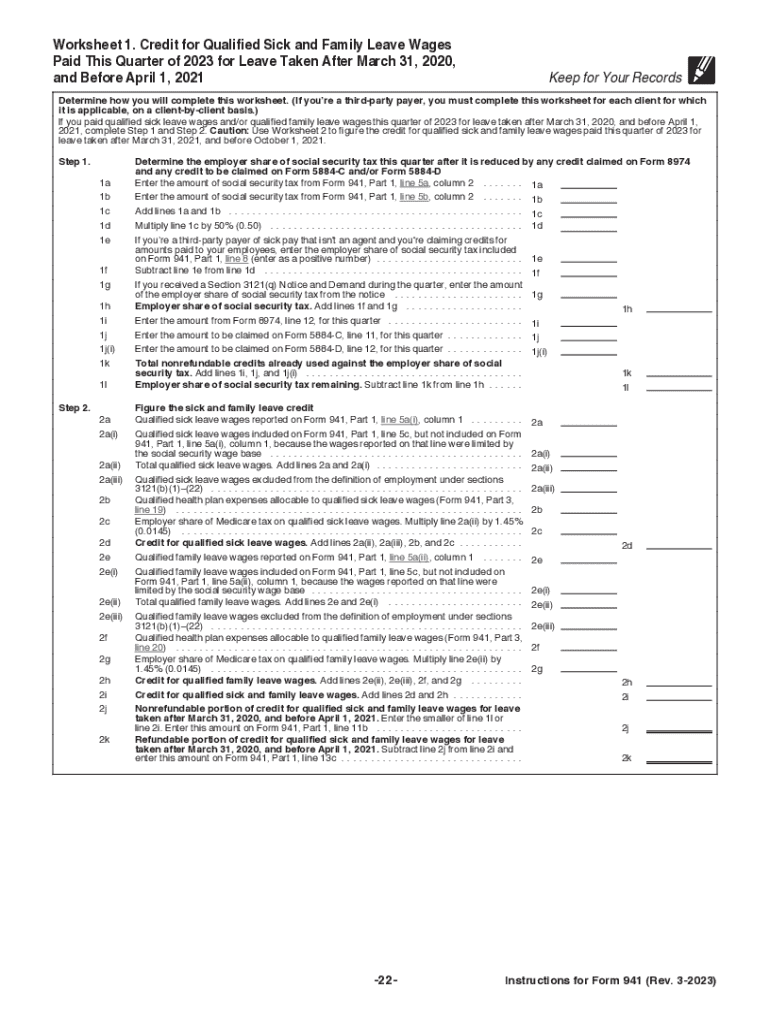

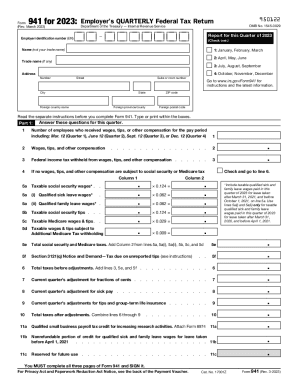

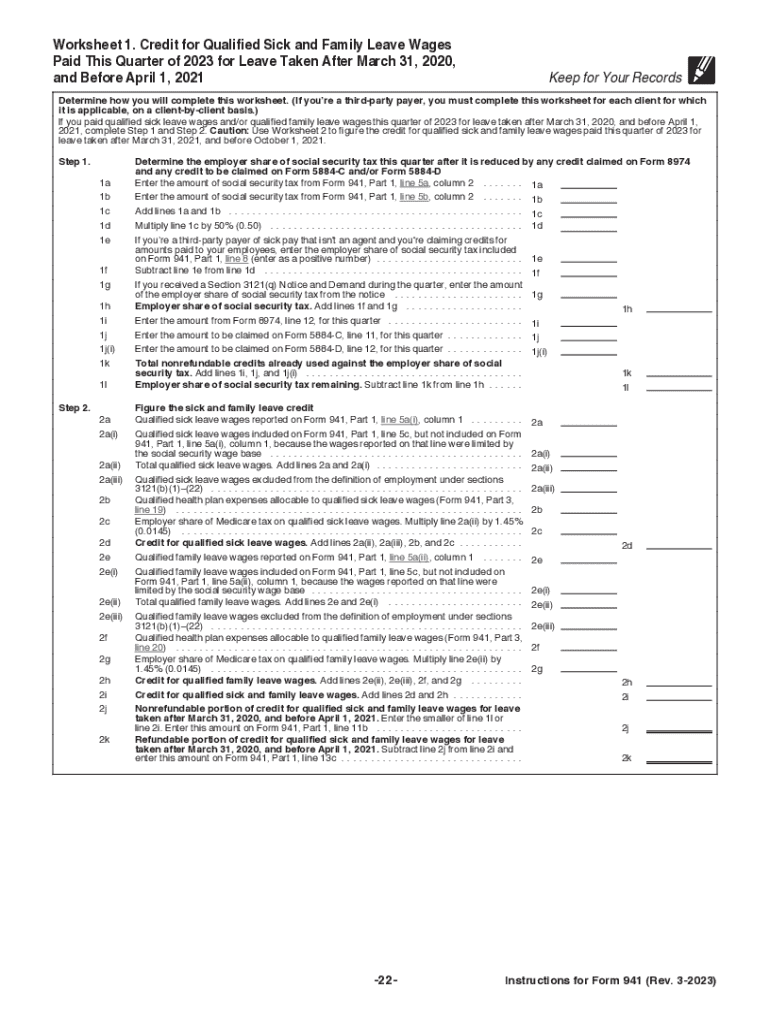

How to Fill Out IRS Form 941 Hi everyone, I'm Priyanka Prakash, senior staff writer at Fund era. Today I'll show you how to fill out IRS Form 941. Form 941 is a form that businesses file quarterly to report withheld income taxes from their employees’ wages, as well as the employer and employees share of Social Security and Medicare taxes, which are together called FICA taxes. In general, if you'll be paying wages of more than $4,000 per year, giving you a tax liability of more than $1,000 per year, then you'll need to submit Form 941 on a quarterly basis. Let's get started with the form. To begin, indicate the quarter for which you're filling the form out. Form 941 is due on the last day of the month following the period for which you're filing. For example, you’d file the form by April 30 to cover wages paid in January, February, and March. The other deadlines are July 31, October 31, and January 31. In this case, I'm going to choose option 1. I'm filing by April 30 to cover wages paid in January, February, and March. Then, you'll type in or right in your hand filling the...

People Also Ask about

How to fill out form 941 Employer's Quarterly Federal Tax Return?

Can you file 941 quarterly federal tax return online?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS Instructions 941?

Can I sign the IRS Instructions 941 electronically in Chrome?

How do I complete IRS Instructions 941 on an iOS device?

What is IRS Instructions 941?

Who is required to file IRS Instructions 941?

How to fill out IRS Instructions 941?

What is the purpose of IRS Instructions 941?

What information must be reported on IRS Instructions 941?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.