IRS 1040-V 2013 free printable template

Instructions and Help about IRS 1040-V

How to edit IRS 1040-V

How to fill out IRS 1040-V

About IRS 1040-V 2013 previous version

What is IRS 1040-V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-V

Can I sign the [SKS] electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your [SKS] in minutes.

How do I fill out [SKS] using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign [SKS] and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete [SKS] on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your [SKS], you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

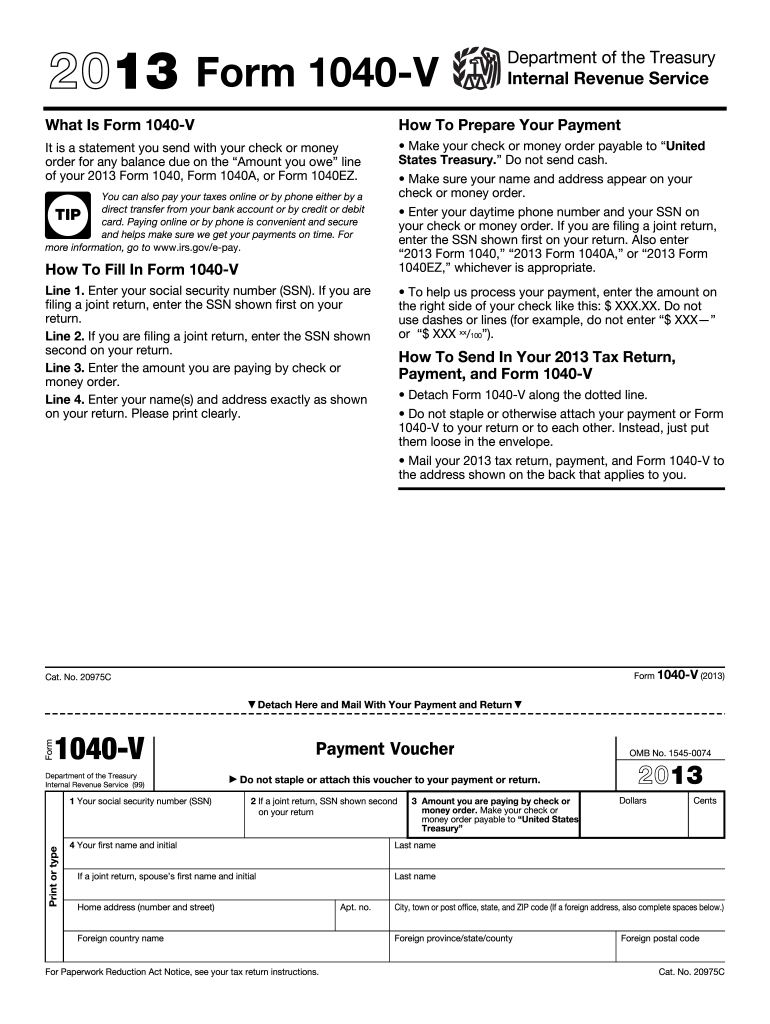

What is IRS 1040-V?

IRS 1040-V is a payment voucher used by individuals to submit their tax payment when they file their federal income tax return.

Who is required to file IRS 1040-V?

Taxpayers who owe tax when filing their individual income tax return (Form 1040) and are making a payment are required to file IRS 1040-V.

How to fill out IRS 1040-V?

To fill out IRS 1040-V, provide your name, address, Social Security number, the amount you are paying, and the tax year on the voucher. Then, submit it along with your payment.

What is the purpose of IRS 1040-V?

The purpose of IRS 1040-V is to ensure that your payment is properly applied to the correct tax return and to facilitate the processing of your payment by the IRS.

What information must be reported on IRS 1040-V?

The information that must be reported on IRS 1040-V includes your name, address, Social Security number, the amount being paid, and the applicable tax year.

See what our users say