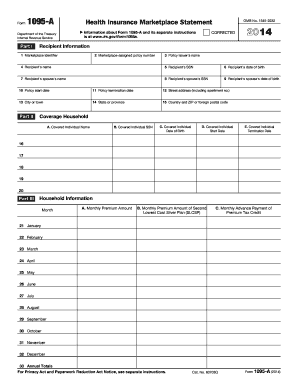

IRS 1095-A FAQs 2015 free printable template

Show details

12. The information on the IRS 1095-A does not have my correct information or APTC amounts how can I have Covered California change/update it Please fill out and mail or fax the Covered California 1095-A Dispute Form available on our website in late January 2015. Changes to names dates of birth social security numbers or addresses can also be reported by contacting the Covered California s Service Center at 800-300-1506. Pdf for the IRS instructi...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IRS 1095-A FAQs

Edit your IRS 1095-A FAQs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1095-A FAQs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1095-A FAQs online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1095-A FAQs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1095-A FAQs Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1095-A FAQs

How to fill out IRS 1095-A FAQs

01

Gather your personal information including Social Security numbers of all covered individuals.

02

Obtain your Form 1095-A from the Health Insurance Marketplace, which should be provided to you after you enroll in a health plan.

03

Review the form for accuracy, ensuring all names, dates of birth, and coverage details are correct.

04

Identify the month(s) you had coverage and note them on the form.

05

Fill out Part I of the form with your information.

06

In Part II, review the details of your coverage for each month, including premiums and any advanced premium tax credits you received.

07

Complete Part III if you had coverage through a family member or spouse, providing the necessary information for each individual.

08

Make sure to keep a copy of the completed form for your records, as well as any documentation that supports the information provided.

Who needs IRS 1095-A FAQs?

01

Individuals and families who received health coverage through the Health Insurance Marketplace.

02

Taxpayers who are required to report their health coverage on their federal tax returns.

03

Those who want to claim a premium tax credit to lower their health insurance costs.

