Get the free NEBRASKA Individual Income Tax Booklet 2013

Show details

Jan 1, 2014 ... revenue.Nebraska.gov ... Failure to file an amended Nebraska income tax return to report changes ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nebraska individual income tax

Edit your nebraska individual income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nebraska individual income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nebraska individual income tax online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nebraska individual income tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nebraska individual income tax

01

Begin by gathering all the required documents and information for the e-filing process. This may include your personal identification information, income statements, and any relevant deductions or credits you qualify for.

02

Access the online platform or software provided by the tax authority or a trusted e-filing service. Make sure you have a stable internet connection and a compatible device, such as a computer or smartphone.

03

Create an account or log in to your existing account if you have used the e-filing service before. Take note of any unique login credentials or security measures required to protect your personal information.

04

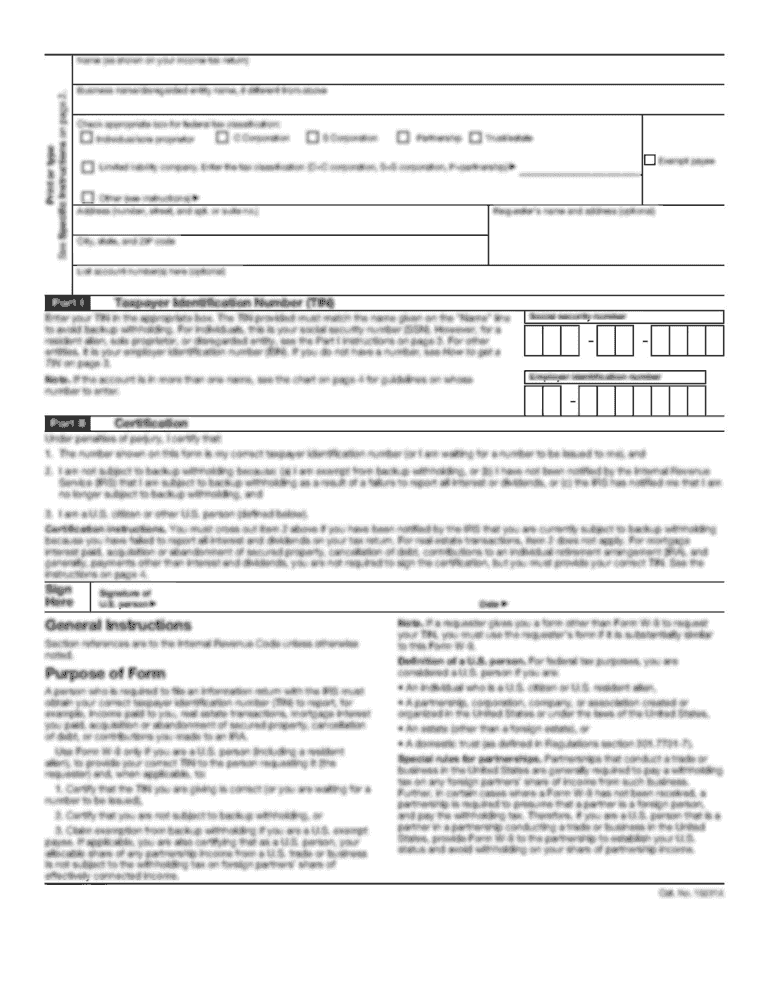

Follow the prompts or designated sections to input the necessary information. This can include your name, social security number or tax identification number, filing status, and other personal details.

05

Enter your income information accurately, including any wages, salaries, self-employment earnings, and investment income. You may need to attach relevant forms or documents such as W-2s or 1099s.

06

Provide details about any deductions or credits you qualify for, such as mortgage interest, student loan interest, charitable contributions, or education-related expenses.

07

Review your entered information thoroughly for accuracy and completeness. Make sure you have accounted for all relevant income and deductions. Some e-filing platforms provide error-checking tools or prompts to help identify potential mistakes.

08

Choose your preferred method of receiving any potential tax refunds, such as direct deposit into your bank account.

09

Submit your completed e-filed return electronically, following the instructions provided by the platform. Double-check that you have successfully submitted your return and keep any confirmation receipts or documents for future reference.

Who needs simplification for e-filing purposes?

01

Individuals or taxpayers who prefer a streamlined and convenient method of filing their tax returns may opt for e-filing. This can simplify the entire process and eliminate the need for paper forms, manual calculations, and physical submissions.

02

Those who have straightforward tax situations with minimal complexities may find e-filing to be a suitable option. This includes individuals without significant investments, multiple income sources, or complicated deductions.

03

Businesses and self-employed individuals may also benefit from e-filing, as it can simplify the reporting of income and expenses, especially if they use accounting software that is compatible with e-filing platforms.

04

People who want to receive their tax refunds quickly and securely may choose e-filing, as it can expedite the processing of their returns and refunds compared to traditional mail-based methods.

05

Taxpayers who prioritize accuracy and error-checking in their tax returns may find e-filing systems helpful, as many platforms have built-in validation mechanisms to minimize mistakes and ensure compliance with tax regulations.

Fill

form

: Try Risk Free

Fill out your nebraska individual income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nebraska Individual Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.