Get the free 299 tax form

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to the 299 Tax Form on pdfFiller

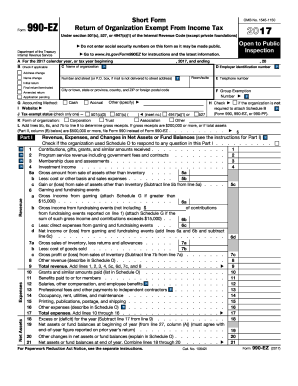

What is the 299 tax form?

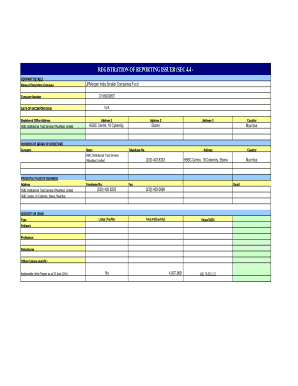

The 299 tax form is a specific IRS document that certain businesses and organizations must submit annually. It serves the purpose of reporting earnings and tax liability. Understanding its requirements is crucial for compliance with federal tax laws.

-

The 299 tax form is used by businesses to report income details and ensure tax accountability, facilitating transparency in financial reporting.

-

Typically, organizations including non-profits and certain corporations must file the 299 tax form, depending on their income levels and types of operations.

-

Filing deadlines for the 299 tax form vary, but most organizations must complete it annually by March 15th, allowing adequate time for review and submission.

How can you fill out the 299 tax form?

Filling out the 299 tax form may seem daunting, but it can be simplified by using intuitive tools like pdfFiller. This guide will provide a step-by-step walkthrough to ensure accurate completion.

-

To start, navigate to pdfFiller, where the 299 tax form is readily available for download and electronic filling.

-

Each section of the form requires specific information, such as your organization's legal name and revenue details. This section-by-section approach ensures that no crucial details are overlooked.

-

One common mistake is failing to report all income generated. Always double-check your figures and ensure accuracy to avoid complications later.

What features does pdfFiller offer for the 299 tax form?

pdfFiller provides a suite of features designed to streamline the process of editing and submitting the 299 tax form. This can significantly reduce time spent on paperwork.

-

Users can quickly edit text, add signatures, and make any necessary adjustments within the framework of pdfFiller.

-

The option to eSign makes the submission process faster and allows for secure record-keeping.

-

pdfFiller allows for real-time collaboration, making it easier to review and finalize the tax form with input from multiple stakeholders.

What compliance issues surround the 299 tax form?

Compliance with IRS regulations is essential when filing the 299 tax form. Understanding these regulations can protect your organization from penalties and legal issues.

-

The IRS has specific guidelines for when and how the 299 tax form must be filed, which can change annually.

-

Neglecting to file correctly or on time can lead to fines and potential audits.

-

Stay informed about any shifts in regulations or requirements for the 299 tax form in the upcoming tax year, as they can have significant implications for filing.

Where can you find help for the 299 tax form?

Accessing resources can aid in successfully completing the 299 tax form. Both IRS information and relevant support services are vital to a smooth filing experience.

-

The IRS website provides comprehensive explanations regarding the form and filing process, which can be a helpful first step.

-

pdfFiller offers tutorials, customer support, and assistance tailored to addressing user-specific tax filing complexities.

-

For personalized help, users can reach out to pdfFiller's support team, who can provide clarifications and solutions to form-related issues.

Frequently Asked Questions about what is a 299 tax form

How do I know if I need to file the 299 tax form?

If your organization meets specific financial thresholds or operates as a non-profit, you are likely required to file the 299 tax form. Check IRS guidelines to confirm your eligibility.

What happens if I miss the deadline for filing?

Missing the filing deadline can result in penalties, including fines from the IRS. It's important to file as soon as possible even if you are late.

Can I electronically file the 299 tax form?

Yes, you can electronically file the 299 tax form using platforms like pdfFiller, which offers web-based forms that simplify the e-filing process.

Are there any changes to the 299 tax form for the coming tax year?

Each year, the IRS may introduce changes to the 299 tax form. It’s recommended to stay updated by checking the IRS website or consulting with tax professionals.

What should I do if I discover an error after submitting the form?

If you find an error after submission, contact the IRS immediately for guidance on how to amend the submitted form. They have procedures in place for corrections.

pdfFiller scores top ratings on review platforms