Fill

form

: Try Risk Free

People Also Ask about

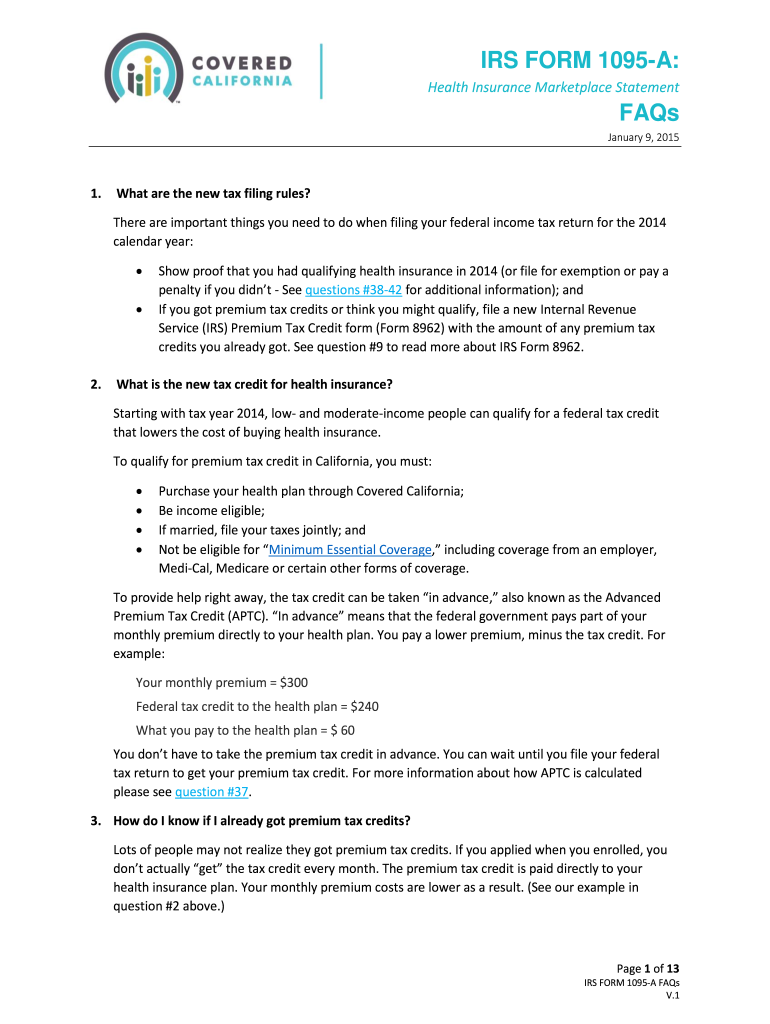

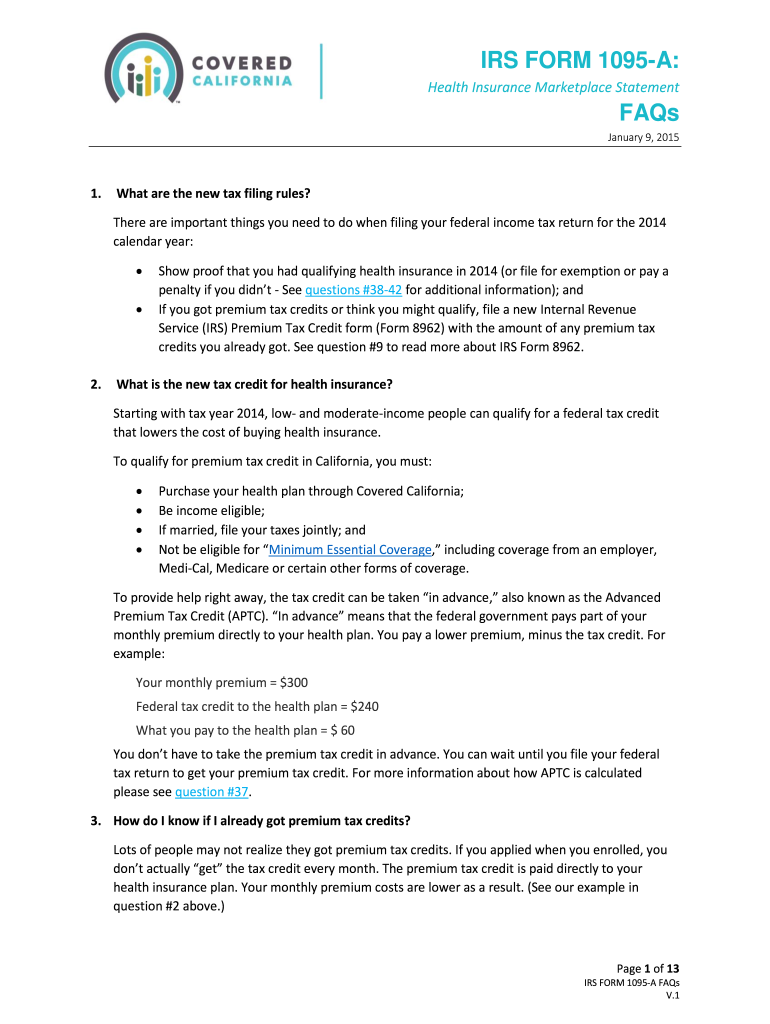

Do I need to include Form 1095-A with my tax return?

Should I attach Form 1095-A, 1095-B or 1095-C to my tax return? No. Although you may use the information on the forms to help complete your tax return, these forms should not be attached to your return or sent to the IRS. The issuers of the forms are required to send the information to the IRS separately.

Why is my tax return asking for a 1095-A?

Form 1095-A gives you information about the amount of advanced premium tax credit (APTC) that was paid during the year to your health plan in order to reduce your monthly premium. This information was also reported to the IRS.

