IRS Schedule R (Form 941) 2023 free printable template

Show details

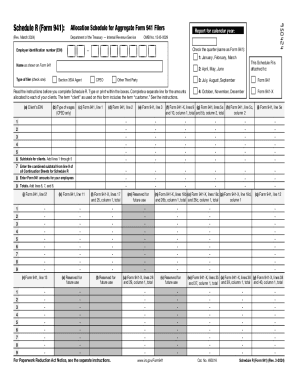

Allocation Schedule for Aggregate Form 941 Filers(Rev. March 2023)Department of the Treasury Internal Revenue ServiceEmployer identification number (EIN)951422Schedule R (Form 941):Report for calendar

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Schedule R Form 941

Edit your IRS Schedule R Form 941 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Schedule R Form 941 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Schedule R Form 941 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Schedule R Form 941. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Schedule R (Form 941) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Schedule R Form 941

How to fill out IRS Schedule R (Form 941)

01

Obtain the IRS Schedule R (Form 941) from the IRS website or your tax software.

02

Enter your business name, address, and Employer Identification Number (EIN) at the top of the form.

03

Determine the number of employees for each month during the calendar year and enter those numbers in the relevant sections.

04

Calculate the total wages paid to employees during the calendar year and enter the amount in the designated section.

05

If applicable, input any applicable tax credits you're claiming on the form.

06

Review the instructions for any additional information or specific calculations needed for your situation.

07

Sign and date the form before submitting it with your Form 941.

Who needs IRS Schedule R (Form 941)?

01

Employers who are subject to the tax deposit requirements under section 3511 and who need to allocate their employment tax liabilities among taxing jurisdictions.

02

Businesses that employ individuals and have certain tax credits or claims related to employment taxes.

03

Employers who must report their employment tax liabilities for the calendar year.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file form 941?

Who must file Form 941. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

Is there a new 941 form for 3rd Quarter 2022?

TaxBandits has updated its e-filing process ingly and the third quarter Form 941 for 2022 is now available for e-filing. It will come as a welcomed relief to employers that there are no notable changes to the form for the upcoming third quarter deadline.

Is there a new Schedule B form 941 for 2022?

Is there a new 941 Schedule B for 2022? The IRS Form 941 Schedule B for 2022 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this Schedule.

Do I need to file form 941 if no wages were paid?

Do I Have to File Form 941 If No Wages Were Paid? Most employers need to file Form 941 even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. However, other IRS forms may be required.

Do you have to file form 941 if no payroll?

Do I Have to File Form 941 If No Wages Were Paid? Most employers need to file Form 941 even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. However, other IRS forms may be required.

What is Form 941 and when must it be filed?

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of

Is there a new form 941?

IRS has released an updated Form 941 for the second & third quarter of 2022, there are a few notable changes that employers will need to be aware of Employers who are required to report federal income taxes, social security taxes, or medicare taxes withheld from their employees' paychecks must submit the new revised

Who Must File form 941?

Most businesses are required to file Form 941 quarterly, with a few exceptions. Seasonal businesses only need to file for the quarters in which they are operating. Businesses that hire farm workers or household employees, such as a maid, also don't need to file Form 941 (but do need to file Schedule H from Form 1040).

How long do you have to amend 941 for employee retention credit?

You may claim the employee retention credit using Form 941-X within 3 years of the date the original Form 941 was filed or 2 years from the date you paid the tax reported on Form 941, whichever is later.

Under which condition is an employer not required to file a quarterly form 941?

Most businesses are required to file Form 941 quarterly, with a few exceptions. Seasonal businesses only need to file for the quarters in which they are operating. Businesses that hire farm workers or household employees, such as a maid, also don't need to file Form 941 (but do need to file Schedule H from Form 1040).

What is form 941 and when must it be filed?

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of

What is a schedule R?

Use Schedule R (Form 1040) to figure the credit for the elderly or the disabled.

Do I need to amend 941 to claim employee retention credit?

For any tax year when wages were withheld and an Employer Retention Credit (ERC) connected to these previously withheld wages was received in a future year, taxpayers must file an updated tax return by IRS Notice 2021-49. So, you will have to amend your tax return to claim ERC.

What happens if you don't file form 941?

If you fail to File your Form 941 or Form 944 by the deadline: Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.

What is a 941 R?

The Schedule R (Form 941) will provide the IRS with client-specific information to support the totals reported on an aggregate Form 941. It includes an allocation line for each client showing a breakdown of their wages and employment tax liability for the tax period.

Is there a new 941 form for 2022?

On June 23, the IRS released an updated Form 941 for the second quarter of 2022, with a few notable changes that employers need to be aware of. The tax relief programs that were passed under the American Rescue Plan Act are continuing to expire and 2022 Form 941 for the second quarter reflects these changes.

What is a form 941 used for?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

How do I get a copy of my 941 from the IRS?

Call 800-829-3676.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS Schedule R Form 941 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like IRS Schedule R Form 941, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for signing my IRS Schedule R Form 941 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your IRS Schedule R Form 941 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the IRS Schedule R Form 941 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign IRS Schedule R Form 941 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is IRS Schedule R (Form 941)?

IRS Schedule R (Form 941) is a form used by employers to report the total wages paid to employees and calculate the federal income tax withheld. It is specifically for employers that are required to report their taxable and non-taxable employment.

Who is required to file IRS Schedule R (Form 941)?

Employers who have employees and who are required to report wages, tips, and other compensation must file IRS Schedule R (Form 941). This includes both seasonal and non-seasonal employers.

How to fill out IRS Schedule R (Form 941)?

To fill out IRS Schedule R (Form 941), employers must provide the required information such as the total number of employees, wages paid, the amount of withheld tax, and other details as prompted by the form.

What is the purpose of IRS Schedule R (Form 941)?

The purpose of IRS Schedule R (Form 941) is to allow employers to report their payroll tax liabilities and make necessary deductions for federal income tax and FICA taxes.

What information must be reported on IRS Schedule R (Form 941)?

Information that must be reported on IRS Schedule R (Form 941) includes the total wages paid to employees, tips, and other compensation, tax liability for the quarter, any adjustments for overreported taxes, and the number of employees.

Fill out your IRS Schedule R Form 941 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Schedule R Form 941 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.