IRS Instructions 941 - Schedule B 2023 free printable template

Show details

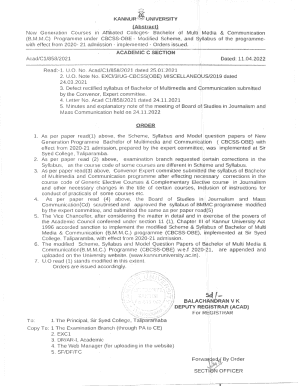

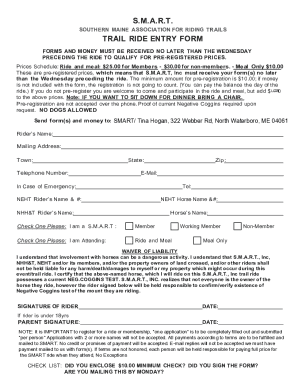

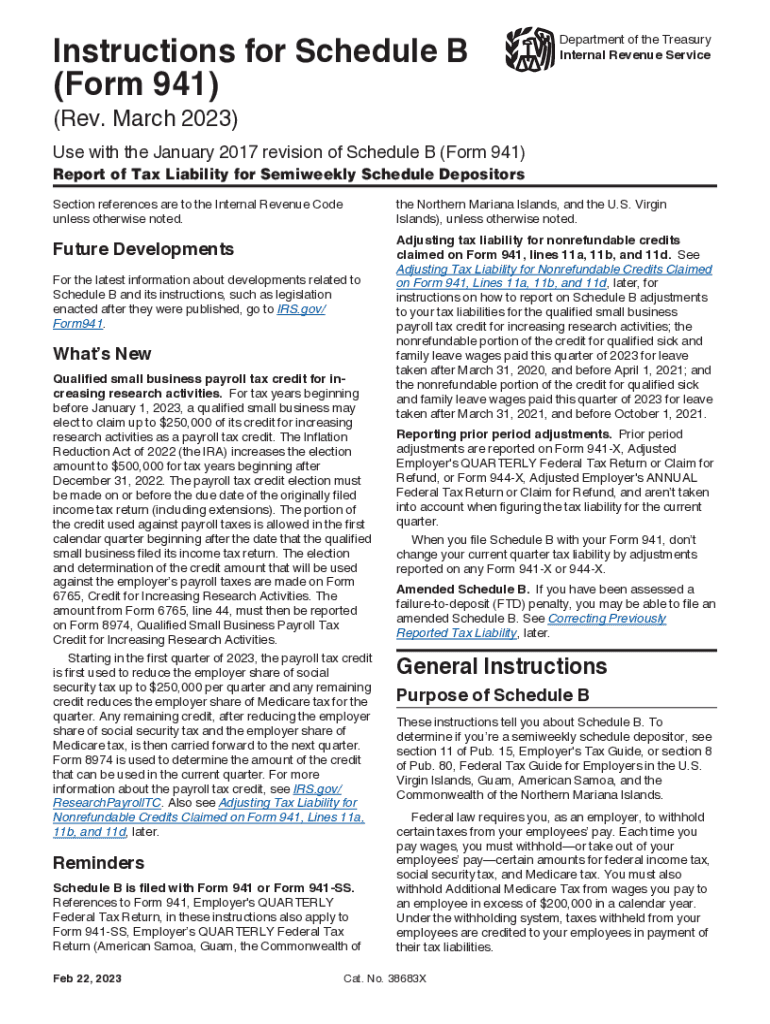

Instructions for Schedule B (Form 941)Department of the Treasury Internal Revenue Service(Rev. March 2023)Use with the January 2017 revision of Schedule B (Form 941) Report of Tax Liability for Semiweekly

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 941 - Schedule B

Edit your IRS Instructions 941 - Schedule B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 941 - Schedule B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 941 - Schedule B online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instructions 941 - Schedule B. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 941 - Schedule B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 941 - Schedule B

How to fill out IRS Instructions 941 - Schedule B

01

Gather your payroll records for the quarter.

02

Obtain IRS Form 941 and Schedule B from the IRS website.

03

Begin filling out Form 941, ensuring all relevant employer information is accurate.

04

Move to Schedule B and enter the total number of employees paid during the quarter.

05

List the dates that you paid wages in the quarter, including any amendments.

06

Calculate and enter the total amount of taxes withheld for each pay date.

07

Double-check your entries for accuracy and completeness.

08

Sign and date the form before submission.

Who needs IRS Instructions 941 - Schedule B?

01

Employers who are required to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks.

02

Businesses that are subject to federal payroll tax deposit requirements.

03

Corporations and partnerships that have employees.

04

Any organization that has a Form 941 filing obligation.

Fill

form

: Try Risk Free

People Also Ask about

What is a Schedule B for foreign bank accounts?

What Is Schedule B? "Schedule B" is a form you file with your regular income tax return by April 15 (or October 15 with an extension). It's most often used to identify interest and dividend income. It is also used to alert the IRS that you have foreign bank or other financial accounts.

What is the FBAR question on Schedule B?

Schedule B, Overseas Accounts This is true, even if you do not meet the FBAR filing threshold, and/or the Form 8938 (FATCA) threshold filing requirement. Schedule B is not asking you how much; rather, it is just asking whether you have any ownership or signature authority over any overseas accounts.

What is the schedule B for FBAR?

Schedule B generally states interest and dividend income from accounts in the U.S. if those amounts exceeded $1,500 in the past year. However, people who have foreign accounts must file Schedule B to report any of these accounts, regardless of how much money they hold.

What is the 941 Schedule B form?

The IRS Form 941 Schedule B is a tax form for the reporting of tax liability for semi-weekly pay schedules. The employer is required to withhold federal income tax and payroll taxes from the employee's paychecks. The 941 form reports the total amount of tax withheld during each quarter.

What is a 1099 B?

If you sold stock, bonds or other securities through a broker or had a barter exchange transaction (exchanged property or services rather than paying cash), you will likely receive a Form 1099-B. Regardless of whether you had a gain, loss, or broke even, you must report these transactions on your tax return.

What is a Schedule B for foreign income?

Schedule B (Form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instructions 941 - Schedule B for eSignature?

When you're ready to share your IRS Instructions 941 - Schedule B, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out IRS Instructions 941 - Schedule B using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IRS Instructions 941 - Schedule B and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit IRS Instructions 941 - Schedule B on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IRS Instructions 941 - Schedule B on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IRS Instructions 941 - Schedule B?

IRS Instructions 941 - Schedule B provides guidance for employers on how to report their employment tax liabilities on Form 941, specifically detailing the reporting of the total tax liability for the quarter.

Who is required to file IRS Instructions 941 - Schedule B?

Employers who have a tax liability of $100,000 or more in a semi-weekly period are required to file IRS Instructions 941 - Schedule B.

How to fill out IRS Instructions 941 - Schedule B?

To fill out IRS Instructions 941 - Schedule B, employers must report their total tax liability for each pay period, including adjustments and any deposits made, ensuring that all information matches Payroll records.

What is the purpose of IRS Instructions 941 - Schedule B?

The purpose of IRS Instructions 941 - Schedule B is to help the IRS track and verify the employment tax liabilities reported by employers and to ensure accurate reporting and compliance.

What information must be reported on IRS Instructions 941 - Schedule B?

Information that must be reported on IRS Instructions 941 - Schedule B includes the total tax liability for each pay period, any adjustments made, and details of tax deposits submitted during the quarter.

Fill out your IRS Instructions 941 - Schedule B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 941 - Schedule B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.