Does a 1095-A affect my tax return?

If you enrolled in qualifying Marketplace coverage, received a Form 1095-A, and filed your tax return based on that form, you do not need to file an amended return based on your corrected Form 1095-A. This is true even if additional taxes would be owed based on the new information.

What is reported on Form 1095-A?

Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

What happens if I don't submit my 1095-A?

Not filing your return will cause a delay in your refund and may affect your future advance credit payments.

Do I need to enter 1095-A on tax return?

Should I attach Form 1095-A, 1095-B or 1095-C to my tax return? No. Although you may use the information on the forms to help complete your tax return, these forms should not be attached to your return or sent to the IRS.

How does a 1095-A affect your tax return?

Form 1095-A gives you information about the amount of advanced premium tax credit (APTC) that was paid during the year to your health plan in order to reduce your monthly premium. This information was also reported to the IRS.

Do I have to claim a 1095-A on my taxes?

Should I attach Form 1095-A, 1095-B or 1095-C to my tax return? No. Although you may use the information on the forms to help complete your tax return, these forms should not be attached to your return or sent to the IRS.

Does a 1095-A affect my tax return?

Basic Information about Form 1095-A You will use the information from the Form 1095-A to calculate the amount of your premium tax credit. You will also use this form to reconcile advance payments of the premium tax credit made on your behalf with the premium tax credit you are claiming on your tax return.

How does the 1095-A affect my tax return?

You'll use the information from your 1095-A to “reconcile” your premium tax credit. To do this, you'll compare the amount of premium tax credit you used in advance during the year against the premium tax credit you actually qualify for based on your final income for the year.

What is monthly enrollment premiums on 1095-A?

In this case, the monthly enrollment premium on your Form 1095-A may show only the amount of your premium that applied to essential health benefits. You or a household member started or ended coverage mid-month. In this case, your Form 1095-A will show only the premium for the parts of the month coverage was provided.

Do I have to report 1095-A on my tax return?

Should I attach Form 1095-A, 1095-B or 1095-C to my tax return? No. Although you may use the information on the forms to help complete your tax return, these forms should not be attached to your return or sent to the IRS.

Where do I enter information from Form 1095-A?

The information on Form 1095-A is reported on Form 8962, Premium Tax Credit, and the form reconciles the amount of premium tax credit the taxpayer received during the tax year with the amount they were eligible to receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 1095-A FAQs directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your IRS 1095-A FAQs as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete IRS 1095-A FAQs online?

Filling out and eSigning IRS 1095-A FAQs is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit IRS 1095-A FAQs straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing IRS 1095-A FAQs, you need to install and log in to the app.

What is IRS 1095-A FAQs?

IRS 1095-A FAQs refer to frequently asked questions regarding the Form 1095-A, Health Insurance Marketplace Statement, which provides information about health insurance obtained through the Health Insurance Marketplace.

Who is required to file IRS 1095-A FAQs?

Individuals who enrolled in a qualified health plan through the Health Insurance Marketplace must receive a Form 1095-A; however, it is the responsibility of the Marketplace to provide this form, not the individuals.

How to fill out IRS 1095-A FAQs?

To fill out the IRS 1095-A, you need to gather basic information such as the names of the policyholders, the months the insurance was active, and the premium amounts paid. Follow the instructions provided on the form carefully to report this information accurately.

What is the purpose of IRS 1095-A FAQs?

The purpose of IRS 1095-A FAQs is to help individuals understand how to report their health insurance coverage to the IRS, specifically related to obtaining health coverage through the Health Insurance Marketplace and claiming premium tax credits.

What information must be reported on IRS 1095-A FAQs?

Information that must be reported on IRS 1095-A includes the names of covered individuals, the months during which coverage was active, the amount of premiums paid, and the amount of any premium tax credits received.

Fill out your IRS 1095-A FAQs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1095-A FAQs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.