Get the free st 1 illinois

Show details

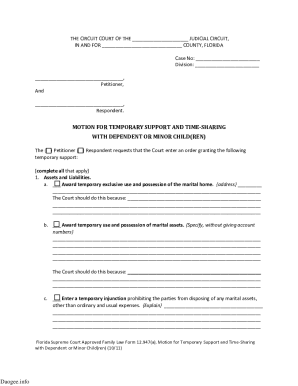

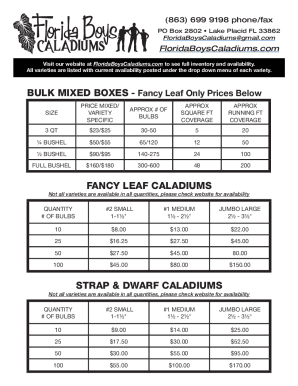

Illinois Department of Revenue ST-1 REV 05 FORM 002 E S // NS CA RC Sales and Use Tax and E911 Surcharge Return Account ID This form is for Reporting period Form ST-1 is due on or before the 20th day of the month following the end of the reporting period. Mailing address Owner s name Business name Business address Write your check and send your payment to ILLINOIS DEPARTMENT OF REVENUE RETAILERS OCCUPATION TAX SPRINGFIELD IL 62796-0001 IDOR ST-1 Schedule A Deductions Section 1 Taxes and...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st 1 form

Edit your obtain the st 1 form authorized tax agency in illinois text provide your business name address form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois st 1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 1 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois st 1 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st 1 sales use tax form

How to fill out ST-1 form Illinois:

01

Obtain the ST-1 form from the Illinois Department of Revenue website or any authorized tax agency in Illinois.

02

Provide your business name, address, and contact information in the designated fields.

03

Indicate your business type by selecting the appropriate category (e.g., Corporation, Partnership, Sole Proprietorship).

04

Fill in the Federal Employer Identification Number (FEIN) or Social Security Number (SSN) associated with your business.

05

Specify the date your business was started in the designated section.

06

Provide details about the nature of your business activities, including any specific products or services offered.

07

Indicate whether you are engaged in interstate commerce and provide the necessary details if applicable.

08

Calculate and enter the total gross receipts or sales made within Illinois during the reporting period.

09

Identify any tax exemptions or credits that apply to your business, if applicable.

10

Sign and date the form to certify its accuracy.

Who needs ST-1 form Illinois:

01

Any business, organization, or individual engaged in selling or leasing tangible personal property in Illinois is generally required to complete the ST-1 form.

02

Retailers, wholesalers, manufacturers, and service providers are among those who typically need to file this form.

03

In some cases, businesses that are exempt from collecting sales tax may still be required to file the form to report their sales activity in Illinois.

Fill

how to fill out st 1 form illinois about the items being purchased

: Try Risk Free

People Also Ask about il st 1

What is Illinois st2?

Form ST-2 is a form that you need if you sell goods from within Illinois. If you are an Amazon seller who has goods in warehouses in the state of Illinois, you will need to fill out this form as well. This business is an Amazon seller. These are all of the Amazon warehouse locations in the state of Illinois.

What is Illinois destination based sales tax?

Illinois is a origin-based sales tax state, which means sales tax rates are determined by the location of the vendor, not by the location of the buyer.

What is IL sales tax form ST-1?

What is an st1 form Illinois? You must file Form ST-1, Sales and Use Tax and E911 Surcharge. Return, if you are making retail sales of any of the following in Illinois: general merchandise, qualifying foods, drugs, and medical appliances, and/or prepaid wireless telecommunications service.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute st1 form online?

Filling out and eSigning illinois sales tax form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I edit st 1 form illinois on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing sales use tax e911 surcharge, you need to install and log in to the app.

How do I fill out form st 1 using my mobile device?

Use the pdfFiller mobile app to complete and sign illinois sales tax return on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is st 1 form illinois?

The ST-1 form in Illinois is a form used for claiming a Sales Tax Exemption. It is issued by the Illinois Department of Revenue.

Who is required to file st 1 form illinois?

Individuals or businesses that qualify for sales tax exemptions in Illinois need to file the ST-1 form.

How to fill out st 1 form illinois?

To fill out the ST-1 form, you must provide your business details, indicate the type of exemption you are claiming, and attach any supporting documentation.

What is the purpose of st 1 form illinois?

The purpose of the ST-1 form is to allow businesses and individuals to claim exemptions from sales tax for specific purchases based on state law.

What information must be reported on st 1 form illinois?

The ST-1 form requires reporting information such as the purchaser's name, address, the reason for the exemption, and details about the items being purchased.

Fill out your st 1 illinois form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Il Sales Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to illinois st1 form

Related to il sales tax return

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.