Who needs Form ST-8?

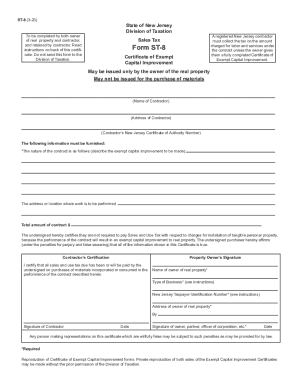

This form is used by both contractors and real property owners. Both of them fill this form out in order to get a tax exemption for capital improvements.

What is Form ST-8 Used For?

The Form ST-8 is a Certificate of Exempt Capital Improvements. Contractors need it to get a tax exemption from sales and use tax with respect to charges for installation of tangible personal property. This form is usable in case of capital improvements to real property only.

Is Form ST-8 Accompanied by Other Forms?

You don't need to attach any other papers to the Form ST-8. It should be filed as it is.

How do I fill out Form ST-8?

The first field requires the name of the contractor to be provided. You should leave an information about the address of contractor while filling out the form. You should also mention contractor's New Jersey Certificate of Authority Number while filling out Form ST-8. Form ST-8 should contain a description of the nature of the contract. Form ST-8 should contain information about the location where work is to be performed. There is a table on the bottom of the certificate. On the left part contractor provides the signature and the current date. The right part of the table is for the real estate owner's information. Here the following information is required:

- Name of owner of real property

- Address of owner of real property

- Signature of owner

- Current date

If you still have any question concerning the form, you can get extra information on the second page of the Form ST-8.

What should I Do Next?

This form is made in two copies. Both copies are retained by a contractor. The Form ST-8 is not filed to the Division of Taxation.