Who needs a NHCT-2A form?

This form is used by all non-profit organizations which are not required to file IRS form 990, the Annual Financial Report.

What is the purpose of the NHCT-2A form?

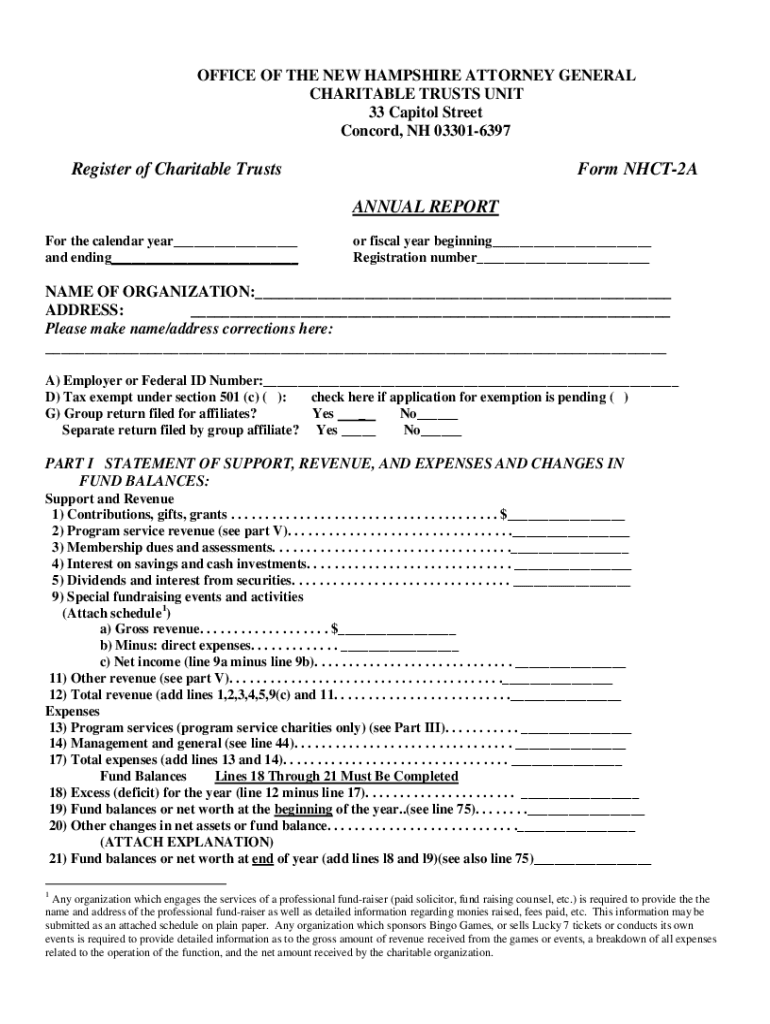

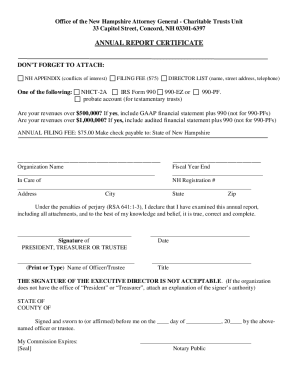

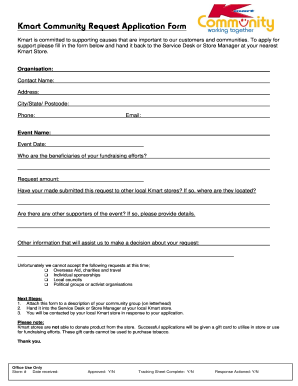

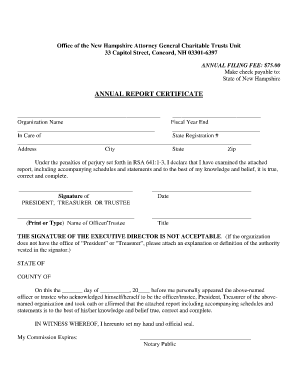

This form is the annual report of the charitable organizations registered with the Charitable Trusts Unit. It is filed with the Charitable Trusts Unit and provides all the required information about the organization’s activity during the year, the organization itself, and all the made transactions. The given form consists of several parts: Annual Report Certificate, Annual Report, Appendix to Annual Report, and the Application for the extension of time to file the annual report with charitable trusts unit.

What documents must accompany the NHCT-2A form?

All the above-mentioned documents can accompany the form NHCT-2A, if necessary. The Appendix to Annual Report and the Annual Report Certificate must be attached to the form. The organization should also pay the required fee.

When is the NHCT-2A form due?

The Annual Report should be submitted no later than four months and fifteen days following the close of the fiscal or calendar year. It’s the same day the IRS form 990 is due.

What information should be provided in the NHCT-2A form?

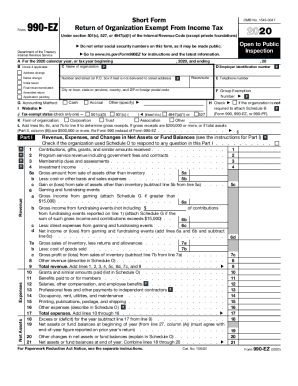

The Annual Report Certificate is completed by the president of the charitable organization. The Annual Report itself contains the following data:

-

Name of the organization and address

-

Beginning and ending of the fiscal year

-

Federal ID number

-

Statement of support, revenue, and expenses in fund balances

-

Statement of functional expenses

-

Statement of program services rendered

-

Officers and directors

-

Program service revenue and other revenue

The Appendix to the Annual Report asks questions about the conflict of interest policy in the organization.

In case the organization needs an extension of time to file the annual report, it can send the completed form NHTC-4.

What do I do with the form after its completion?

The completed and signed form is forwarded to the office of the New Hampshire Attorney General Charitable Trusts Unit.